Panoro Energy ASA is pleased to announce that PetroNor E&P Limited and Panoro have reached an agreement to extend the completion long stop date for the previously announced sale of its fully-owned subsidiaries that hold 100% of the shares in Pan Petroleum Aje Limited. The original long stop date was December 31, 2020, being the date by which authorisation of the Nigerian Department of Petroleum Resources and the consent of the Nigerian Minister of Petroleum Resources were required to have been received. The amended long stop date to complete the Transaction is now June 30, 2021.

The regulatory approval process in Nigeria is well underway but has been delayed by the COVID 19 pandemic. The process is in an advanced stage and is expected to resume following the holiday period and to complete afterward.

As previously announced, following completion of the Transaction, Panoro’s intention is to declare a special dividend and distribute to its shareholders USD 10 million equivalent in Petronor shares in order for Panoro shareholders to retain a direct listed exposure to Aje/OML 113.

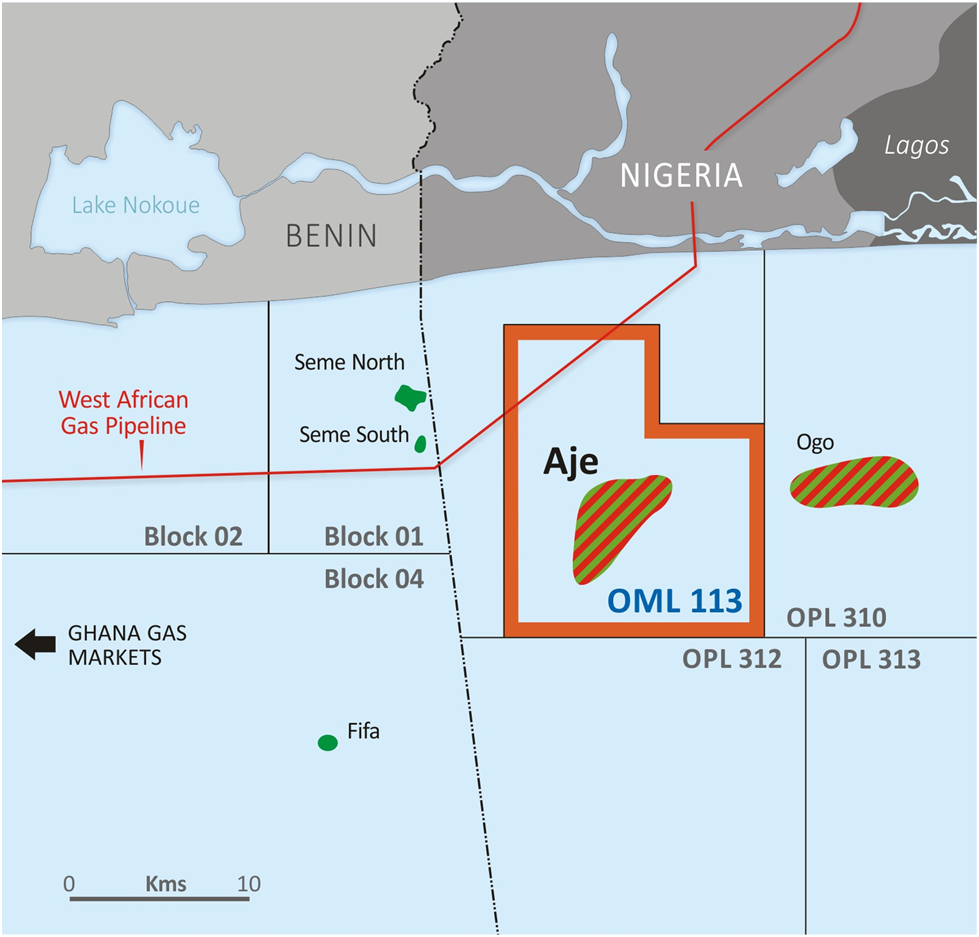

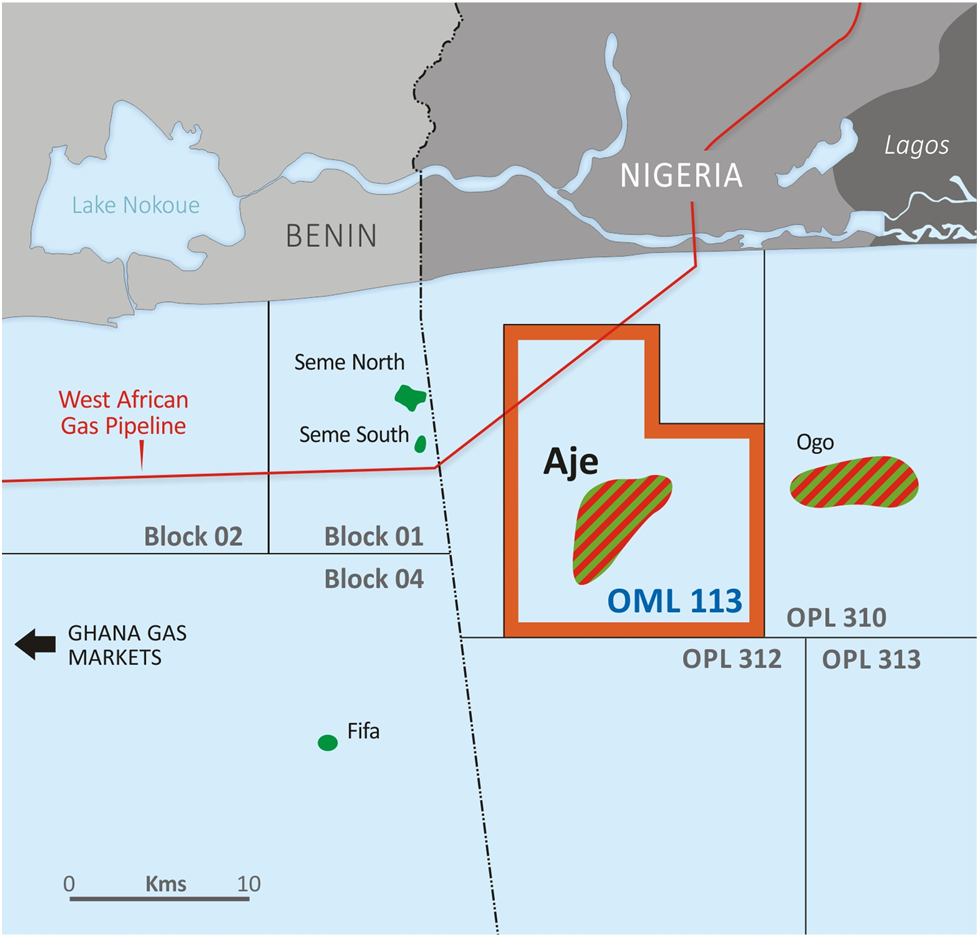

PetroNor had also in 2019 entered into separate agreements with the OML 113 operator Yinka Folawiyo Petroleum to create a holding company to exploit the substantial gas and liquids reserves at Aje. The regulatory process for this agreement is aligned with the Transaction and is expected to be approved concurrently.

Panoro and PetroNor have also taken the opportunity to review the deferred contingent element of the Transaction, reflecting the changed macro-economic background since the original announcement in 2019. Under the original agreement, once PetroNor had recovered all its costs related to their future investments to bring Aje gas into production, PetroNor was to pay to Panoro additional consideration of USD 0.15 per 1,000 cubic feet of the natural gas sales, such additional consideration being capped at USD 25 million.

The amended terms are for the consideration to be USD 0.10 per 1,000 cubic feet with the additional consideration being capped at USD 16.67 million.

All other terms and conditions of the Transaction remain unchanged.

This announcement is subject to disclosure pursuant to section 5-12 of the Norwegian Securities Trading Act.