Baker Hughes and Akastor ASA have announced an agreement to create a joint venture company that will bring together Baker Hughes’ Subsea Drilling Systems (SDS) business with Akastor’s wholly owned subsidiary, MHWirth AS (MHWirth). The Company will deliver global full-service offshore drilling equipment offering that will provide customers with a broad portfolio of products and services.

The transaction will result in a leading equipment provider with integrated delivery capabilities, financial strength, and flexibility to address a full range of customer priorities. The Company will be owned 50-50 by Baker Hughes and Akastor, and following the closing of the transaction, the Company’s operations will be managed from current offices in Houston, Texas, and Kristiansand, Norway. Merrill A. “Pete” Miller will serve as chairman and chief executive officer. Miller has been in the oil and gas industry over 40 years holding various leadership roles including chairman, president and chief executive officer of National Oilwell Varco.

The Company’s broader scope of services will also provide a more solid foundation for future growth, including the capability to participate in the oil and gas industry’s transition towards more energy-efficient solutions, as well as deploying technologies and service solutions to make the sector more competitive through increased drilling efficiency.

“I would like to express sincere gratitude to the good work and dedication shown by the respective teams of Baker Hughes and Akastor for making this happen despite the current challenges caused by the global COVID-19 pandemic. I strongly believe that this Company will give a solid basis for both organizations to meet the current challenges in today’s market and to continue as a leader in developing advanced and efficient drilling solutions that support the industry’s transition towards more sustainable operations.” CEO of Akastor, Karl Erik Kjelstad, said.

“This transaction is a major step for MHWirth, and the transformation strategy announced in February 2019. The Company will offer customers a strengthened product offering and investors attractive value creation. This transaction will also allow Akastor to maximize, and ultimately realize, value to its shareholders,’’ Kristian M. Røkke, chairman of Akastor, said.

“The oil and gas industry is rapidly evolving, and we are constantly looking at new and innovative ways of delivering value to our customers. This Company is the perfect fit between our respective portfolios and further transforms our core operations for long-term success, bringing complementary solutions to market and offering our customers a full offshore drilling equipment package,’’ Neil Saunders, executive vice president of Oilfield Equipment at Baker Hughes, said.

MHWirth is a global provider of advanced drilling solutions and services designed to offer customers a safer, more efficient and reliable alternative. MHWirth has a global span covering five continents with offices in 13 countries.

Baker Hughes’ SDS business is a division of the Oilfield Equipment segment of Baker Hughes and is headquartered in Houston. SDS provides integrated drilling products and services worldwide, with service and manufacturing facilities in 11 countries and a competitive portfolio, including world-class blowout preventor (BOP) systems, controls and riser equipment.

The closing of the transaction is subject to customary conditions, including regulatory approvals, and is expected to occur in the second half of 2021. Morgan Stanley, Paul Weiss, Thommessen, and EY are acting as advisors for Baker Hughes. Goldman Sachs, BAHR, Sidley Austin, and EY are acting as advisors for Akastor.

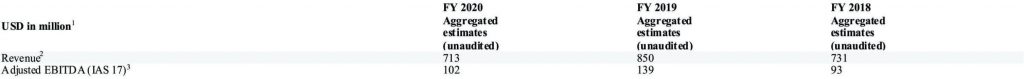

Key Financial information

The table below provides certain estimated pro-forma financial information for the combined operations of SDS and MHWirth. This information is unaudited, based on management accounts for the respective companies and provided for illustrative purposes only. It may not be representative of reported figures following completion of the transaction. Further, the information may not necessarily be comparable to similar information presented by other companies nor relied upon as any indication of what the Company’s financial position or results of operations actually would have been had the transaction been consummated as of the dates indicated.

Note:

1 Average FX used for corresponding period

2 Pro forma MHWirth Group figures include MHWirth, Bronco Manufacturing (which has been part of MHWirth since June 2019) and Step Oiltools (which became part of MHW Group in February 2020)

3 Items affecting comparability comprises material items outside normal business such as net gains or losses from business and assets disposals, costs for closure of business operations and restructurings, and other costs of non-recurring nature

Transaction structure and main conditions

The Company shall be owned 50/50 by Baker Hughes and Akastor. Akastor shall contribute its shares in MHWirth to the Company in return for 50% of the shares and USD 120 million in consideration, of which USD 100 million is payable in cash at closing. Baker Hughes shall contribute the SDS business to the Company in return for the other 50% of the shares and USD 200 million in consideration, of which USD 120 million is payable in cash at closing. The Company shall issue notes to Baker Hughes and Akastor representing the balance of the consideration owed to them. The notes shall be subordinated to the Company’s external debt financing.

The Company will finance the cash consideration payable to Baker Hughes and Akastor by way of a USD 220 million bank facility. In addition, the Company will also be financed by a USD 80 million working capital facility.

The Transaction Agreement entered into by Akastor and Baker Hughes provides for customary terms for agreements of this nature, including representations and warranties relating to the businesses being contributed as well as an agreed form shareholders agreement customary for a 50/50 controlled company, including governance and exit provisions. Completion of the Transaction is subject to customary conditions, including regulatory approval. The closing of the Transaction is expected to take place in 2H 2021.

Implications for Akastor’s corporate credit facility and accounting policies

The transaction will require the refinancing of Akastor’s existing corporate credit facility. Akastor has received commitments for a NOK 1,250 million revolving credit facility that will be entered into prior to closing of the transaction.

Following completion of the transaction, it is expected that MHWirth no longer shall be accounted for as a consolidated subsidiary of Akastor. Instead, it is expected that Akastor shall treat the Company as a joint venture for accounting purposes and that, following which Akastor shall recognise 50% of the equity of the Company and 50% of the Company net profits in its accounts based on the “equity method”.

Implications for Baker Hughes’ accounting policies

Following completion of the transaction, it is expected that SDS will no longer be accounted for under Baker Hughes’ Oilfield Equipment segment. Instead, it is expected that BKR shall treat the Company as a joint venture for accounting purposes, following which BKR shall recognise 50% of the equity of the Company and 50% of the Company net profits in its accounts based on the “equity method.”