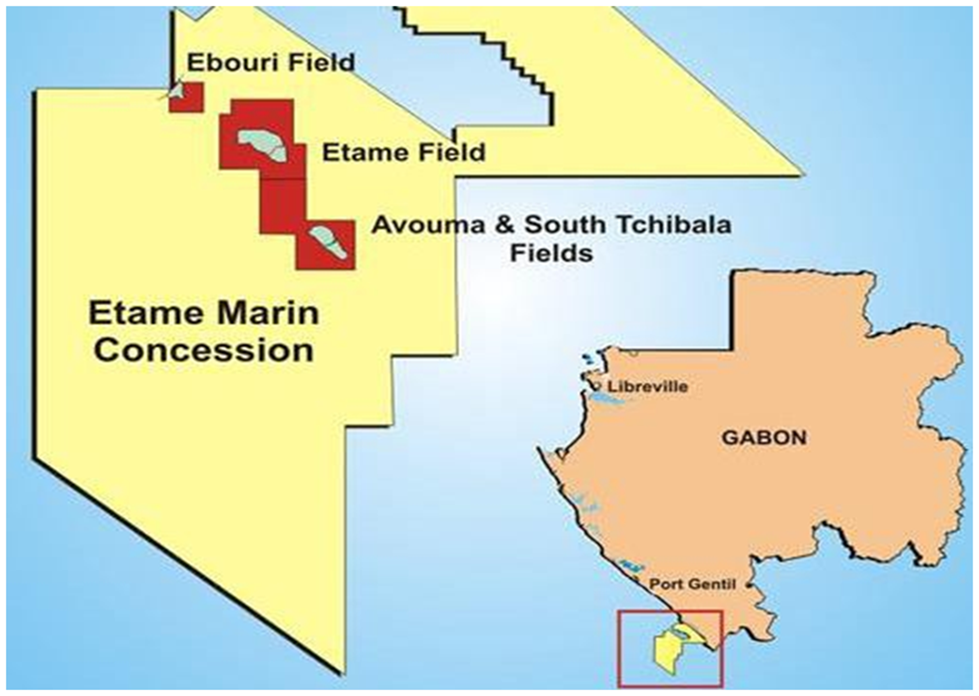

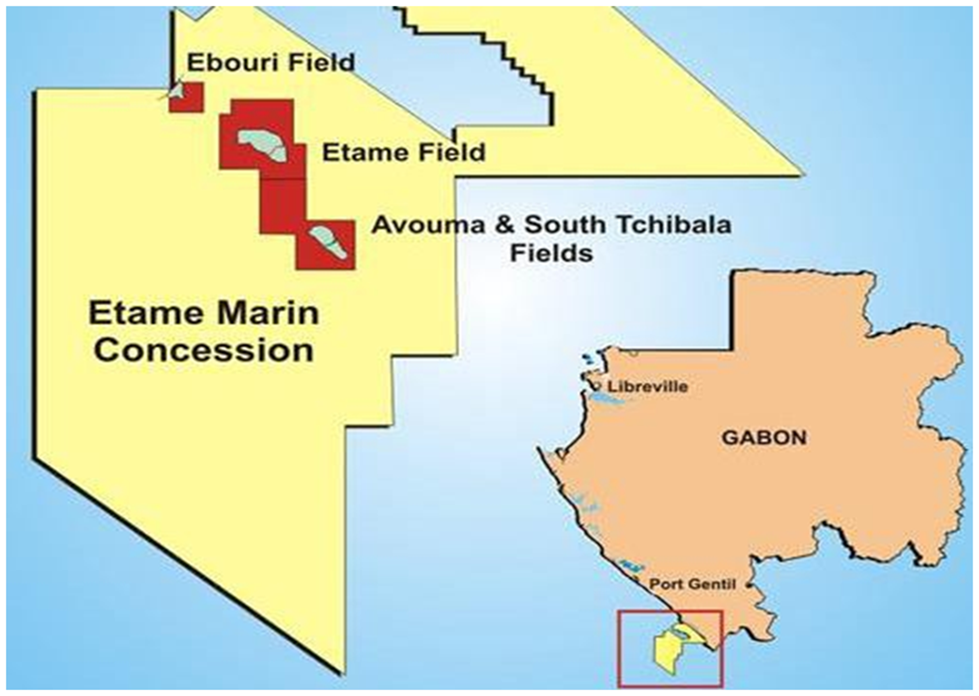

Sasol said it has completed the divestment of the 27.75% non-operated interest in the Etame Marine Permit (EMP) to VAALCO Gabon S.A. (VAALCO) on 25 February 2021 after completion of all legal and regulatory closing conditions.

Subsequent to concluding the Sale and Purchase Agreement with VAALCO in November 2020 to divest both the EMP and DE-8 Permit, Perenco has exercised its pre-emptive right to acquire Sasol’s interest in the DE-8 permit. This transaction will now be concluded separately and not form part of the acquisition by VAALCO as previously announced.

The economic effective date of the divestment of EMP was agreed as 1 July 2020 for a total cash consideration of US$44 million. Under the terms of the agreement, a contingent payment of US$5 million will be payable to Sasol by VAALCO if Brent oil pricing averages greater than US$60 per barrel for 90 consecutive days during the period between 1 July 2020 and 30 June 2022 (inclusive).

Defers 2020 operations update

VAALCO said it will issue its fourth quarter and full year 2020 earnings release on Tuesday, March 9 after the close of trading on the New York Stock Exchange and host a conference call to discuss its financial and operational results on Wednesday morning, March 10 at 9:00 a.m. Central Time (10:00 a.m. Eastern Time and 3:00 p.m. London Time.)

Interested parties in the United States may participate toll-free by dialing (877) 270-2148. Interested parties in the United Kingdom may participate toll-free by dialing 08082389064. Other international parties may dial (412) 902-6510. Participants should ask to be joined to the “VAALCO Energy Fourth Quarter 2020 Conference Call.”

Acquisition shores VAALCO reserves

The oil production of the American Vaalco Energy is expected to double in Gabon. This, thanks to the repurchase of the 27.8% of the shares of the South African Sasol in the oil block Etame marin in Gabon, which allows the company to now hold 58.8% of the direct shares in this permit, announced the company in a press release dated February 25. According to recent independent 2P data from contractor CPR, Vaalco’s reserves could then increase from 9.2 million barrels to 17.5 million barrels.

“ With the additional production from the acquisition, we anticipate significant cash flow generation in 2021, ” said Cary Bounds, CEO of Vaalco. The acquisition should pay off immediately for Vaalco, with minimal additional variable costs, according to the company.

To have these additional shares, Vaalco paid “ $ 29.6 million in cash to Sasol, taking into account the agreed transaction price of $ 44 million, the deposit already paid and adjustments after the effective date. , with a future conditional payment of up to $ 5 million , ”the company statement said. Indeed, under the terms of the deal, a conditional payment of $ 5 million will be paid to Sasol if the price of Brent oil averages over $ 60 per barrel for 90 consecutive days during the July 1 period. 2020 to June 30, 2022.

The South African Sasol is therefore turning his back on the Etame oil block at a time when Gabon is fighting to slow down the fall in oil production and to diversify its hydrocarbon sector. Located off Gabon, the Etame marine block has produced more than 120 million barrels of crude oil to date. Founded in 1985, Vaalco is the operator of this oil block.