Afrrica Oil Corp has said that the Prime’s first quarter 2021 average daily W.I. production was 27,700 boepd and economic entitlement production was 30,300 boepd (84% light and medium crude oil and 16% conventional natural gas), net to Africa Oil’s 50% shareholding in Prime.

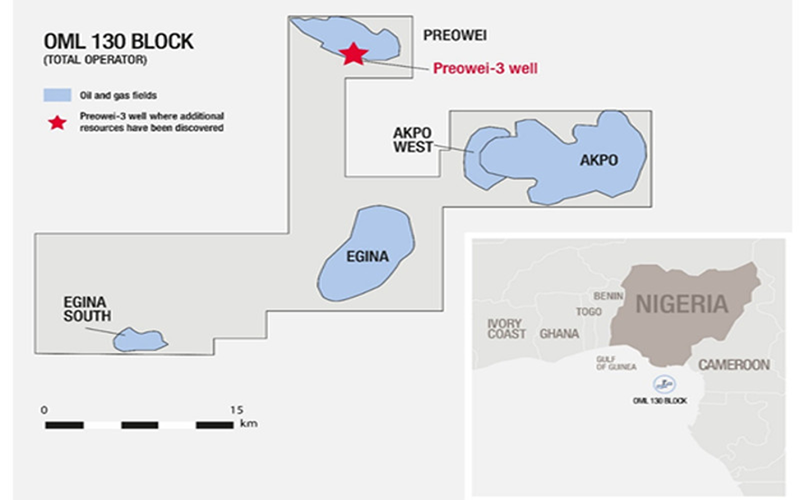

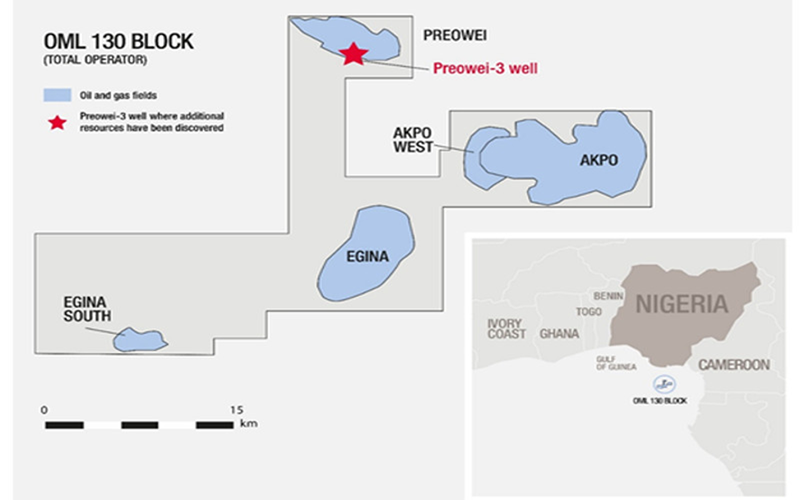

It stated that the Production of the Egina field is continued to be affected in the first quarter of 2021 by the imposition of Opec+ quotas. These quotas limited production from Egina in the first quarter of 2021 to an average of approximately 152,000 bopd. In April 2021 Opec+ members agreed to gradually increase the crude production quotas and production from Egina is now expected to exceed 160,000 bopd in the second quarter 2021.

During the first quarter of 2021, Prime was allocated five oil liftings with total sales volume of approximately 4.9 million barrels or 2.4 million barrels net to Africa Oil’s 50% shareholding.

Prime continues its hedging program in 2021 and has sold forward or hedged 95% of its 2021 cargoes at an average price of $56/bbl. These contracts are with counterparties including oil supermajors and commodity trading houses. The counterparties are part of groups with investment grade credit ratings.

First quarter 2021 average operating cost of $6.4 per boe compares to fourth quarter 2020 average operating cost of $5.9 per boe. The increase is primarily attributed to non-recurring well intervention costs for Akpo and Egina fields. No leasing costs are payable for Prime’s Floating Production, Storage and Offloading (“FPSO”) platforms because they are fully owned by the joint venture partners.

Prime achieved first quarter 2021 sales revenue of $153.3 million; EBITDA of $143.1 million and cash flow generated from operating activities of $85.9 million, in each case net to Africa Oil’s 50% shareholding.

Capital expenditure during the quarter, net to the Company’s shareholding was $2.6 million.

Africa Oil President and CEO Keith Hill commented: “I am delighted with the strong support from our banking syndicate, a clear endorsement of our investment case and high-quality assets. As well as the immediate benefits of lower borrowing costs and improved liquidity, this refinancing strengthens our banking relationships, a strategic advantage as we seek to acquire additional producing assets in this attractive market and progress our South Lokichar project in Kenya. We also look forward to the results from our high impact Venus and Gazania exploration wells as we progress Brulpadda and Luiperd discoveries towards development.”

About Africa Oil

Africa Oil Corp. is a Canadian oil and gas company with producing and development assets in deepwater Nigeria; development assets in Kenya; and an exploration/appraisal portfolio in Africa and Guyana. The Company is listed on the Toronto Stock Exchange and on Nasdaq Stockholm under the symbol “AOI”.