The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) has announced the commencement of the 2022 Mini Bid Round. The Mini Bid Round is seen as a great opportunity to spur new exploration and drilling activities in the prospective deep waters offshore Nigeria.

The Mini Bid Round is aimed at further development of the deep offshore acreages which will be held in accordance with the Petroleum Industry Act (PIA), 2021 with its enhanced legal and regulatory frameworks that seeks to encourage new investors and investments into the next phase of exploration in this region.

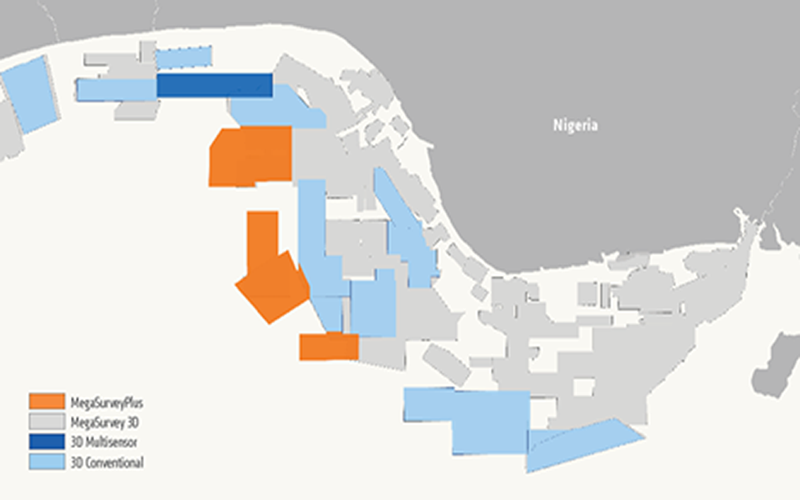

The Nigeria Mini Bid Round is coming few months after PGS has unveiled first Nigeria MegaSurveyPlus covering 11 230 sq. km of 3D data and allows a thorough AVO analysis of structural provinces directly linked to the Akata Shale Formation in November 2022.

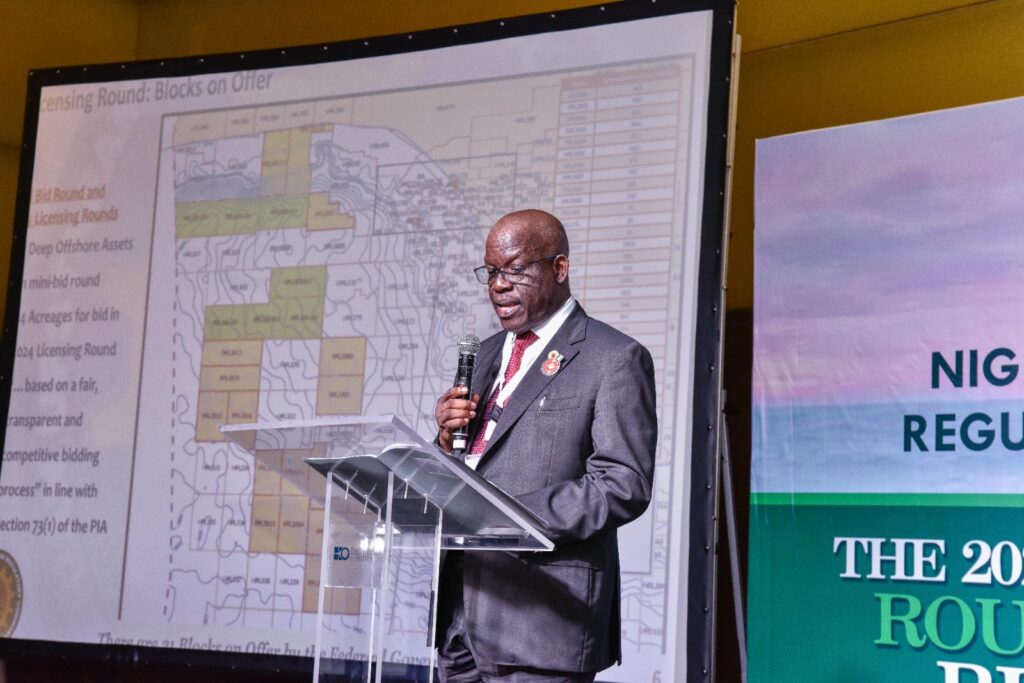

The Mini Bid Round will be managed by the NUPRC, in line with the provisions of the PIA, as the statutory body responsible for ensuring compliance with petroleum laws, regulations, and guidelines in the Nigerian upstream petroleum industry.

The National Data Repository (NDR) of NUPRC and our multi-client partners are delighted and ready to support the Mini Bid Round underpinned by high-quality datasets. The blocks have extensive 2D and 3D seismic data coverage, including multi-beam and analog data. Additionally, a remarkable quality, 3D MegaSurveyPlus reprocessed Pre-stack Time Migration, with angle stacks and gathers is also available to prospective bidders. Links to all data can be accessed via the dedicated NUPRC portal.

According to NUPRC the Mini Bid Round is a market-driven programme and will follow a transparent and competitive procurement process designed to attract competent third-party investors from across the world that have the capability and proficiency in operating in deepwater environment.

“Historically, this Mini Bid Round intends on the successes of the last bid round that held in April 2007 during which a total of forty-five (45) blocks, drawn from the inland Basins of Anambra, Bunue and Chad; the Niger Delta Continental Shelf; Onshore Niger Delta and Deep Offshore were put on offer. The 2007 bid round was held under a different regulatory regime (the Petroleum Act, 1969) and generated massive interest and participation with its attended revenue which made the exercise a success.

“In this 2022 Mini Bid Round, seven (7) Offshore blocks covering an area of approximately 6,700 sq km in water depths of 1,150m to 3,100m were put on offer. The success of the Mini Bid Round will ensure all stakeholders gain value from the country’s resources, whilst paying close attention to reduction in carbon emission, as well as overall environmental, social and government (ESG) considerations,” Commission Chief Executive , Engr. Gbenga Komolafe said.

The Nigeria Mini Bid Round is coming after 2020 marginal oilfield bid round was the first successful bid since 2003 when 24 assets were last put on offer. The process, which eventually culminated in the presentation of letters to the bid winners in Abuja by the industry regulator in June 2021, started in June 2020, with 57 marginal fields spanning land, swamp and offshore put up for lease by the federal government.

Nigeria-Round-Off-Marginal-Field-Bid-Round-Present-Letters-To-Successful-Winners

The commission in a press release stated that a dedicated programme portal (br.nuprc.gov.ng) for the Mini Bid Round has been published by NUPRC which provides details of the bid round process, including the registration and prequalification requirements, and detailed guidelines for applicants.

A pre-bid conference is scheduled for 16th January 2023 at Eko Hotels and Suites, Lagos to provide potential applicants with an opportunity to ask questions they may have concerning the Mini Bid Round process and requirements after which interested companies will be invited to submit their pre-qualification applications by 31st January 2023. NUPRC will continue to provide further details and roadmap for this international competitive Mini Bid Round in due course. Interested applicants are by the publication invited to participate in the process.