TotalEnergies has released the second quarter 2023 financial statements. On the occasion, Patrick Pouyanné said:

“In a favorable but softening oil & gas environment TotalEnergies once again delivered this quarter robust results, strong cash flow, and attractive shareholder distribution. The Company generated adjusted net income of $5.0 billion and return on average capital employed of 22%. TotalEnergies generated $8.5 billion in cash flow in the second quarter and $18 billion in the first half of 2023.

Exploration & Production reported adjusted net operating income of $2.3 billion and cash flow of $4.4 billion. Production of 2.5 Mboe/d was up 2% year-on-year, thanks to new project start-ups (Ikike in Nigeria, Mero 1 in Brazil, Block 10 in Oman) and benefited from the integration of the SARB and Umm Lulu oil fields in the United Arab Emirates.

The Integrated LNG segment posted cash flow of $1.8 billion, benefiting from the high margins captured in 2022. Adjusted net operating income was $1.3 billion reflecting lower LNG prices (averaging 10 $/Mbtu in the second quarter) and softer trading results in less volatile markets.

Integrated Power’s adjusted net operating income and cash flow increased to $450 million and $491 million respectively in the second quarter, building its track record as an integrated and profitable player in the electricity markets with a ROACE of 10.1%.

Downstream reported resilient adjusted net operating income of $1.5 billion and cash flow of $2.1 billion in a context of lower refining margins.

As part of the implementation of its multi-energy strategy, the Company also announced four major projects this quarter:

- the launch of its multi-energy GGIP project in Iraq,

- the launch of the RGLNG project in Texas, which will boost its LNG export capacity from the US to 15 Mt/y,

- the completion of the acquisition of 100% of Total Eren in renewable electricity,

- the award of the EPC contracts for the Amiral petrochemical project in Saudi Arabia.

These projects demonstrate TotalEnergies’ ability to seize opportunities allowing the Company to deploy its multi-energy model based on two pillars: production of low-cost low-emissions hydrocarbons (oil and LNG) and the development of a profitable integrated power business.

In this favorable environment, the Board of Directors confirmed for 2023 a shareholder distribution of more than 40% of cash flow. The Board decided the distribution of a second interim dividend for the 2023 financial year in the amount of €0.74/share, up 7.25% year-on-year, and authorized the Company to buy back shares for $2 billion in the third quarter of 2023.”

Highlights

Multi-energy strategy

- Launch of GGIP in Iraq: major multi-energy project (access to low-cost, low-emission oil from the Ratawi field, gas gathering and treatment for electricity generation, 1 GW solar farm and sea water treatment) in favor of the sustainable development of natural resources in Basrah area

- Partnership with SONATRACH to increase the production of the Tin Fouyé Tabankort fields, extend to 2024 2 Mt/y of LNG deliveries in France, and develop renewable energy projects in Algeria

Upstream

- Production start-up of Absheron gas and condensate field, in Azerbaijan

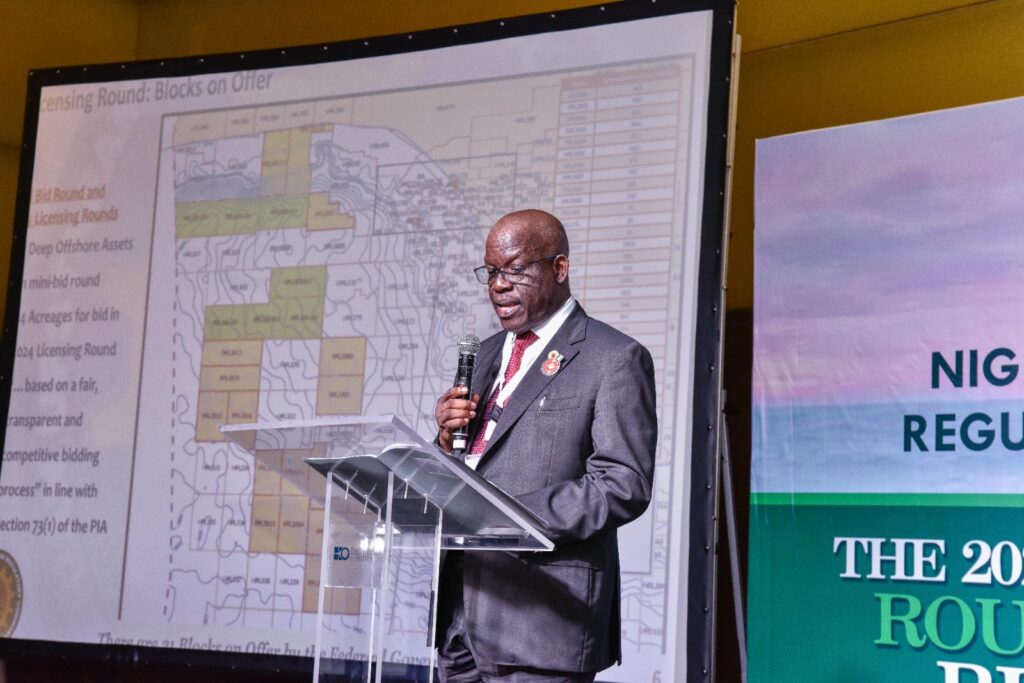

- Oil and gas discovery on the Ntokon well, located on OML 102 in Nigeria

- Renewal for 20 years of the OML130 license, in Nigeria

- Exercise by ConocoPhillips of its preemption right on Surmont, following the announcement of the sale to Suncor of the entirety of the shares of TotalEnergies EP Canada Ltd

- Signature of Production Sharing Contracts on Blocks 6 and 8, in Suriname

- Signature of the Production Sharing Contract for the Agua Marinha block, in Brazil

Downstream

- Award of $11 billion EPC contracts for the Amiral project, in Saudi Arabia

- Realignment with INEOS of stakes in petrochemical assets in Eastern France

- Integrated LNG

- Launch of the RGLNG project, in Texas: acquisition of a 16.67% stake in the JV in charge of developing the 17.5 Mt/y project, acquisition of a 17.5% stake in NextDecade, and signature of a 5.4 Mt/y offtake agreement for 20 years

- Delivery of the first LNG cargo to the Dhamra LNG terminal in India

- Signing of LNG sale contracts to IOCL in India for 10 years and to ADNOC Gas for 3 years

Integrated Power

- Acquisition at 100% of Total Eren, a leading renewable electricity producer

- Award of two maritime leases to develop two offshore wind farms for a total capacity of 3 GW in Germany

- Favorable environmental impact assessment for 3 GW of solar projects in Spain

- 25-year Power Purchase Agreement for 1 GW onshore wind farm with battery storage in Kazakhstan

- Launch at Antwerp, in Belgium, of a 75 MWh battery energy storage project

- Strategic Collaboration Agreement with Petronas, to develop renewable energy projects in the Asia Pacific region. Agreement to develop the 100 MW Pleasant Hills solar project in Australia.

Decarbonization & new molecules

- Partnership with TES to develop a large-scale production unit for e-natural gas in the United States

- Agreement with VNG to initiate the future supply of green hydrogen to the Leuna refinery, in Germany

- SAF: doubling SAF production capacity to 285 kt per year at Grandpuits, in France

Biomethane:

- Acquisition of 20% stake in the Finnish start-up Ductor

- Signature with Saint-Gobain France of a 100 GWh sale agreement over 3 years

Construction in Grandpuits, in France, of a production unit with annual capacity of 80 GWh