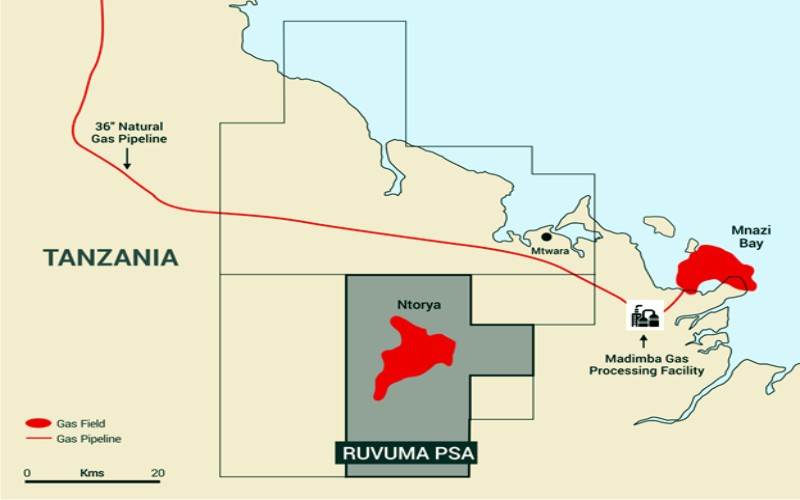

ARA Petroleum Tanzania (APT) has set out a path to first gas at Tanzania’s Ruvuma production-sharing agreement (PSA).

APT was established in 2018 to accelerate the development of the Ntorya area. A farm-in agreement for a 50% working interest was agreed with the operator AMINEX Plc. Once the farm-in was completed in 2020 APT became the Operator.

APT immediately started planning the approximately 350 Sq Km seismic program and preparing for the drilling and testing of the new Chikumbi-1 well. The Ntorya discovery contains 1.8 Tcf of gas according to 3rd party CPR and has been proven by 2 wells both producing 20 MMSCF/d each during testing.

Once the 3D data and the new well has been drilled and analysed it is likely that APT will prepare a Field Development Plan (FDP) and after approval from the various authorities in Tanzania commence the development. There is ullage in nearby processing plants to allow for evacuation of significant volumes of gas. ARA Petroleum very much looks forward to working with the various bodies in Tanzania in an effort to mature this very promising asset at the earliest possible opportunity.

ARA Petroleum Tanzania (APT) has set out plans to drill an exploration well in Tanzania in 2024.

The company recently completed the acquisition of Scirocco Energy’s 25% stake in the Ruvuma licence. As a result, APT now has 75% in the licence.

Aminex has the remaining 25%. Aminex drilled the initial discovery well, in 2011, with the Ntorya find. A follow-up well in 2017, Ntorya-2, found more hydrocarbons.

Sultan Al Ghaithi, CEO of ARA Petroleum, said buying Scirocco’s stake demonstrated his company’s confidence in Ruvuma. ARA Petroleum is based in Oman.

“ARA is now well positioned to take decisive steps towards developing the asset and ensuring that the natural gas produced from the Ntorya field is introduced to the market as quickly as possible. We remain dedicated to contributing to Tanzania’s energy sector, fostering economic growth, and ensuring the sustainable development of the region’s natural resources,” he said.

APT bought into Ruvuma in 2020, becoming the operator. It struck the deal with Scirocco in August 2022.

Reports have previously suggested APT would bring Ntorya into production this year. It should ramp up the $140mn project to reach 140 million cubic feet per day of gas. The first phase of production is likely to be around 60 mmcf per day. It will ramp up to 140 mmcf perhaps two years later.

However, APT’s statement suggests it will press ahead with Chikumbi, before using the rig to carry out a workover on Ntorya-1.

The Tanzanian authorities have responsibility to build the pipeline tie-in, from the field to the Madimba gas plant. Tanzania’s Daily News reported in June the pipeline construction was in its final stages.

It has acquired 335 square km of 3D seismic and submitted a field development plan to Tanzania in July this year.

In addition to an exploration well in 2024, the company also plans to execute its development plan. APT has been planning exploration drilling, on the Chikumbi-1 sit, for some time. In 2021, it was planning on drilling the well in 2022. Aminex, earlier this year, said the operator planned to drill Chikumbi by the end of 2023.

Scirocco provided an update to the market in mid-October on the completion of the Ruvuma sale. APT paid $2.54 million and Scirocco has no ongoing liabilities on the asset. Scirocco sold out in order to focus on sustainable energy in Europe.

APT is due to pay another $3mn to Scirocco on final investment decision. AIM-listed Scirocco said first gas was due in December. As a result, it said, it expected the payment this year.

APT is carrying Aminex at Ruvuma up to $35mn.

When Ruvuma begins producing, Scirocco will also receive up to 25% of net revenues, up to $8mn. Should production pass 50 billion cubic feet, it would be due another $2mn. Such a payment is unlikely to occur before 2025 at the earliest, it noted.

ARA Petroleum’s parent company is also an investor in Aminex. Eclipse Investments is the single largest shareholder in Aminex, with a 28.35% stake and the ability to appoint two directors to its board. As a result, Sultan Al Ghaithi sits on the Aminex board.