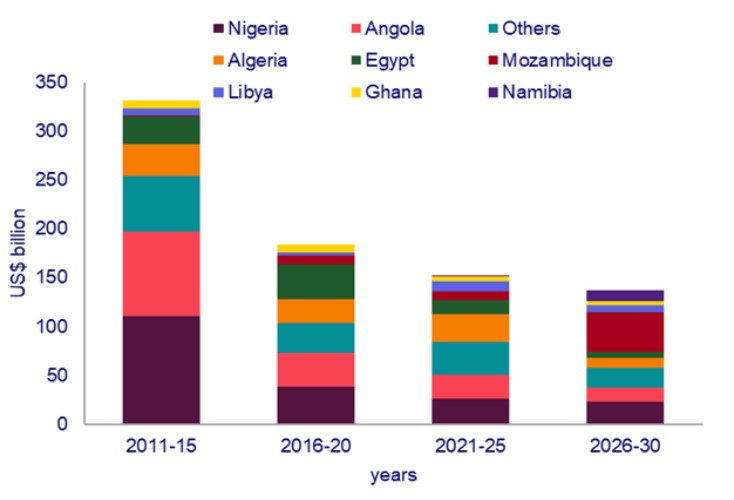

The African upstream oil and gas sector is in the middle of an US$800 billion capital expenditure (capex) programme that will see liquified natural gas (LNG) emerge as a major investment theme alongside traditional deepwater oil according to Ian Thom, Upstream Research Director at Wood Mackenzie.

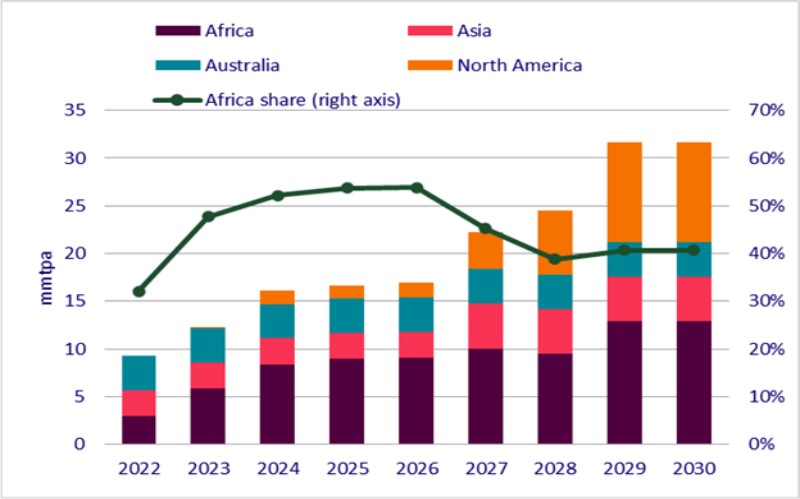

Speaking at the African Energy Week event in Cape Town, Thom told delegates that the 20-year investment cycle that started in 2010 would culminate at the end of the decade with world-scale LNG projects in Mozambique and floating LNG (FLNG) across five countries. Africa is already a leader in floating LNG with over 50% of global capacity, and scope for more projects to emerge.

“With abundant gas resources, Africa is looking at all opportunities to develop gas for domestic and export markets,” Thom said. “The niche role that FLNG plays has gained traction in Africa due to its flexibility, quick time to market and suitability for smaller volumes. We see more examples where FLNG could be applied to African resources, and we expect there is more to come on this growth story.”

West Africa offers huge LNG potential

Thom added that current LNG exports coming from Africa are just over 40 million tonnes per annum (mmtpa) and there are a number of LNG projects in Sub-Saharan Africa (SSA) that are in various stages of development. These include bp’s Tortue FLNG, located offshore from Senegal and Mauritania, which comes onstream next year.

“Tortue Phase 1 is expected onstream next year, so we will see 2.4 mmtpa of supply growth in the short term,” Thom said. “With easy access to European markets deepwater gas in Senegal-Mauritania offers significant potential in what are relatively stable and supportive countries.”

Mozambique LNG plays vital role

Thom also cited several LNG and FLNG projects in Mozambique as key to the future success of the continent’s LNG export aspirations. These include Coral Sul FLNG which shipped its first cargo in November 2022 as well as Rovuma LNG and Mozambique LNG both having stalled.

“Mozambique needs improved security to resume construction of onshore LNG facilities,” Thom said. “Rovuma and Mozambique LNG central to a potential doubling of African LNG supply by 2035, there is a risk that exports could flatline longer term if these projects fail to materialise.”

African Upstream capex by country

Oil trending down but deepwater projects offer hope

With gas projects in the ascendency, Thom told delegate that oil production in traditional hubs across Africa will struggle to offset production declines at mature assets. Big oil players such as Nigeria, Angola, and Egypt as a group will see oil production flatline as we move towards the end of the decade.

“With the global upstream trend firmly focused on advantaged resources, it is inevitable oil production will be affected in higher cost and higher emitting assets in Africa,” Thom said. “However, there could still be some upside from reserve growth or yet-to-find resources.”

TotalEnergies recent discovery at Ntokon in Nigeria is a great example where new oil discoveries drive incremental growth. And the exploration success in Namibia underlines how deepwater exploration can generate strong investment opportunities.”