Afentra provides the following update regarding the previously announced Angolan acquisitions.

Sonangol Acquisition

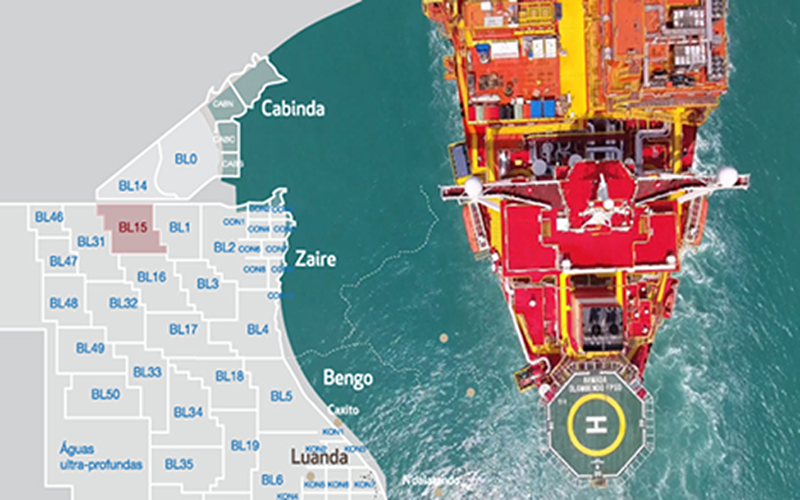

On 28 April 2022, the Company announced that its wholly-owned subsidiary, Afentra (Angola) Ltd, had signed a sale and purchase agreement (the ‘SPA’) with Sonangol Pesquisa e Producao S.A. (‘Sonangol’) to purchase non-operating interests in Block 3/05 and Block 23, offshore Angola. As set out in the admission document published by the Company on 10 August 2022, the Sonangol Acquisition is subject to a number of conditions precedent (the ‘CPs’), including the receipt of governmental approvals and the extension of the Block 3/05 Production Sharing Agreement until at least 31 December 2040.

The Company remains in discussion with all relevant parties and expects to finalise the Sonangol Acquisition in Q4 2022, as previously guided. Whilst Afentra remain on track to achieve this timing, satisfaction of the CPs is anticipated to occur after the current long-stop date of 20 October 2022. The Company has reached an agreement with Sonangol to extend the long-stop date to 31 December 2022 in order to facilitate satisfaction of the CPs in Q4 2022.

INA Acquisition

On 19 July 2022, the Company announced that its wholly-owned subsidiary, Afentra (Angola) Ltd, had signed an SPA with INA – Industrija Nafte d.d. (‘INA’) to purchase interests in Block 3/05 and Block 3/05A, offshore Angola (the ‘INA Acquisition’). As set out in the admission document published by the Company on 10 August 2022, the INA Acquisition also remains subject to a number of CPs. Given the progress made to date, there is not considered to be any requirement to extend the long-stop date pursuant to the INA Acquisition at this time, as set out in the Company’s admission document.

The Board looks forward to providing shareholders with further updates on both transactions, as appropriate, in due course.

“We are pleased to provide this update on the Sonangol and INA acquisitions and remain confident, having engaged with local authorities and counterparties in Angola earlier this month, that the transactions will complete within the previously guided timeline (Q4 2022). On the Sonangol Acquisition, we consider the extension of the long-stop date as a prudent measure to ensure that the conditions precedent can be satisfied within the agreed timeframe. We look forward to completing both transactions and working with Sonangol and the other partners to optimise production and extend the life of these quality, long-life assets.” Commenting on the update, CEO Paul McDade said.