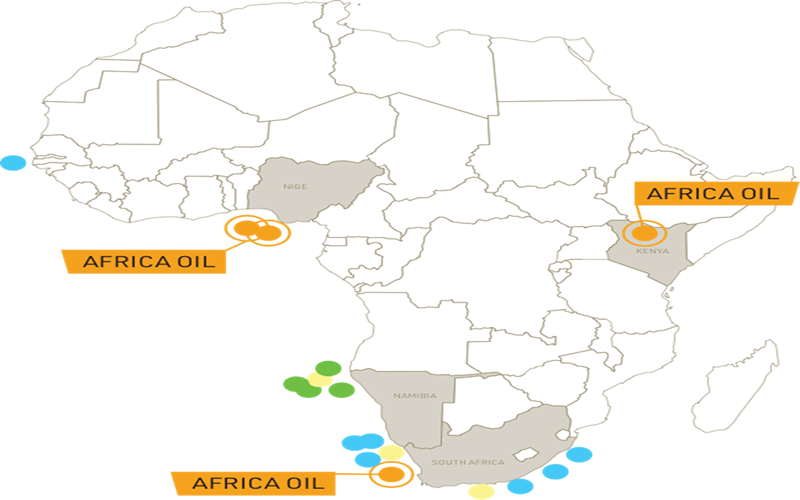

Africa Oil Corp is a Canadian oil and gas company with a diversified African portfolio. The Company has transitioned to a full cycle E&P growth vehicle with production, cashflow, world-class development as well as significant exploration upside. The African regional prtfolio includes production in Nigeria Deepwater, developmental activity in Kenya Lokichar Basin, and exploration activities in Kenya, South Africa as well as Deepwater Equity Investment assets.

Performance of the Company’s investment in Prime has continued to exceed expectations with strong cash flows, dividend distributions and very modest investments on the upstream assets, offshore Nigeria. Higher oil prices and a strengthening outlook for the oil markets support increasing capital investments to arrest production declines and monetize undeveloped assets, such as the Preowei field, a low-risk satellite tie-back project to the Egina Floating Production, Storage and Offloading platform (“FPSO”).

Financial and Drilling Campaign Outlook

The successful drilling and completion of Akpo-P4 infill well, that came onstream late last year and which was ramped up to 6,000 bopd, is very encouraging for the upcoming drilling program on OML 130. The operator is finalizing an extendable one-year rig contract with the plan to drill up to 9 development wells and up to 2 near field exploration/appraisal wells on the current rig schedule, with the drilling expected to commence at end of Q3 2022. Processing of the 2021 Egina 4D seismic survey is ongoing and is helping to confirm the final well locations. Up to 3 development wells are expected to be completed on the asset by the end of this year, with further infill drilling or near field exploration/appraisal expected after the completion of the first 3 infill wells on Egina. The rig will move to Akpo upon completion of the Egina drilling campaign.

The Company will work to maximize Prime’s dividends by distributing its excess cash, whilst maintaining a prudent treasury management policy at Prime. The near-term priority is to extend Prime’s debt tenor with the primary objective over the next year of refinancing Prime’s RBL facility, possibly facilitated by the voluntary early conversion of Prime’s licenses in Nigeria to the new PIA terms. The Company’s management will also work with Prime to assess other financing options that could extend Prime’s debt maturity profile on competitive costs, such as the PXF facility that was arranged by Prime in 2021.

Through its 30.9% shareholding in Impact Oil & Gas, the Company has an indirect interest of 6.2% in Block 2913B, offshore Namibia. The Company announced the Venus light oil and associated gas discovery on this block on February 24, 2022. Venus’ initial results have exceeded pre-drill estimates and along with the recently announced Graff discovery on a neighboring block, has opened a new petroleum province in the Orange Basin with significant upside potential. Venus and Graff discoveries support the exploration case for Block 3B/4B, which is operated by the Company with a 20% working interest and Impact’s Orange Basin Deep Block, both located on trend in the Orange Basin, South Africa. The Company’s management expects the Venus appraisal drilling program to commence later this year providing shareholders with potentially high impact catalysts.

Through its shareholdings in Africa Energy, the Company has exposure to the Gazania-1 exploration well that will be drilled in Block 2B offshore South Africa, with a target spud date by end of 2022. Gazania-1 will test a prospect in the A-J rift basin that is near but updip of the A-J1 oil discovery (1988) that flowed 36o API oil to surface. A success at Gazania-1 would de-risk a large inventory of prospects in the block that have been identified from 3D seismic data. Africa Oil has an indirect 5.5% economic interest in Block 2B through its 19.8% shareholding of Africa Energy. Africa Energy holds a carried 27.5% working interest in Block 2B with partners Eco Atlantic (Operator, 50% WI), Panoro Energy (12.5% W.I.) and Crown Energy (10% W.I.).

Farm-out and Acquisition

During 2021, the Company and its JV Partners (Tullow Oil and TotalEnergies) have completed the redesign of Project Oil Kenya to ensure it is technically, commercially and environmentally robust. The Company and its partners initiated a farm-out process for Project Oil Kenya in 2021. Advanced discussions are on-going with the interested parties. A successful farm-out is viewed by the Company as a critical step towards the FID for Project Oil Kenya being achieved over the course of next year. There is no guarantee that the Company can successfully conclude a farm-out to new strategic partner(s) on favorable terms. The Company will update the market on this process in due course.

The Company has been actively working on the acquisition of strategic producing assets that are accretive on per share valuation and cashflow metrics. The Company has maintained a very disciplined approach towards this goal with detailed technical, commercial and legal due diligence applied for each opportunity and the primary goal of not diluting or risking the current strong investment case. The Company’s focus remains on buying producing assets offshore West Africa and the management will consider both operated and non-operated opportunities as well as oil and natural gas assets. The Board may also consider corporate merger and acquisition opportunities if there is strong strategic rationale for such a transaction with strong prospects to increase shareholder value. There is no guarantee that the Company can complete such transactions and it will update the market during the year on its efforts.

Africa Oil President and CEO Keith Hill commented: “I am pleased to report another strong quarter of operating and financial results. We received our largest dividend payment from Prime to date for $100 million. This takes our total dividend receipts to $500 million since our acquisition of a 50% interest in Prime in January 2020 for $520 million. Also, our share of Prime’s cash at end of first quarter 2022 of approximately $266 million, compares to about $70 million at the time of the acquisition. Prime’s performance, that includes achieving positive reserves replacement ratios for the last two years, has exceeded all our expectations. However, I view the news of the Venus light oil discovery as the most important and exciting update in the first quarter of this year. Most immediately, we can look forward to the high-impact Venus appraisal drilling program and the Gazania exploration well, both of which are expected to commence later this year. We also have further prospectivity on Block 3B/4B, which we operate with a 20% interest and on Impact’s Orange Basin Deep Block, both are in Orange Basin and on trend with the Venus discovery.”