Sintana Energy provides the following update, including a recently approved extension to Petroleum Exploration License 87 (PEL 87), a year-end review and 2023 outlook, and summary of incentive awards approved at the Company’s annual general meeting.

“2022 was a seminal year in Sintana’s history underpinned most notably by our entry into Namibia in March,” said Robert Bose, President and Director.

“The significant progress in 2022 on both our licenses and on the blocks around us, particularly in the offshore Namibian basins has continue to demonstrate the timeliness of our entry. Multiple catalysts in the near-term position the Company and its shareholders for success in 2023,” he added.

PEL 87 Extension & Relinquishment Waiver

Earlier this month, Namibia’s Minister of Mines and Energy granted a second one-year extension to the current, first four-year Initial Exploration Period associated with PEL 87 located in Orange Basin.

The revised Initial Exploration Period will now expire in January 2024. Three additional periods totaling six years are available after the current period, with further possible extensions thereafter. The extension will be used to conduct, among other things, an extensive 3D seismic survey.

An obligatory relinquishment of the license area of PEL 87 was waived by the Minister, preserving an area of 10,970 square kilometers.

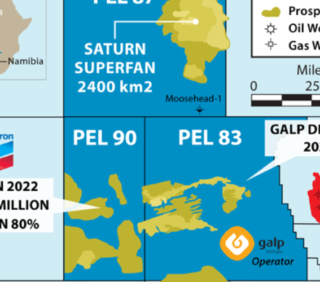

Sintana maintains a 7.4% indirect, carried interest in PEL 87. The other working interest owners include National Petroleum Corporation of Namibia (Namcor) owner of 10% and Pancontinental Orange (Pty) Ltd. (“Pancontinental”) the operator and owner of a 75% interest.

PEL 87 includes the 2,400 square kilometer Saturn turbidite complex that has been mapped by Pancontinental. This complex has similar geologic characteristics and is on-trend with TotalEnergies’ Venus oil discovery, made in February 2022.

The working interest partners continue to have discussions with potential farmout partners.

Year End Review & Outlook

2022 included numerous milestones and events associated with the Company’s entry into Namibia. These included the following:

- In January, amending the definitive agreement to acquire a 49% interest in InterOil (Pty) Ltd., the owner of indirect interests in 4 offshore and 1 onshore exploration licenses in Namibia and launching a public offering of units to support completion of the Acquisition.

- In February, the announcement by Shell of its light oil discovery at Graff-1, and the announcement by Total of its oil discovery at Venus-1.

- In March, closing of an oversubscribed public offering raising gross proceeds of C$13,282,500 and completion of the Acquisition.

- In June, the announcement of the extension of the First Renewal Exploration Period for Petroleum Exploration License 83 (“PEL 83”) providing for an increase to the related work program.

- In October, the announcement that a subsidiary of Chevron had entered into an agreement to acquire an 80% working interest and operatorship of Petroleum Exploration License 90 (“PEL 90”) in exchange for upfront cash consideration and a carry through 3D seismic program and an exploration well – Sintana retains a 4.9% indirect working interest in the block and benefits from the carry on its retained interest.

- In December, the extension of the Initial Exploration Period and waiver of the mandatory relinquishment associated with PEL 87.

The Company expects continued activity in 2023 on and around its offshore blocks including:

- Completion of a 3D seismic survey and the potential drilling of an exploration well by Chevron on PEL 90.

- Potential farmout announcements on PELs 83 and 87.

- Additional exploration and appraisal activity by both Shell and TotalEnergies in the Orange Basin on their respective blocks which immediately offset blocks in which Sintana has indirect interests.

- Up to 5 wells drilled by Maurel & Prom on PEL 44 in the Walvis Basin, which is located directly below PEL 82 where Sintana has an indirect 4.9% interest.

“The numerous catalysts expected in 2023 will provide many opportunities to assess and substantiate the multi-billion barrel potential of the Namibian offshore as it emerges as the next global hydrocarbon province,” said Robert Bose. “We look forward to significant progress in the year ahead,” he added.

Incentive Awards

The Company reports that its Board of Directors has approved grants of a total of 6,400,000 incentive common stock options to several directors and officers of the Company and six consultants. The options have an exercise price of $0.11, vest in three equal tranches over the next 24 months and will expire on December 19, 2032.

The Company also approved grants to several directors and officers of an aggregate of 3,900,000 restricted share units which will vest on January 3, 2024.