Sequel to Nigerian Agip Oil Company Limited NAOC onshore and power assets acquisition deal recently signed between Eni and Oando, the Nigerian National Petroleum Corporation Limited NNPCL has in its response placed a caveat to the milestone deal claiming that NAOC did not obtain its consent prior to announcing a deal to sell its onshore oil and power assets to the Nigerian indigenous oil company – Oando PLC.

In a letter sighted by Reuters, The repositioned Nation oil firm which recently unveiled a new acronym NNPCL in line with the new provisions guiding the Petroleum Industrial Act said that Eni-Oando acquisition deal breached terms of a joint operating agreement.

According to the letter dated Sept. 4, NNPCL asserted that the Nigerian Agip Oil Company Ltd (NAOC) did not seek its consent before venturing into the deal, and that its consent is mandatory and must be followed in transferring of any participating interest in a joint venture.

This grave breach of Joint Operating Agreement (JOA) is hereby declared Non Sequitur, sighting that its subsidiary the NNPC Exploration and Production Limited (NEPL) holds a 60% stake in a NAOC joint venture and must have a major role to play in the transaction.

But Eni, has claimed that its NAOC Ltd subsidiary had not breached any of the joint venture contract agreement. “NNPC has a pre-emption right on the JV shares, but Eni doesn’t have any contractual obligation to inform beforehand NNPC about the deal, also because the information was price sensitive for the potential buyer,” Eni said.

According to Reuters report, NNPC spokesperson Garba Deen Muhammad has confirmed that NEPL sent the letter to NAOC, but said the letter did not indicate an objection to the transaction.

“NEPL is only drawing attention to certain important clauses in the JOA, which might have been overlooked in error. Adherence to those clauses will protect the transaction now and in the future,” he said.

Oando declined to comment on the letter, but said “we trust that, as requested by NEPL, NAOC will engage accordingly to ensure that their concerns are addressed”. Oando also said that Eni had not assigned its 20% interest in the NAOC JV to Oando but had signed an agreement to sell 100% of the shares of NAOC Ltd, subject to all relevant regulatory and partner approvals and due diligence.

The NNPCL reaction to the NAOC – Oando acquisition agreement is coming after similar approach was exhibited by NNPCL during ExxonMobil and Seplat onshore oil and gas acquisition deal with NNPCL accusing ExxonMobil Corp. of not reaching out to NNPCL of having the right of pre-emption and subsequently sought for its consent before signing the acquisition deal with Seplat.

Right of pre-emption is a legal right to parties in a joint venture to be the first to be considered for any planned sale or takeover of assets in the Joint Ventures JVs if either party chooses to trade them off. And the latest decision from the NNPC implies that the Sales Agreement between SEPLAT and ExxonMobil will no longer continue.

In the letter signed by Kyari, and addressed to ExxonMobil, the NNPC reiterated its resolve to take over the ExxonMobil’s share of the assets. The letter reads in part, “We are aware that you reached an agreement to divest from onshore and shallow waters JVs, clearly we are interested.”

Following the implementation of the Petroleum Industry Act, the NNPC in the letter stated that it has been transformed from being a corporation to a profit driven company. The National Oil Company, according to the letter now has the capacity to buy over the share of ExxonMobil in the Joint ventures.

The NNPC is currently being positioned to be the most capitalized company in Africa as the PIA has provided business opportunities that will enable the National Oil Company earn more revenue for the country.

Agip State Threaten Strike

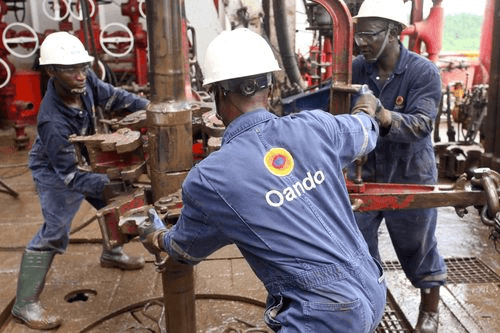

Over 3,000 indigenous workers could be thrown into the labour market if the planned divestment of Nigeria Agip Oil Company onshore assets to Oando finally comes to fruition. This was recently disclosed by the Petroleum and Natural Gas Senior Staff Association of Nigeria whose Port Harcourt branch threatened to withdraw its members from all offices and oil fields over the purchase of Eni Nigeria and Nigerian Agip Oil Company Limited by Oando Plc.

In his recent media briefing, the Branch Chairman Agip Group, Eyong Survival, disclosed that the association has frown at the proposed acquisition of the oil firms by Oando without proper consultations with the union body. He further stated that the management of the NAOC is being secretive about the whole transactions when the Union Executive made an approach to decipher the true position of the rumored assets sale.

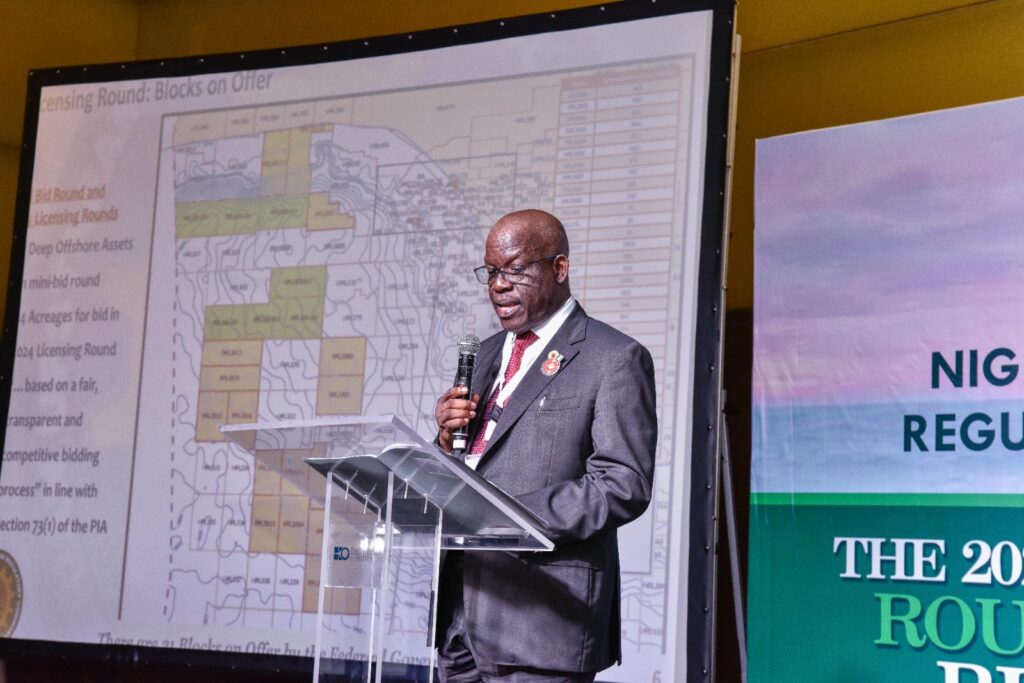

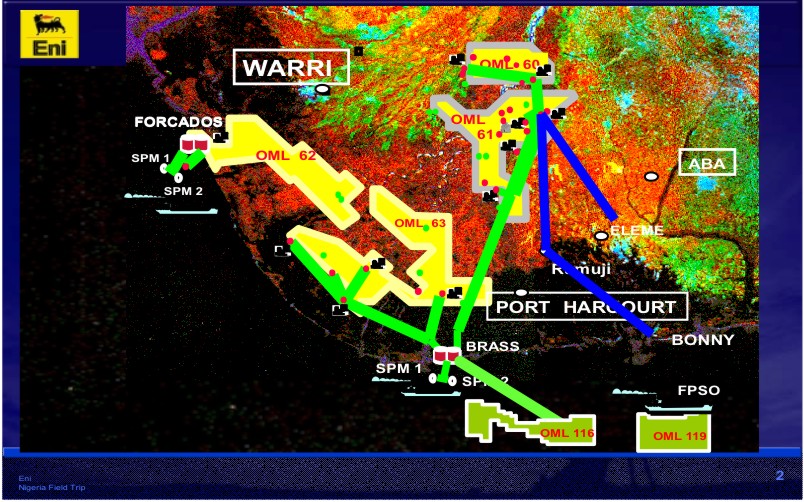

“The Managing Director of Eni Nigeria, Mr. Fabrizio Bolondi, invited the workforce to a meeting on September 4, 2023, and callously informed us that Eni has sold its 20 per cent equity share in NAOC JV, comprising OML 60, 61, 62 & 63, covering parts of Rivers, Delta, Bayelsa and Imo states to Oando Nigeria Limited, transferring all her assets and liabilities to Oando, without recourse to outstanding financial obligations to the workers, vis-a-vis their employee savings plan, pension and gratuity.

“Not long from date, the union on hearing rumours of the sales of the assets, held a meeting with the management on July 12, 2023, where the question was put forward to Eni Nigeria Management if they had any plan of selling the NAOC JV assets to Oando or any other company, but the managing director vehemently denied any plan of selling the JV assets.”

Continuing, the Agip Group PENGASSAN chairman in Port Harcourt, said, “Instead the MD made presentations on planned injection of IPP phase 2 generated power to national grid, as well as the possible conversion of OPL 245 to OML by the government.”

“At the moment, a lot of NAOC workers have suddenly developed some health challenges as a result of that callous announcement made by the MD of Eni Nigeria. The union position is for due process to be followed by Eni management.

“The Union has ordered a total withdrawal of her members from all offices and field locations of the company until a proper agreement is reached with Eni Nigeria and AGIP Group PENGASSAN.

“By that withdrawal action, gas supply to Indorama has been affected, daily oil production of 30,000 barrels of crude has been suspended, and about 10mscf of LNG gas to NLNG has been cut-off, and about 350MW of Okpai IPP power to the national grid has been shutdown,” Survival stated.

He further said prior to the shocking announcement of NAOC JV sale, the management had pulled out all Italian expatriates from the field locations.