Highlight

- Reported production of 382,000 barrels of oil equivalent (BOE) per day; adjusted production, which excludes Egypt noncontrolling interest and tax barrels, was 326,000 BOE per day;

- Generated net cash from operating activities of $671 million, adjusted EBITDAX of $1.14 billion, and free cash flow of more than $500 million;

- Delivered upstream capital investment and LOE below guidance;

- Announced in January fourth consecutive discovery in Block 58 offshore Suriname at Keskesi East-1 well;

- Modernized company’s legal structure with formation of holding company APA Corporation; and

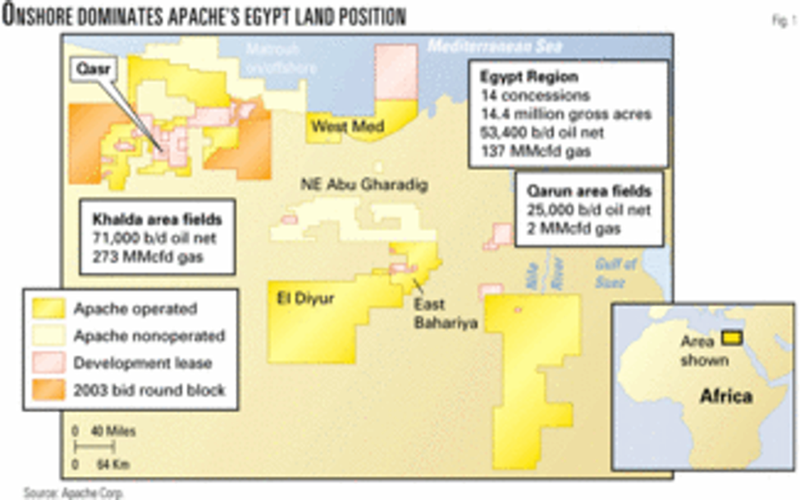

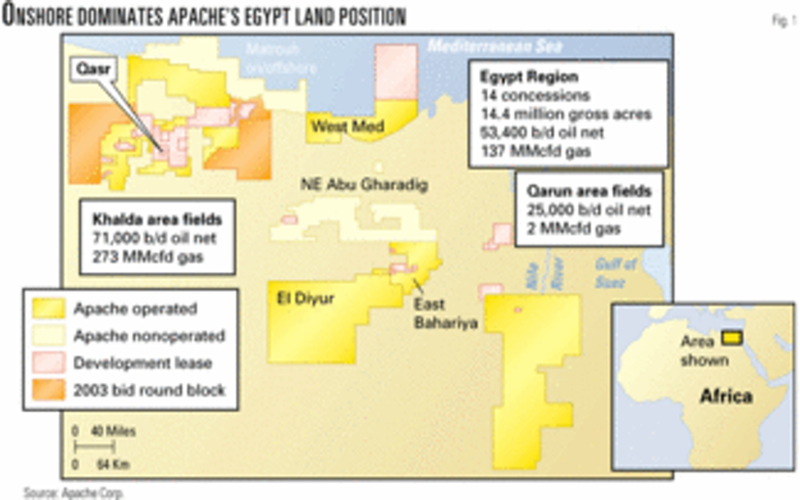

- Reached agreement in principle in May to modernize Egypt Production Sharing Contracts.

APA Corporation( Apache) has announced its financial and operational results for the first-quarter 2021.

APA reported net income attributable to common stock of $388 million, or $1.02 per diluted share. When adjusted for items that impact the comparability of results, APA’s first-quarter earnings were $346 million, or $0.91 per diluted share. Net cash provided by operating activities was $671 million, and adjusted EBITDAX was $1.14 billion. The company generated $502 million in free cash flow during the quarter.

“We made excellent progress during the first quarter with regard to our top priority of free cash flow generation and net debt reduction,” said John J. Christmann IV, APA’s CEO and president. “We performed well relative to our production expectations, demonstrated good capital and cost discipline, delivered excellent safety performance across the organization despite challenging weather events, and made significant progress on our ESG goals, which are focused on air, water, people and communities.”

First-Quarter Summary

First-quarter reported production was 382,000 BOE per day, and adjusted production, which excludes Egypt noncontrolling interest and tax barrels, was 326,000 BOE per day. U.S. production of 210,000 BOE per day benefitted from a faster-than-expected recovery following winter storm Uri. This more than offset slightly lower-than-expected international adjusted volumes of 116,000 BOE per day, which were impacted by the effect of higher oil prices on Egypt PSC cost recovery barrels and some extended operational downtime in the North Sea. APA delivered first-quarter upstream capital investment of $243 million and Lease Operating Expense (LOE) was $264 million for the quarter, both below expectations.

“I’m very pleased with our first-quarter performance. We are seeing encouraging early results from our Permian Basin well completion program, and in Suriname, we have successfully transitioned Block 58 operatorship to Total and are currently running two rigs offshore. This week, we also announced a very significant agreement in principle with Egypt’s Ministry of Petroleum and Mineral Resources and the Egyptian General Petroleum Corporation with regard to a modernized Production Sharing Contract. Looking ahead, our full-year 2021 guidance is unchanged, and we have clear visibility into at least $1 billion of free cash flow generation for the year, the vast majority of which will be directed to reducing net debt,” Christmann concluded.