Africa Oil Corp. has confirmed positive and successful operations and consolidated financial results for the three months and the year ended December 31, 2023, together with its 2024 Management Guidance.

The company in its end of fourth quarter release stated that ithassuccessfully met 2023 Management Guidance on production and cash flow from operations, declaring that the company has received three dividends totaling $175.0 million in 2023 from its shareholding in Prime, including one dividend of $50.0 million in Q4 2023. AOC’s cash and cash equivalents at December 31, 2023, stood at $232.0 million.

Also in its 2023 Full year report update the company’s net income stood at $87.1 million (2022: net loss of $60.3 million) or $0.19 per share (2022: net loss of $0.13 per share). The Company launched a new NCIB share buyback program on December 6, 2023, and post year-end, on January 10, 2024, started share buybacks under the new NCIB. The Company will pay a dividend of $0.025 per share on March 28, 2024.

The company disclosed that OML 130 in Nigeria has been renewed for 20 years, thereby securing AOC’s long term production base and enabling the refinancing of Prime’s debt. Prime’s OML 130 and OML 127 were converted to operate under Nigeria’s new Petroleum Industry Act (PIA) and are now subject to a 30% Corporate Income Tax regime compared to the previous 50% Petroleum Profit Tax (PPT) regime.

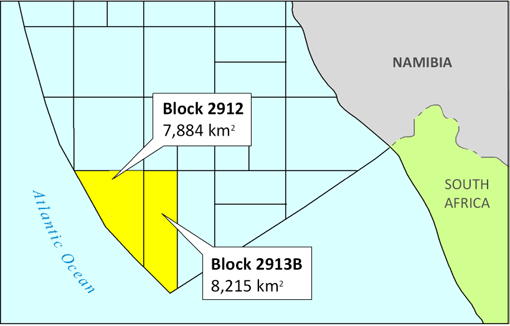

The company also reported the commenced f the appraisal campaign for the Venus light oil and associated gas discovery Namibia, with the positive results supporting the commercial development of the field.

Subsequent to the year-end, the Company announced a strategic farmout agreement between its investee company Impact Oil and Gas Limited (Impact), and TotalEnergies, that allows the Company to continue its participation in the world class Venus oil development project, and the follow-on exploration and appraisal campaign on Blocks 2913B and 2912 with no upfront costs.

The company Recorded full-year average daily WI production of approximately 19,800 barrels of oil equivalent per day (“boepd”) and average daily net entitlement production of approximately 22,400 boepd. These compare with mid-range 2023 Management Guidance figures of 20,000 boepd and 22,000 boepd for WI and net entitlement production, respectively.

The recorded cashflow from operations2,5 of $298.8 million, which compares with the guidance mid-point of $290.0 million. Prime’s cash position of $76.1 million and debt balance of $375.0 million resulting in a Prime net debt position of $298.9 million at December 31, 2023.

“2023 was a very good year for Africa Oil. Two highlights are the renewal of Prime’s OML 130 license for a further 20-year period and the successful appraisal of the Venus discovery, which supports the case for its commercial development.

“ The OML 130 renewal not only secured the long-term future of our core producing assets, it also facilitated the refinancing of Prime’s debt on competitive terms and allowed a dividend distribution of $175 million to Africa Oil for the year. The renewal also supports further investments including in the Preowei development project.

The appraisal of the Venus field during 2023 was very encouraging and we note the operator’s positive public statements regarding the development of this world-class discovery. We are also excited by the wider prospectivity in the area, as evidenced by the recent Mangetti discovery. Post period end we announced the farmout agreement between Impact and TotalEnergies

. Under this transformational agreement Africa Oil will retain exposure to the Venus field and associated exploration upside at no upfront cost, and with no further demand on our balance sheet.”

Our focus for 2024 is to enhance the value of our core assets, including our operated exploration assets through strategic farm down transactions, and pursuing opportunities to consolidate and streamline our asset ownerships,” Africa Oil President and CEO, Roger Tucker said.