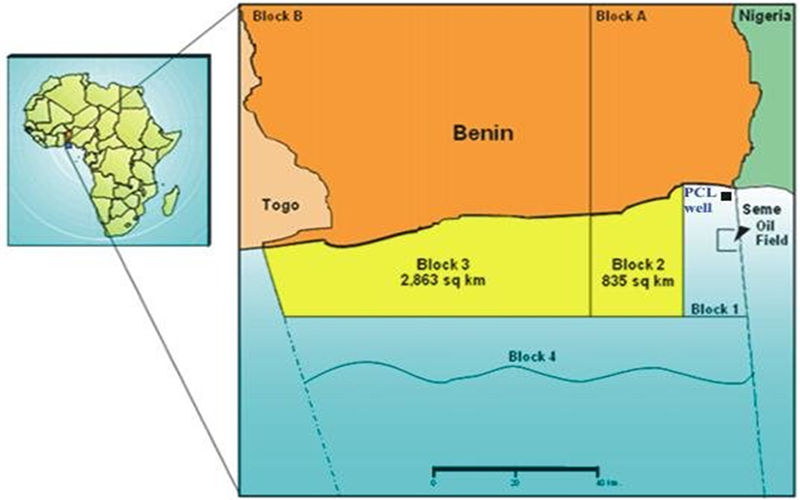

In December 2023, Rex International Holding’s indirect subsidiary Akrake Petroleum Benin S.A. (Akrake) was awarded a Production Sharing Contract for operatorship and a 76%* working interest in Block 1, Sèmè Field in Benin, West Africa. The remainder of the working interest is held by the government of Benin holding 15%* and Octogone Trading, an integrated energy and commodities company trading throughout West Africa, holding 9 per cent.

Block 1, Sèmè Field

The offshore Block 1 in Benin covers 551 sq km and is in shallow water depth of 20 to 30 metres. The block includes the Sèmè Field discovered by Union Oil in 1969. The Sèmè Field was first developed by Norwegian oil company, Saga Petroleum, and had produced approximately 22 MMbbl1 between 1982 and 1998, before production was stopped prematurely due to low oil prices of around US$14 per barrel in 1998.

Sèmè Field Redevelopment and Production Update:

Phase 1 Plan and Independent QPR Overview

Akrake plans to redevelop the Sèmè Field using the Group’s proven low-cost production system, which includes a jack-up Mobile Production Unit (MOPU) and a Floating Storage Unit (FSO). This redevelopment approach aims to restart production and maximise oil recovery through the use of horizontal wells and modern completion technology for effective water control.

An independent Qualified Person’s Report (QPR) published in March 2025 estimates 10.9 MMstb of 2P reserves in the field.

Phase 1 of the redevelopment comprises:

- 2025: Drilling a vertical exploration and appraisal well to test multiple reservoirs, which will then serve as a vertical producer? A horizontal well will follow to exploit the previously produced H6 reservoir.

- 2026: Phase 1 will conclude with the drilling of two additional horizontal wells.

It is to be noted that the summary QPR does not include resources estimates for Phase 2 of the Field Development Plan (FDP), with plans to concentrate on prospects in the deeper H7 and H8 reservoirs with a potential three oil wells (H7) and two gas wells (H8), which have not been on production but have been tested with flow to surface.