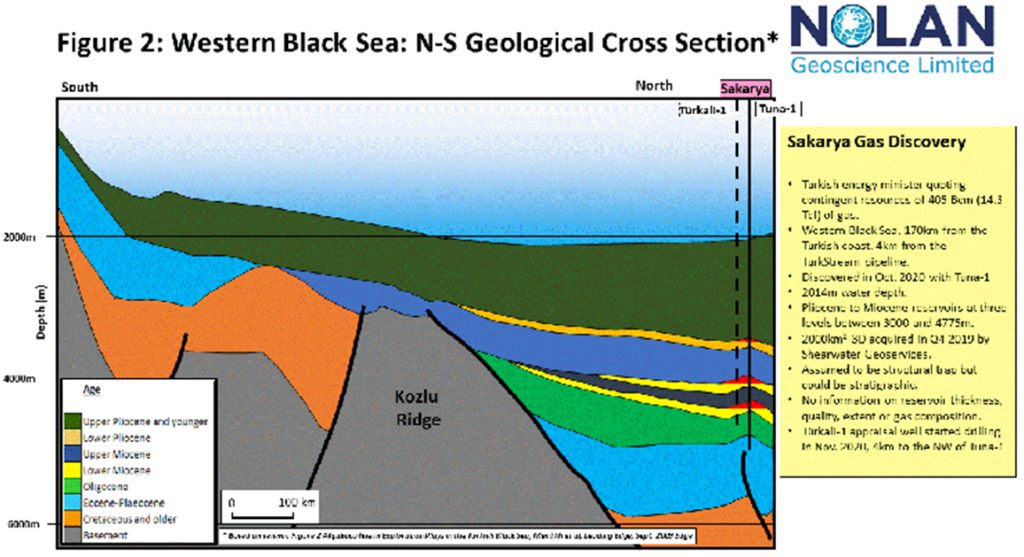

In October 2020 Turkey’s President, Recep Tayyip Erdoğan stated that the Sakarya Gas Discovery in the southern Black Sea may have established contingent resources of 405 Bcm (14.3 Tcf) of gas.

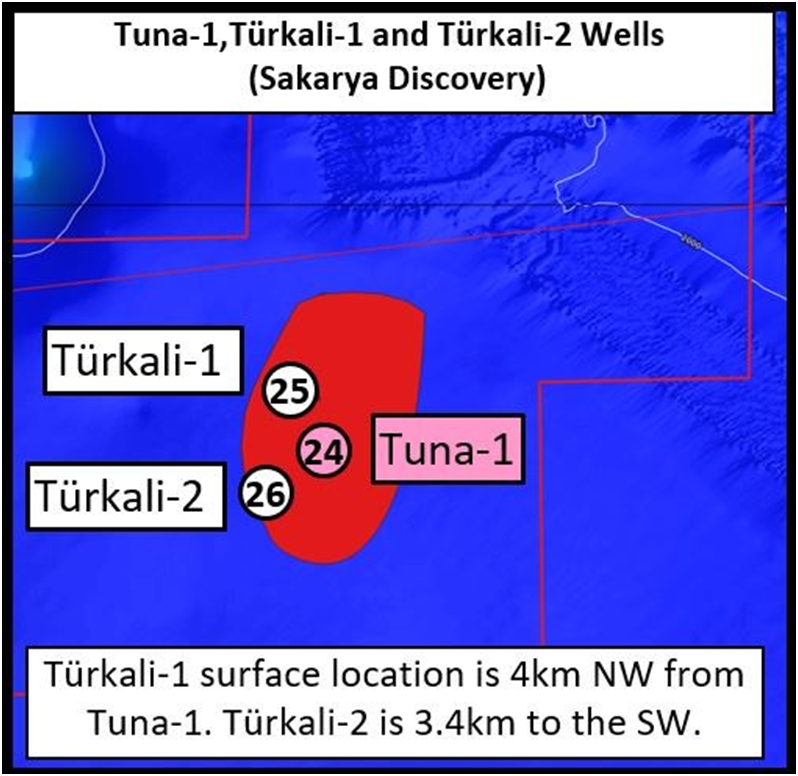

Turkish media recently reported the completion of the Türkali-1 appraisal well, which was drilled 4km to the northwest of the Tuna-1 discovery well.

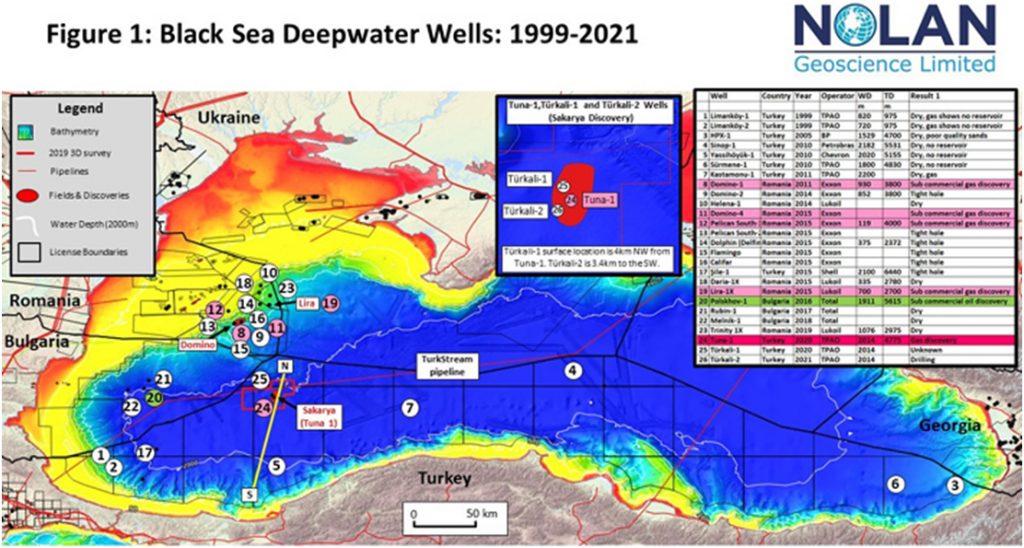

The map above shows the location of all three wells. The Fatih Drillship has now moved to the Türkali-2 appraisal well location, 3.4 km to the southwest of Tuna-1. Türkali-1 operations completed on January 18th 2021 after 77 days of operations. Operator Türkiye Petrolleri Anonim Ortaklığı (TPAO) has not provided any details on reservoir quality, reservoir thickness, reservoir extent or gas composition for Tuna-1 or Türkali-1.

Tuna-1 which was spudded in July 2020 using the Fatih drillship (bearing the same name as the Turkish energy minister) and reached a final total depth of 4775m in October 2020. The Sakarya discovery is located in the western Black Sea, 170km from the northern Zonguldak Province and in 2014m water depth. Tuna-1 is only 14km from the TurkStream pipeline that started delivering Russian gas to Bulgaria and North Macedonia in January 20202. The concession is 100% TPAO. In Q4 2019 Shearwater GeoServices carried out a 6200km² program of 3D acquisition including a 2000 km² program over the Sakarya area.

Black Sea Exploration

Since 1999 26 exploration and appraisal wells have been drilled in the deep waters of the Romanian, Bulgarian and Turkish parts of the Black Sea (see the table in Figure 1 for details). Tari and Simmons in their 2018 paper summarise the play types and the results from the pre-2018 wells. Wells have targeted a variety of play types and majority are located in the western Black Sea. Many of the wells have encountered gas shows, a few have established gas bearing reservoirs and one in Bulgaria has encountered oil (Polskhov-1). So far, none of the discoveries have established sufficient contingent resources to justify a development. One of the main plays is the Pliocene-Miocene Domino Play.

Domino Play: Pliocene–Miocene turbidite sandstones on structural highs

The Domino Play in Romania contains three gas discoveries; Domino, Pelican South and Lira. Domino 1 penetrated a total 70.7m of net gas pay and Lira-1 encountered 46m of net gas pay. Gas has been encountered in a series of stacked intervals that comprise generally fine to very fine grained Upper to Lower Pontian (Miocene) turbidite sands, sealed by marine mudstones and siltstones. The gas is biogenic – generated at low temperatures by decomposition of thick Oligocene–Miocene Maykop organic-rich deep marine mudstones by anaerobic microorganisms. Recent press reports suggest both Exxon and Lukoil are looking to exit the XIX Neptun Deep and EX-30 Trident licenses containing the Domino and Lira discoveries.

Miocene and Pliocene reservoir challenges of the in the Black Sea

The Miocene and Pliocene sands of the Romanian offshore were associated with the uplift and erosion of the Carpathian Mountains and deposited in deltaic and base of slope settings. The reservoirs are generally dominated by fine to very fine, grained sands and silts that are thinly bedded with abundant small pores that can trap large volumes of water. Niculescu and Andrei in their paper from 2018 and Lukoil in an online article reveal some of the challenges in exploring for and evaluating the fine grained, thinly bedded Miocene and Pliocene sands.

Sand detection on logs: Total gamma ray logs (GR) recorded in the wells shows an unusually low contrast between reservoir and non-reservoir intervals. The increased radioactivity of the reservoir rocks can be explained by a higher adsorption of radionuclides in the very fine sands and silts and, also, by the presence of potassium-bearing mica

Pay Estimation on logs: The high bound water content results in supressed resistivity logs over gas bearing zones, causing an overestimation of resistivity-derived water saturation (Sw). Conventional wireline analysis can therefore be misleading or problematic. Acquiring reliable formation pressure data in these thinly bedded fine grained reservoirs can also be a challenge. In turn establishing reliable water and gas gradients is difficult and hence establishing the free water level (FWL) and gas water contact (GWC). In the thickest, best quality sands, resistivity-derived Sw matches very closely with bound water saturation derived from Nuclear Magnetic Resonance (NMR) logs. In many instances the bound water appears to be immoveable, and only dry gas is produced on production tests, even when conventional log derived Sw is very high. The transition zone between the FWL and the GWC can be significant in very fine-grained reservoirs such as the Pontian and Dacian.

Seismic imaging: As outlined in a paper by Routh et al in 2017, seismic imaging in the Western Black Sea is challenging due to the presence of complex overburden, such as canyons, shallow gas channels, and complex shallow stratigraphy. Such overburden complexities create amplitude dimming and wipe-outs in the images and cause structural distortions of the reservoir units. Conventional velocity model building and seismic migration methods are not optimal for addressing such challenges. Full-wavefield inversion (FWI) technology was applied to overcome the complex seismic-imaging challenges in the Western Black Sea and to support the exploration, appraisal and development.

Seismic response of Miocene and Pliocene sands: In an ideal world thick (>10m), high quality (>20% porosity) gas sands should have a seismically detectable low impedance unit that would result in bona fide direct hydrocarbon indicators (DHIs) including amplitude brightening and a Class III amplitude versus offset (AVO) response. For a variety of reasons this often not the case in the Western Black Sea and there is generally a poor fit between Miocene amplitudes and structure on 3D seismic (personal experience). This has implications for exploration, appraisal and development.

3D seismic and CSEM water v gas response: In Romanian licenses EX29 and Ex-30, operator Lukoil have drilled three dry holes and made one non-commercial discovery (Lira). In their online article Lukoil highlighted their thorough examination and integration of all of the available data including; wireline data such as MDT and NMR, special core analysis, reprocessed 3D seismic and CSEM data. Lukoil also revealed the challenges with evaluating the finely laminated Miocene sand bodies comprising fine to very fine, grained sandstones. The suppressed resistivity response of the gas bearing Miocene sands and the large residual gas saturations of the water bearing sands creates challenges for conventional wireline analysis. The low resistivity contrast between shale and thin (<10m) gas and water bearing sands is difficult to differentiate on both 3D seismic and Controlled Source Electromagnetic (CSEM).

Biogenic Gas Systems and Trap Underfill

The biogenic discoveries of the Levantine Basin in the Eastern Mediterranean (including Leviathan, Tamar and Zohr) as well as the shallow gas fields of the Dutch sector of the North Sea provide some insight into the Black Sea biogenic gas discoveries such as Domino and Lira. In both examples direct hydrocarbon indicators (DHIs) and well results clearly demonstrate under fill of the traps. In the case of the Levantine Basin, the biogenic system is not very rich or efficient, relying on large areas and thick volumes of fairly lean (<1% TOC) Class III type source rock. It is fully active up to 55oC and then gradually switches off and is virtually ineffective above 70 degrees C. As a consequence, most of the fields are not full to spill (with one exception) and most have a GRV range of fill of 30-60%, two have fills of less than 25%. Further burial of the gas bearing traps below 70 degrees C (2-2.5km), after biogenic gas generation will result in compression of the gas that will enhance any underfill due to biogenic charge inadequacies.

Possible Scenarios for a Miocene Black Sea Discovery

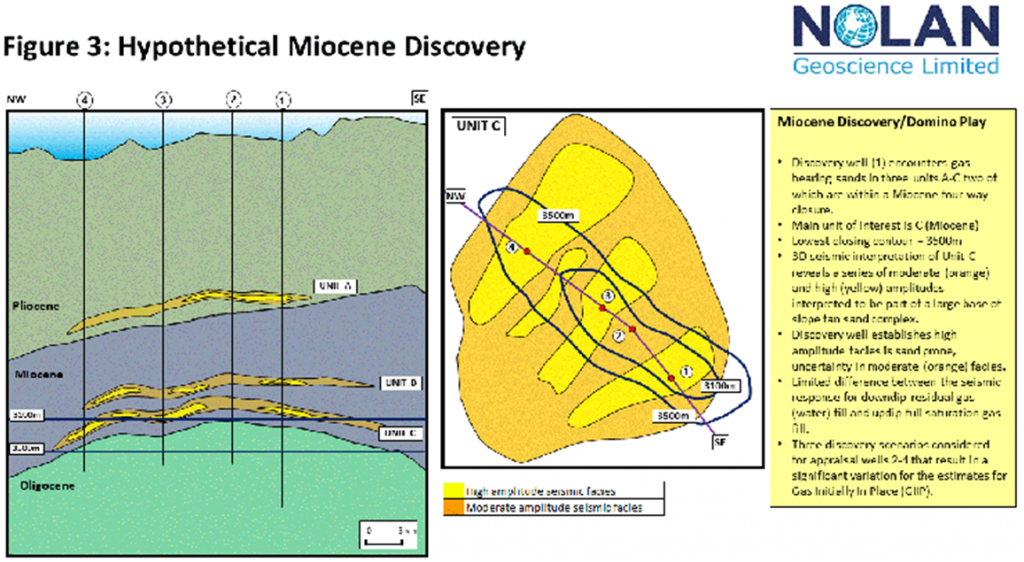

Based on the observations outlined above a series of scenarios are considered for a hypothetical Domino Play discovery in which the discovery well (1) encounters gas bearing sands in three units A-C, two of which are within a Miocene four-way closure (see Figure 3 below for illustration). The main unit of interest is Unit C (Miocene) with a lowest closing contour of 3500m. 3D seismic interpretation of Unit C reveals a series of moderate (orange) and high (yellow) amplitudes interpreted to be part of a large base of slope fan sand complex. The discovery well establishes high amplitude facies is sand prone, uncertainty in moderate (orange) facies. There is a limited difference between the seismic response for downdip residual gas (water) fill and updip full saturation gas fill.

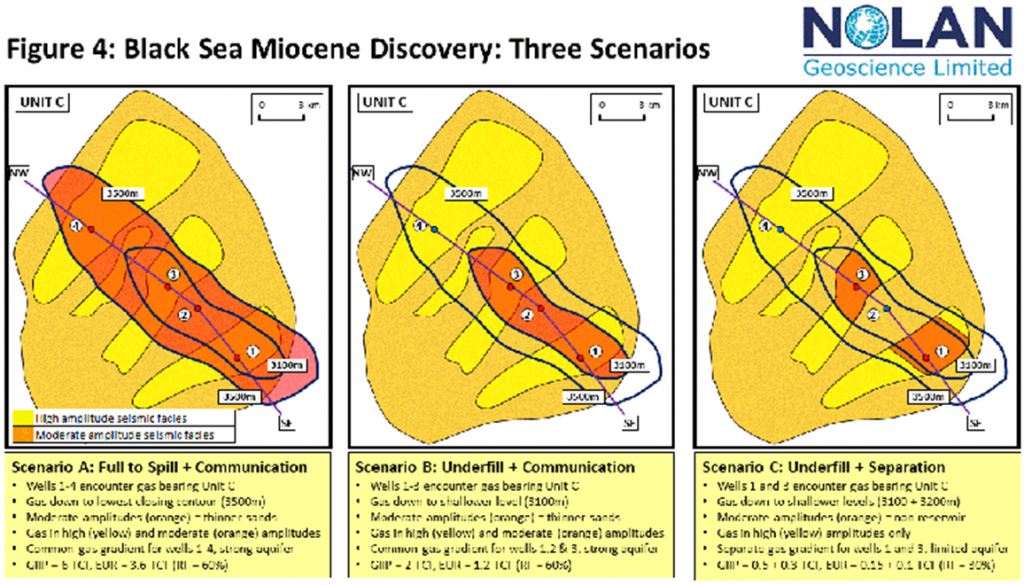

Three scenarios are considered for the results of appraisal wells 2-4 that result in a significant variation in the estimates for gas in place (GIIP) and recoverable resources (EUR) from 3.6 TCF to 0.25 TCF. See Figure 4 below.

Scenario A: Full to Spill + Communication: Wells 1-4 encounter gas bearing Unit C. Gas down to lowest closing contour (3500m). Moderate amplitudes (orange) = thinner sands. Gas in high (yellow) and moderate (orange) amplitudes. Common gas gradient for wells 1-4 and a large aquifer with strong support. GIIP = 6 TCF. EUR = 3.6 TCF (RF = 60%).

Scenario B: Underfill + Communication: Wells 1-3 encounter gas bearing Unit C. Gas down to shallower level (3100m). Moderate amplitudes (orange) = thinner sands. Gas in high (yellow) and moderate (orange) amplitudes. Common gas gradient for wells 1,2 and 3 and a large aquifer with strong support. GIIP = 2 TCF. EUR = 1.2 TCF (RF = 60%).

Scenario C: Underfill + Separation: Wells 1 and 3 encounter gas bearing Unit C. Gas down to shallower levels (3100 + 3200m). Moderate amplitudes (orange) = non-reservoir. Gas in high (yellow) amplitudes only. Separate gas gradient for wells 1 and 3 and a small aquifer with limited support. GIIP = 0.5 + 0.3 TCF. EUR = 0.15 + 0.1 TCF (RF = 30%).

Conclusions

Sakarya has lowered the risks for other prospect and leads in this part of the Domino play. There are significant remaining uncertainties, risks and challenges with the Domino Play and the Sakarya Discovery, these include;

Reservoir: presence, thickness and quality. Are the Sakarya reservoirs significantly thicker and/or better than those encountered on the Romanian side of the Domino Play? Are individual reservoir units in pressure communication or isolation? Is there a large aquifer with strong support?

Degree of gas fill: As outlined above many biogenic gas plays have undefiled structures. Further burial of the structures after biogenic charge further reduces the size of fill. Is there evidence for higher degree of fill in this part of the play?

Seismic imaging and calibration of 3D amplitudes: Well results from the Romanian side demonstrate the challenges of obtaining good quality seismic, to calibrate it to the well response and ultimately to determine an integrated lithologic and fluid model. Is the seismic data quality better at Sakarya? Can the fluid model differentiate between full saturation gas and residual gas with just one well to calibrate to the seismic?

The Türkali-1 and 2 appraisal wells are relatively modest step-outs (<4km) given the size of the resources quoted by President Erdoğan. Results from the Romanian side of the play suggest a number of appraisal wells will be required to reduce the uncertainties in the lithologic and fluid models and constrain the range in resource estimates. If the Türkali-1 and 2 appraisal wells are commercial successes, Sakarya may yet prove to be a transformational discovery for TPAO and Turkey producing up to 20 Bcm per year, meeting 40-50% of Turkey’s gas requirements.