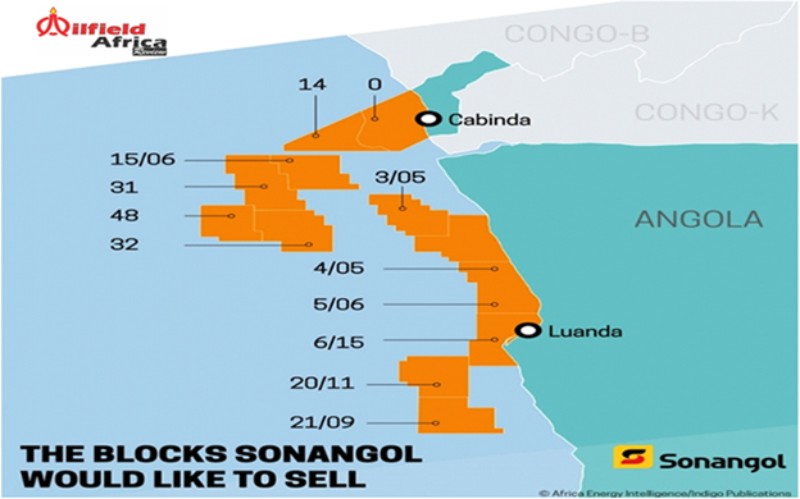

Afentra plc an upstream oil and gas company listed on AIM and focused on acquiring production and development assets in Africa, has stated that, further to the announcement made on 19 July 2023 regarding the proposed acquisition of interests in Block 3/05 and Block 3/05A from Azule Energy Angola Production B.V. and the amendment to the terms of the SPA with Sonangol dated 20 April 2022 to reduce the interest being acquired by Afentra in Block 3/05 from 20% to 14% , and together with the Azule Acquisition (the ‘Acquisitions), an Admission Document in relation to the Acquisition and Notice of General Meeting to approve the Acquisitions will be posted to shareholders today and is available to download from the Company’s website.

Following the publication of the Admission Document, the Company anticipates that the suspension of the trading in the Company’s shares will be lifted and that trading in the Company’s Ordinary Shares will recommence at 8.00am BST this morning. The General meeting to approve the Acquisition will be held electronically on 5 October 2023.

“We are pleased to see Afentra’s shares recommence trading after a short suspension associated with these value enhancing transactions. The assets are performing strongly and Afentra will continue to benefit from the associated production from both 3/05 and 3/05A from the respective effective dates up until completion which ensures the Company is accruing strong cash flow that can be used to offset the firm consideration at completion.

“We look forward to completing both transactions in the coming months, at which point Afentra will have meaningful interests in these high quality and strategically complementary assets, and will be underpinned by strong cash flow, proven reserves and material upside that we intend to realise alongside our asset partners. I’d like to thank all our shareholders for their support through the suspension period and look forward to rewarding their patience as we demonstrate to the market the value enhancing nature of the transactions which will be further strengthened by the improvements to the fiscal terms which are currently proceeding through the approval process. We look forward to updating the market as we deliver the various milestones towards completing these transformative transactions,” CEO Paul McDade said.