Exports of LNG from West Africa’s four producers showed impressive resilience in 2020 despite the impact of the coronavirus pandemic on gas demand generally, an analysis of S&P Global Platts Analytics data showed.

Total LNG exports from the four exporting countries in the region — Angola, Cameroon, Equatorial Guinea and Nigeria — totaled 39 Bcm, broadly in line with 2019, the data showed.

That was despite sharp falls in LNG utilization rates in other parts of the world last year, particularly in the US over the summer, while spot-exposed Egypt halted LNG exports almost completely in the April-September period.

Now, with spot LNG prices having surged to all-time highs in early 2021 — the JKM benchmark price was assessed by S&P Global Platts at $32.49/MMBtu on Jan. 12 — the West African exporters will be looking to keep their LNG supplies at elevated rates.

Nigeria is relatively exposed to the spot market with around 50% of its LNG exports sold on a spot or short-term basis in 2019, according to industry group GIIGNL.

Nigeria’s LNG exports in 2020 stayed strong and totaled 27.6 Bcm of gas equivalent, down 1% on 2019 and not far off the 30 Bcm/year (22 million mt/year) capacity of the six-train Nigeria LNG (NLNG) facility.

Despite its resilience last year, however, there is growing concern in Nigeria that militants could be set to resume regular attacks on oil and gas infrastructure.

In November, a gas pipeline in Rivers State was damaged by explosions, which impacted oil and gas production, and briefly suspended exports of Nigeria’s Brass River crude.

There were also local media reports that a gas pipeline exploded on Jan. 5 in Rivers State, with speculation that supplies to NLNG may have been impacted.

The outlook is uncertain, with a coalition of former oil rebels in the Niger Delta, now known as the Reformed Niger Delta Avengers (RNDA), issuing a statement on Jan. 6 threatening to resume attacks on installations.

The RNDA said it had pulled out of talks with the federal government, after it accused the President Muhammadu Buhari-led administration of not following up on its promises on improving the economy in the Niger Delta.

The original Niger Delta Avengers were responsible for the bulk of the attacks on Nigeria’s oil infrastructure in 2016.

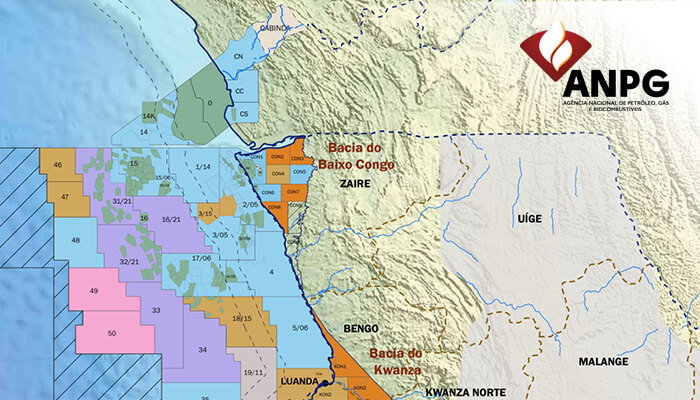

Angola-India route

West Africa’s second biggest LNG exporter Angola, meanwhile, saw its supplies increase 8% in 2020, with a total of 6.39 Bcm of gas equivalent exported.

The 5.2 million mt/year (7.2 Bcm/year) Angola LNG plant resumed operations in June 2016 having been closed for more than two years due to technical problems.

Of the 64 cargoes shipped last year, some 33 were sent to India, with other markets served including China, Kuwait, South Korea and a number of countries in Europe.

Meanwhile, LNG exports from Equatorial Guinea totaled 3.32 Bcm in 2020, down 22%, due in part to falling production from the facility’s main feedgas field, Alba.

Equatorial Guinea hopes that first gas from the Chevron-operated Alen field offshore the West African country can be delivered soon to help back-fill its one-train, 3.7 million mt/year EG LNG export facility on Bioko Island.

The government said in late December the pipeline linking Alen to the Equatorial Guinea LNG facility had been completed.

Chevron, which acquired operatorship of Alen with its 2020 takeover of US independent Noble Energy, still says first production is anticipated in the first half of 2021.

The EG LNG complex — which shipped its first LNG cargo in 2007 — has traditionally relied on gas from the now declining Marathon-operated Alba field, so more gas is needed to maintain export levels.

Cameroon became the fourth West African LNG exporter in May 2018.

It exported 1.63 Bcm of gas equivalent in 2020, up from 1.56 Bcm in the previous year.

Production comes from the floating LNG production vessel, the 2.4 million mt/year Hilli Episeyo.

Actual production from the vessel is lower than its capacity at around 1.2 million mt/year, with Gazprom Marketing & Trading having signed a deal to take that volume from the project.