ADM Energy PLC a natural resources investing company has provided the following update with respect to the internal technical review of its 12.3% cost share and 9.2% profit share interest in OML-113, Aje Field, offshore Nigeria, announced 1 December 2023.

Aje Field Internal Technical Review

Since the announcement dated 1 December 2023, “Internal Review of Aje Field Interest” the Company has been contacted by a number of financial and strategic investment groups that have expressed interest in the Company’s interest in the Aje Field. The Company remains in discussion with several of these groups and will provide further updates in due course;

In the Autumn of 2023, the Operating Committee (of which the Company is a member along with Yinka Folawiyo Petroleum, PetroNor E&P and Energy Equity Resources Ltd. – the “Aje Partners”), initiated the reprocessing of 3D seismic covering the Aje Field and a significant portion of the OML-113 License area, offshore Nigeria, at a gross cost of approximately US$600,000 that has been settled from funds available to the Aje Partners in the Operating Account maintained by and for benefit of the Aje Partners;

The 3D seismic reprocessing has been completed and a field wide structural reinterpretation by the Aje Partners and engaged geophysical consultants is currently underway;

The Company intends to have the reinterpretation of the Aje field 3D seismic dataset reviewed by an independent technical consultant and provide an update to the field volumetrics and recoverable reserves and resources via a revised Competent Persons Report (CPR);

Based on the initial internal review, the Aje Partnership believes that the results of the reprocessed Aje field 3D seismic dataset may have a material uplift on (i) the potential of the Aje field and (ii) the value of Aje, as well as financing options available to the Company for its interest in Aje Field.

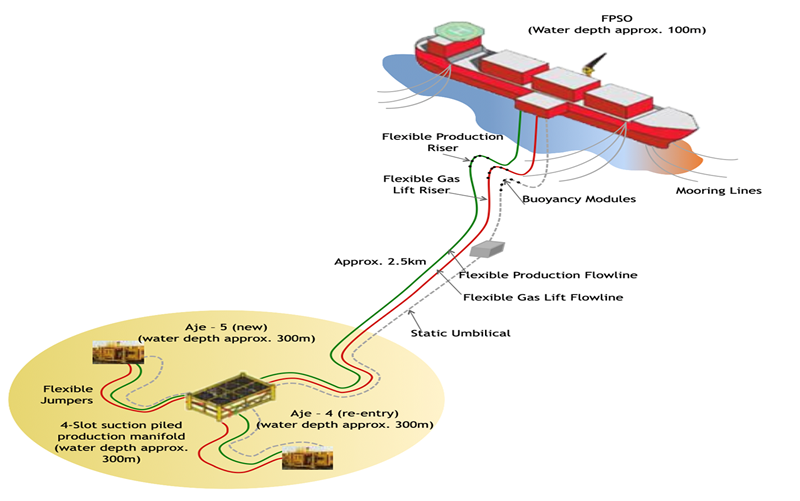

Aje Field Description

The Company holds a 12.3% cost share and 9.2% profit share interest in OML-113 covering an area of 835km² offshore Nigeria, which includes the Aje Field. Aje, which has produced more than 5 million barrels of oil to date, is rich in gas and condensate reserves with multiple oil, gas, and gas condensate reservoirs in the Turonian, Cenomanian and Albian sandstones with five wells drilled to date. Based on ADM’s 2019 Competent Persons Report, the Aje field represents 8.9 million barrels of oil equivalent resources with a mid-case NPV10% of US$25.9 million to ADM’s interest based on a US$70 oil price scenario.

“The Board is very encouraged by the Aje Partnership’s assessment of the newly reprocessed 3D seismic dataset across the Aje field. We look forward to having the data reviewed by an independent technical consultant and are confident that the results, once available, will result in a material uplift to the assessment of the Aje field and the intrinsic value of the asset,” Stefan Olivier, CEO of ADM Energy PLC said.

Oilfieldafricareview offers you reviews and news about the oil industry.

Get updates lastest happening in your industry.

©2025 Copyright - Oilfieldafricareview.com

Please wait....

Thank you for subscribing...