FAR has announced that with reference to the attached letter dated 14 April 2021 which was received from Remus Horizons PCC Limited as requested by it advising its intention to make a takeover offer for FAR shares at 2.1 cents per share.

According to the letter, Remus has stated it was proceeding to finalise its Bidder’s Statement so that it would be lodged by no later than 28 April 2021. Far said that Sequel to the above letter, An adjournment of the shareholder meeting until 10am on 28 April 2021 was proposed and supported by shareholders in order to give Remus time to lodge its Bidder’s Statement.

Overnight, FAR said that it has received two further letters from Remus:

1. In the first further letter from Remus, Remus states that it is unable to lodge its Bidder’s Statement over coming days. Remus states that this is because it has recently had its registration as a private investment fund suspended by the Guernsey Financial Services Commission.

2. In the second further letter authored by a different Remus signatory, Remus states that the intended takeover offer was not properly authorised by Remus, that Remus does not have the funding to complete the takeover offer, that the takeover offer intention letter issued by Remus contained a number of factual inaccuracies, and that the Remus Board would not approve a Bidder’s Statement. In these circumstances, it seems clear that the proposed Remus takeover offer won’t be proceeding.

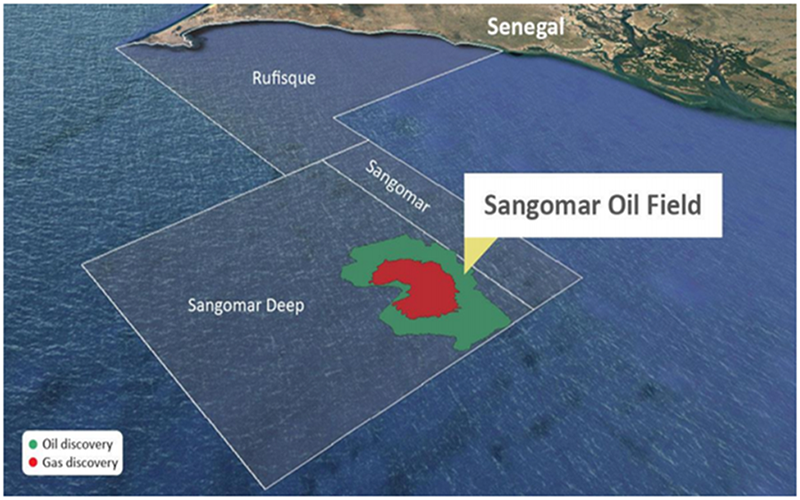

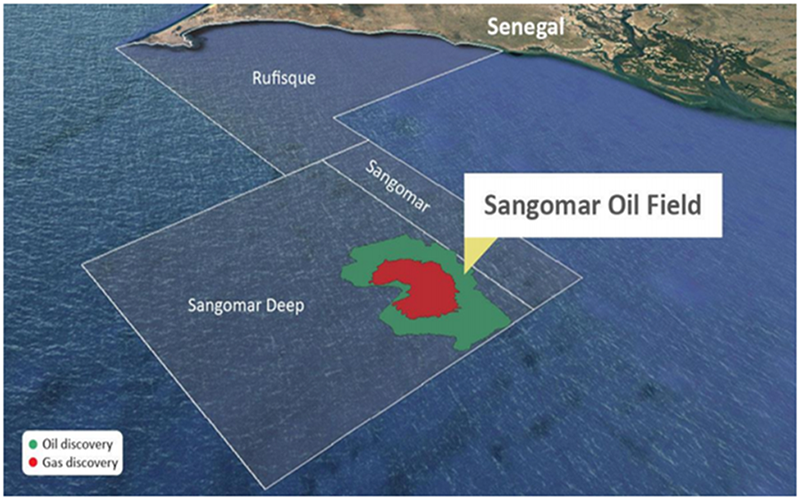

Accordingly, the FAR Board has continued strongly to recommend shareholders vote in favour of the sale of its interest in the RSSD Project at the shareholders meeting. Meeting details for the 28 April 2021 shareholders meeting (aside from the change in relevant dates) remain the same as those specified in the Second Addendum to the Notice of General Meeting issued by FAR on 31 March 2021.