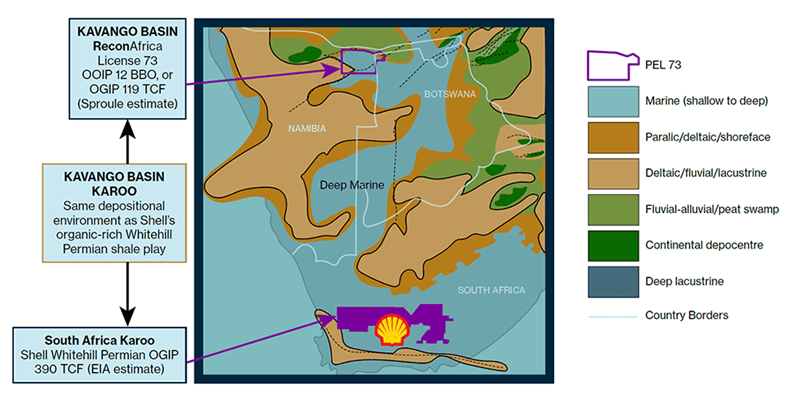

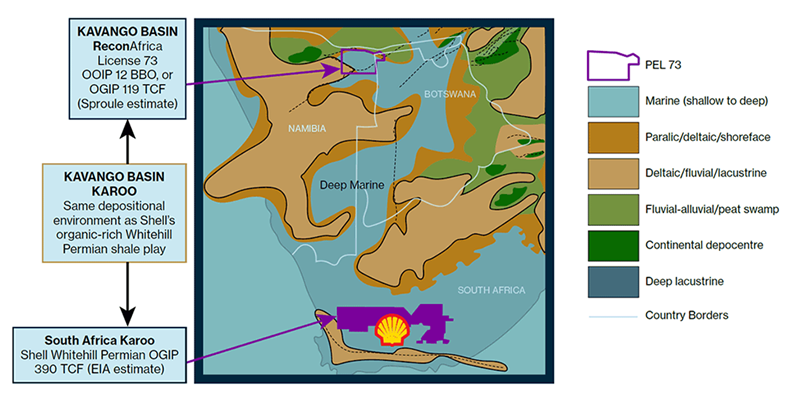

Reconnaissance Energy Africa Ltd. is pleased to announce it has been granted a petroleum license in northwestern Botswana for 2.45 million acres (9,921 km2) and has entered into a farm-out option agreement on these lands. The Botswana lands are contiguous to the Company’s 6.3 million acre petroleum license in northeast Namibia.

As a result of acquiring and interpreting additional tight grid regional aeromagnetic data, ReconAfrica feels it has definitively established the eastern boundary of the Kavango basin, where a deep and high potential section of the basin extends from northeast Namibia into northwest Botswana. As a consequence, ReconAfrica has successfully acquired the License covering the eastern part of the entire Kavango basin.

Based on the licensing terms, which include 100% working interest in all petroleum rights from surface to basement, is an initial 4-year exploration period, with renewals up to an additional 10 years, in accordance with the Botswana Petroleum (Exploration and Production) Act.

Also in the terms is that Upon declaration of commercial production, the operator holds the right to enter into a 25-year production license with a 20-year renewal period, in accordance with the Botswana Petroleum (Exploration and Production) Act and royalties associated with the production license will be subject to negotiation, in accordance with the Botswana Petroleum (Exploration and Production) Act, and generally range from 3 to 10% of gross revenue from production

The Company has a commitment to a minimum work program of US$432,000 over the first 4-year exploration period. While the corporate tax rate in Botswana is stands at 22%.

The acquisition and analysis process of the Botswana lands and initial data set used to define the most eastern portion of the Kavango basin in Botswana was initiated over the past several years by a private company, controlled by Mr. Craig Steinke, a related party to ReconAfrica.

While Mr. Steinke was proceeding with the application process, he proposed a joint venture with ReconAfrica. In consideration of Mr. Steinke allowing ReconAfrica to lead the acquisition and operate the Botswana lands, the Company, through its wholly-owned Botswana subsidiary, has entered into a farm-out option agreement with a private company wholly-owned by Mr. Steinke under the following terms:

The farm-out option will carry a 3-year term providing the Farmee with the right to acquire a 50% working interest in the License with an Initial payment of C$100,000 from the Farmee to ReconAfrica

The Farmee will pay ReconAfrica C$1,000,000 upon transfer of the License following exercise If the Option is exercised within 18 months of the date the License was awarded and C$1,500,000 If the Option is exercised between 18 months and 36 months.

The Agreement is subject to certain conditions, including the approval of the Botswana Department of Mines and Ministry of Mineral Resources, Green Technology and Energy Security (“MMR”) to the transfer of the License upon exercise of the Option.

The Agreement may be terminated if the MMR does not provide its approval to the transfer within six months following exercise of the Option, the transfer is not completed within six months following the exercise of the Option, or by mutual agreement.

Due to travel restrictions precipitated by the COVID-19 pandemic, the Company has deferred drilling operations which were originally scheduled to commence by June 30, 2020. As Namibia was only lightly affected by the COVID-19 virus, with only 29 confirmed cases (16 recoveries and 13 active cases) as of the date of this news release, guidance from Namibia on the timing of lifting international travel restrictions suggests international travel will commence in July or August, 2020. As a result, ReconAfrica’s revised drilling schedule, subject to the lifting of travel restrictions in a timely manner, includes shipping the Company’s Crown 750 drilling rig from Houston, Texas to Walvis Bay, Namibia on or before the second week of September with an anticipated spud, of the first of the three initial wells, late October, 2020.

The Agreement is not an “Arm’s Length Transaction” as such term is defined by the TSX Venture Exchange and therefore constitutes a “related party transaction” as such term is defined in Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). Craig Steinke, the sole director and shareholder of the Farmee, has beneficial ownership of more than 10% of ReconAfrica’s common shares.