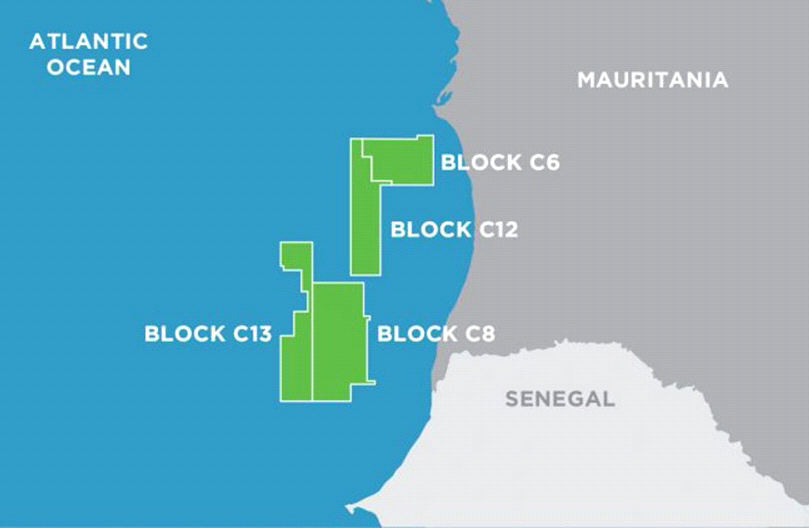

The year 2020 is expected to usher in a new horizon in some of Africa’s oil and gas producing countries as they look forward for better oilfield exploration and production bargains and strategic partnership alliances with prospective investors. Increasing continent crude oil production volume amid favorable and stable crude oil price is a projected economic aspiration of the oil and gas producing countries in the region. The need to speed up its approved offshore exploration plans to counter falling production volumes and meeting its global increasing demand especially for natural gas required for power generation and crude oil export demand particularly from Asia and Europe. Major continent crude oil producers like Gabon, Nigeria, Senegal and Angola are expected to initiate new licensing bids or conclude existing ones those opened in 2019 hoping for enabling environment and platform in attracting suitable and credible investors in the sector. The Nigeria long awaited Petroleum Industrial Bill is still yet to be passed by the country’s legislative arm of government. The Gabonese government launched the 12th shallow and deepwater licensing in 2018 whose biding round is slated for closure in January 2020. Nigeria in last quarter of 2019 signed a major gas expansion deal with OIC’s, which the Nigeria LNG said would boost its liquefied natural gas output by more than 30%. The agreement this came amid amity with international oil majors on recent tax dispute and new law increasing the government’s take on deepwater oil production which irked some companies. The final investment decision on the Train 7 processing unit at the Bonny Island plant was signed by Nigeria LNG partners state-run Nigerian National Petroleum Corporation (NNPC), Eni, Total and Royal Dutch Shell. In the same vein, some countries with pending legislative issues such as local content implementation policies, environmental regulations, host communities MOUs and promulgation of comprehensive hydrocarbon codes are expected to be resolved amicably to able investors to operate in a very conducive environment free from disruptions of oil and gas exploration and production operations. More offshore developments are expected in Egypt when the results of the offshore Red Sea bid round that was opened in March 2019 and closed in the last quarter of the year are fully released. Of course Egypt’s offshore market ended 2019 on a positive note when ExxonMobil announced it had acquired more than 1.7 million acres for exploration including acreage in the 1.2 million North Marakia Offshore block, which is located approximately eight kilometers offshore Egypt’s northern coast in the Herodotus basin. Oil major BP has made ‘a major gas discovery’ with the Orca-1 exploration well, which is located in the BirAllah area in Block C8 offshore Mauritania. The results continue the 100 percent success rate from nine wells targeting t h e inboard gas trend in Mauritania/Senegal, Kosmos. Kosmos said that the Orca-1 well, which targeted a previously untested Albian play, had exceeded pre-drill expectations encountering 36 meters of net gas pay in excellent quality reservoirs. In addition, the well extended the Cenomanian play fairway by confirming 11 meters of net gas pay in a downstructure position relative to the original Marsouin-1 discovery well, which was drilled on the crest of the anticline. The location of Orca-1, approximately 7.5 kilometers from the crest of the anticline, proved both the structural and stratigraphic trap of the Orca prospect, which Kosmos estimates has a mean gas initially in place (GIIP) of 13 TCF. More upstream activity is expected in Equatorial Guinea, where seven oil and gas exploration and production bidders were awarded concessions for nine blocks in November after the country’s 2019 licensing round launched in April. The ministry announced the winners of Blocks EG 03, 04, 09, 18,19,23,27 and 28 last November. The preferred bidders included Lukoil, Noble Energy, Vaalco Energy, Walter Smith, Hawtai Energy, Levene Energy and GEPetrol. First quarter 2019, Italian oil company Eni has “a major oil discovery” in Block 15/06, in the Agogo exploration prospect, in Angola’s deep water. The discovery is estimated to contain between 450 and 650 million barrels of light oil. The Agogo-1 NFW well, which has led to the discovery, is located approximately 180 kilometers off the coast and about 20 kilometers west from the N’Goma FPSO (West Hub). The well was drilled by the Poseidon drillship in a water depth of 1636 meters and reached a total depth of 4450 meters. A similar upstream program is expected to be completed this new year in neighboring Gabon where the government launched the 12th shallow and deepwater licensing in 2018 that was initially slated for closure in January 2020. Furthermore, another West African oil and gas market, Sierra Leone, expects to close the oil blocks licensing round it started in May 2019 with the preferred bidders under the direct tender award expected to be announced alongside those classified under open tender winners by mid of February. In last quarter of 2019 Ghanaian company Springfield and its partners, GNPC and GNPC EXPLORCO, officially announced significant oil discovery following its maiden Afina-1 well drilling campaign in the West Cape Three Points (WCTP) Block 2, offshore Ghana. December 2019, Springfield revealed that the Afina-1 well, which is located at a water depth of 1030 meters, was drilled to a total depth of 4085 meters and encountered light oil with a gross thickness of 65 meters, with 50 meters light net oil pay in good quality Cenomanian sandstones. The secondary target in Turonian age sands was drilled at the edge of the structure and encountered 10 meters of hydrocarbon-bearing sands consisting of light oil and gas. Springfield said it had more than doubled its discovered oil in place volume to 1.5 billion barrels and added 0.7tcf of gas. The current undiscovered potential of the Block is estimated at over 3 billion barrels of oil and gas in multiple leads and prospects within various proven reservoir units. Springfield is currently the operator and majority interest holder (84%) of WCTP Block 2, with GNPC and its exploration company, EXPLORCO, holding the remaining interest. Senegal is likely to open its next oil and gas licensing round if all

goes according to plan. Although, it is still unclear how 2020 will turn out for exploration plans in Somalia, Madagascar and Namibia. In Somalia, the deepwater bidding round that opened in July 2019 remains suspended because of a maritime dispute with neighboring Kenya. Similar suspension was also announced in Madagascar for the 2018 licensing round while things have gone a bit quiet in Namibia despite individual progress for specific international oil companies. December 2018, French oil company Total has made a significant gas condensate discovery at the Brulpadda prospect on Block 11B/12B offshore South Africa using the Deepsea Stavanger drilling rig.

The results of the well as announced by Africa Energy Corp., which holds a 4.9% effective interest in the Exploration Right for Block 11B/12B, the block covers an area of 19,000 square kilometers with water depths ranging from 200 to 1,800 meters and is located in the Outeniqua Basin 175 kilometers off the southern coast of South Africa. Despite the noted delays and hiccups in finalizing licensing rounds across Africa, the region looks forward to ride on the already achieved progress to attract adequate investment in harnessing the continent’s proven respectively. Currently, Africa’s oil and gas production is estimated to be 8.1 million bbl/d and 7.95 tcf which is an equivalent of 8.7% and 7.1% of global production respectively. oil and gas reserves estimated at 126.5 billion barrels (bbl) and 487.8 trillion cubic feet (TCF) respectively