Africa Oil has announced its operating and consolidated financial results for the three months and the year ended December 31, 2020. The Company is also releasing today, its 2021 Management Guidance including guidance related to its 50% equity investee, Prime Oil & Gas Coöperatief U.A.

Highlights

- Africa Oil fourth quarter net income of $79.8 million and full-year net income of $198.0 million, excluding a $215.6 million non-cash impairment of Kenya exploration assets posted in the first quarter 2020.

- Strong quarterly profit contribution by Prime to AOC’s net income amounting to $59.2 million.

- During 2020, Africa Oil repaid $109 million of its $250 million corporate term loan facility and has commenced the refinancing process for the balance with closing expected in July 2021.

- Year-end 2020 cash balance of $40.5 million and working capital of $29.3 million.

Selected Prime’s fourth quarter 2020 results net to Africa Oil’s 50% shareholding

- quarterly average daily working interest production of 26,200 barrels of oil equivalent per day (“boepd) and economic entitlement production of 30,100 boepd (83% light and medium crude oil and 17% conventional natural gas);

- full-year W.I. production of 28,700 boepd and economic entitlement production of 33,900 boepd (85% light and medium crude oil and 15% conventional natural gas) are in line with Third Quarter 2020 Management Guidance; and

- EBITDA of $128.8 million (full-year period: $619.5 million)

2021 Guidance

- average daily W.I. production range of 24,000-28,000 boepd and net entitlement production range of 26,000-30,000 boepd net to AOC’s 50% shareholding in Prime, with approximately 85% expected to be light and medium crude oil and 15% conventional natural gas; and

- Prime’s cash flow from operations5 of $310-$440 million net to AOC’s 50% shareholding.

“I am pleased to report strong full-year results for the Company, despite

one of the most challenging years for our industry. Our investment in Prime has

performed exceptionally well with its strong production and free cash flows

that enabled significant deleveraging, both at the Prime and Africa Oil

corporate levels. Prime reduced its RBL debt by $522 million or 29% of the

principal amount at the start of 2020. Africa Oil reduced its corporate

term loan by $109 million or 44% of the original amount of $250 million that

was drawn in January 2020.

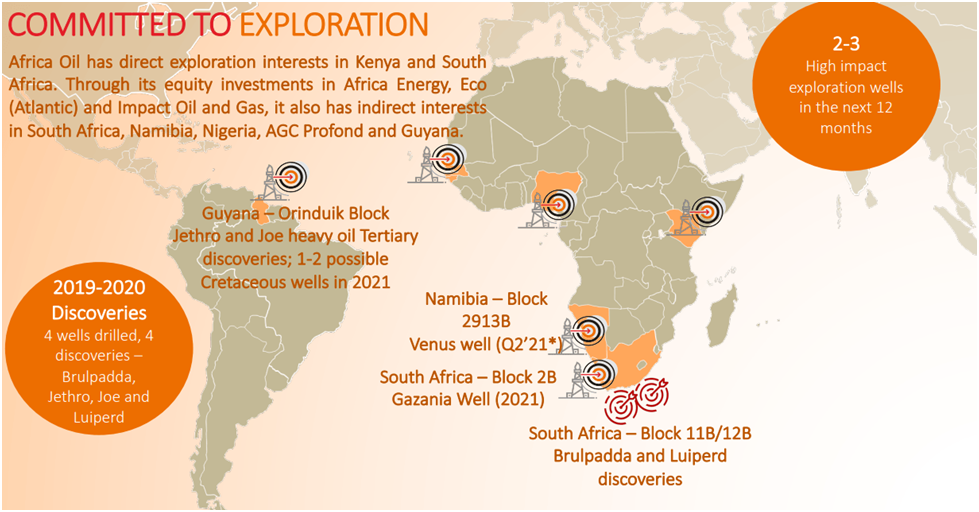

“We are in a strong position to continue this strong performance and also plan to pursue new business development opportunities with a focus on the acquisition of producing assets, offshore West Africa. We can also look forward to exciting catalysts through our other portfolio investment companies. These include further progress in the development of Block 11B/12B discoveries, offshore South Africa, the drilling of the Venus exploration well in Block 2913B, offshore Namibia and the drilling of the Gazania exploration well in Block 2B, South Africa. We also continue to work closely with the Government of Kenya and our JV partners to progress the South Lokichar development project.

“I am confident that we can realize the significant potential in this project supported by a recovery in the commodity markets and a return to a normal business climate with the COVID-19 recovery gathering momentum,” Africa Oil President and CEO Keith Hill commented.

Finance

The Company recognized a total operating income of $91.2 million and net income of $79.8 million during the fourth quarter of 2020. The operating income primarily relates to the Company’s share of profit from its investments in Prime amounting to $59.2 million and in Impact Oil and Gas amounting to $11.1 million. For the full year, the Company recognized a net loss of $17.6 million with a total operating income of $240.4 million being offset by $229.7 million in operating expenses, that primarily relates to the recognition of a $215.6 million non-cash impairment of intangible exploration assets, relating to the valuation of the Kenyan development project and Kenyan Block 10BA.

In addition, the Company recognized a dilution gain of $21.1 million during the three months ended December 31, 2020 relating to Africa Energy Corp’s Subscription Agreement with Impact.

The Company ended 2020 fourth quarter with cash of $40.5 million and working capital of $29.3 million in comparison to cash of $329.5 million and working capital of $290.7 million at the end of 2019. The reduction in the Company’s cash position of $289.0 million is primarily attributed to its acquisition of a 50% shareholding in Prime for a purchase price of $519.5 million. This acquisition was funded with a cash payment of $269.5 million and a term loan facility of $250.0 million.

Operational performance

Prime’s fourth quarter 2020 average daily W.I. production was 26,200 boepd and economic entitlement production was 30,100 boepd (83% light and medium crude oil and 17% conventional natural gas), net to Africa Oil’s 50% shareholding in Prime. Its full-year average working Interest production was 28,700 boepd and economic entitlement production was 33,900 boepd (85% light and medium crude oil and 15% conventional natural gas), net to Africa Oil’s 50% shareholding in Prime.

During the fourth quarter, Prime was allocated three oil liftings with total sales volume of approximately 2.9 million barrels or 1.4 million barrels net to Africa Oil’s 50% shareholding. For the full year, Prime was allocated 20 oil liftings with total sales volume of approximately 19.0 million barrels or 9.5 million barrels net to Africa Oil’s 50% shareholding.

Prime benefited from a robust oil price hedging program in 2020, achieving an average sale price of $64/bbl for a total of 20 cargoes (19 mmbbl) via financial hedges and forward sales contracts.

Prime is continuing its hedging program to 2021 and as of 22 February 2021, has sold forward or hedged 100% of its H1-2021 cargoes at an average price of approximately $57 per barrel and 56% of its H2-2021 cargoes at an average price of approximately $55 per barrel. These contracts are with counterparties including oil supermajors and commodity trading houses with investment grade credit ratings.

Fourth quarter 2020 average operating cost of $5.9 per boe and full-year average operating cost of $5.2 per boe. No leasing costs are payable for Prime’s Floating Production, Storage and Offloading (“FPSO”) platforms because they are fully owned by the joint venture partners.

Prime achieved fourth quarter 2020 sales revenue of $82.3 million (full-year period: $633.5 million); EBITDA of $128.8 million (full-year period: $619.5 million) and cash flow generated from operating activities of $146.4 million (full-year period: $582.5 million), in each case net to Africa Oil’s 50% shareholding.

Prime’s total 2020 capital expenditure of $30 million is 33% lower than the Third Quarter 2020 Management Guidance of $45 million and 67% lower than initial budget of $91 million. The reduction includes deferral of infill drilling and activities related to the Preowei field development project due to COVID-19 and the oil price crash. These activities are expected to resume in 2021 and 2022 as economic conditions improve, subject to partners’ consent.