Afentra has announced completion of the acquisition from INA-Industrija d.d. (‘INA’) of a 4% interest in Block 3/05 and 4% interest(1) in Block 3/05A offshore Angola (the ‘INA Acquisition’) pursuant to a sale and purchase agreement between INA and Afentra’s wholly owned subsidiary, Afentra (Angola) Ltd, dated 18 July 2022 (‘SPA’). This acquisition marks Afentra’s entry into Angola where it is well positioned to build a material production business and contribute to a responsible energy transition for the country.

- The transaction effective date of 30 September 2021 results in a net upfront consideration at completion of $17.0m, which is offset by the Company inheriting crude oil stock with an approximate value of $16.6m at $80/bbl (207,868 bbls(2))

- The Company has also set aside $10.0m into an escrow deposit at completion, which will be paid to INA after the Block 3/05 licence extension is formally completed

- The net upfront consideration and escrow deposit will be funded by $18.9m from the agreed Reserve Based Lending (‘RBL’) and working capital facilities and $8.1m from cash resources

- The Company expects to sell its first cargo of crude oil in Q3 2023, thereby monetising the inherited crude oil stock and subsequent production

- Block 3/05 current gross production in April averaged 19,000 bbl/d (net 760 bbl/d)

The upfront consideration of $17.0m comprises a $12.0m initial consideration, $4.8m in working capital and interest(3) and $2.0m in payments of crystallised contingent consideration,(4) adjusted downwards by $1.8m due to positive net asset cashflows.(5)

The Company is pleased to announce that Mauritius Commercial Bank (‘MCB’) has entered both the RBL and working capital facilities as the lender to the Company. Trafigura retains an interest in the RBL facility and will continue as offtake provider for the Block 3/05 crude. The principal terms and conditions for both the RBL and working capital facility remain unchanged. The combination of MCB and Trafigura is a further positive step as the Company strengthens its credit relationships with two lenders who are supportive of the energy sector.

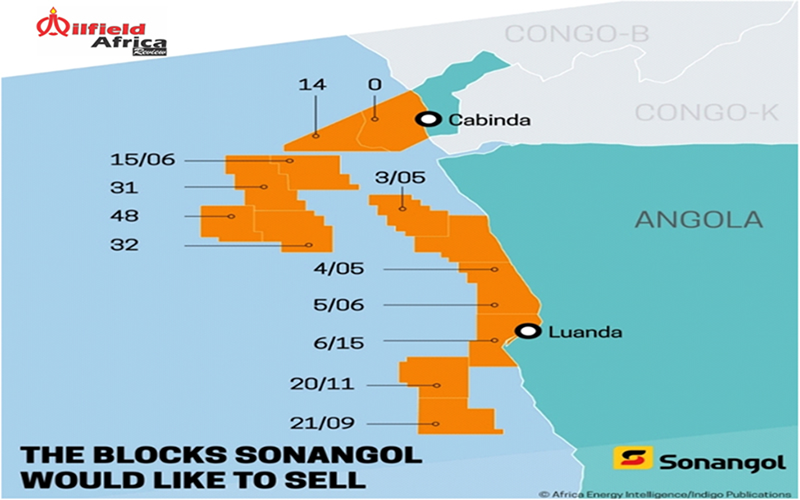

Sonangol Acquisition Update

The Block 3/05 JV partners and ANPG, the Angolan Oil & Gas regulator, have now agreed the terms of the Block 3/05 licence extension, extending the production sharing agreement (‘PSA’) from 1 July 2025 to 31 December 2040 with improved fiscal terms that strengthen the economics of the permit. ANPG will now begin the process of obtaining the requisite governmental approvals for the licence extension.

The agreement between ANPG and the JV partners of the terms for the licence extension, which is a Condition Precedent to the Sonangol acquisition, now allows Sonangol, as seller, to start the process of obtaining the requisite government approvals for the Sonangol transaction where we remain on track to complete by 30 June 2023.

Operations Update

Production from Block 3/05 averaged 17,206 bbl/d in Q1 2023 as a result of downtime experienced through planned restoration works on power generation and the distribution network. Recent production levels have improved with April volumes averaging ~19,000 bbl/d. Furthermore, long-term testing commenced in Block 3/05A, at the Gazela field, of an additional ~1,100 bbl/d, enabling framing of potential development options.

Updated Competent Persons Report

ERCE has completed its annual update of the Competent Persons Report (‘CPR’) on the Block 3/05 assets with an effective date of 1 January 2023. The updated 2P gross reserves, at the new effective date, are 108 mmbbls (net 4.3 mmbbls) and the updated 2C gross resources are 43 mmbbls (net 1.7 mmbbls). The outcome is in-line with previous CPR expectations taking into account 2022 production.

“We are very pleased to complete the INA Acquisition and we would like to thank all involved, especially our shareholders, for their continued patience and support. The indicative transaction metrics upon sale of crude inventories speak to the competitiveness with which we have been able to structure this deal and we are pleased to mark the inception of our partnership with Sonangol in Blocks 3/05 and 3/05A. It is also highly encouraging that the terms for the Block 3/05 licence extension award have been agreed; this represents a major step towards completion of the Sonangol transaction within our previously guided timeline. We now look forward to working with the partnership to enhance production and reserves to a level that reflects the potential of this very material asset,” CEO Paul McDade said.

(1) Subject to final approval of the distribution of the China Sonangol International (‘CSI’) interest to the remaining joint venture partners, Afentra’s working interest in Block 3/05A increases from 4% to 5.33%

(2) As at 30 April 2023

(3) Working capital adjustments and interest on consideration from effective date to completion date(4) Further Contingent consideration of up to $9m will also become payable to INA subject to certain oil price hurdles on Block 3/05 and upon successful future development of discoveries and oil price hurdles on Block 3/05A. This $9m is split as follows: up to $4 million over 2 years on Block 3/05, subject to certain oil price hurdles and an annual cap of $2 million; and up to $5 million on Block 3/05A linked to the successful future development of certain discoveries and oil price hurdles.

(5) Asset cashflow generation from effective date to completion, comprising crude oil sales less cash calls paid, excluding significant stock in tank inherited at completion