BP has announced its fourth quarter and full year 2021 results. Reported profit for the quarter was $2.3 billion, compared with a loss of $2.5 billion for the third quarter 2021. Underlying replacement cost profit for the quarter was $4.1 billion, compared with $3.3 billion for the previous quarter.

- Net debt reduced for seventh quarter in a row to $30.6bn end 2021

- 2021 ROACE 13.3%

- Delivering distributions – $4.15bn total buyback from 2021 surplus cash flow

- Continued strategic momentum – seven major projects; accelerated EV strategy; growing offshore wind portfolio

Bernard Looney,chief executive officer, said:

“2021 shows bp doing what we said we would – performing while transforming. We’ve strengthened the balance sheet and grown returns. We’re delivering distributions to shareholders with $4.15 billion of buybacks announced and the dividend increased. And we’re investing for the future. We’ve made strong progress in our transformation to an integrated energy company: focusing and high grading our hydrocarbons business, growing in convenience and mobility and building with discipline a low carbon energy business – now with over 5GW in offshore wind projects – and significant opportunities in hydrogen.”

Highlights

Underlying results and cash flow

- Underlying replacement cost profit for the quarter was $4.1 billion, compared with $3.3 billion for the previous quarter. This result was driven by higher oil and gas realizations, higher upstream production volumes and stronger refining commercial optimization, partly offset by a significantly lower oil trading result and an average contribution from gas marketing and trading and the impact of higher energy costs.

- Reported profit for the quarter was $2.3 billion, compared with a loss of $2.5 billion for the third quarter 2021. The reported result includes adjusting items before tax of $3.0 billion with net impairments of $1.1 billion and adverse fair value accounting effects of $0.9 billion primarily due to further increases in forward gas prices compared to the third quarter.

- Operating cash flow of $6.1 billion includes a working capital build of $2.2 billion (after adjusting for inventory holding gains and fair value accounting effects).

- bp received $7.6 billion of divestment and other proceeds in the full year including $2.3 billion during the fourth quarter. bp expects to receive proceeds of $2-3 billion in 2022.

- For full year 2021 ROACE was 13.3%.

Building a track-record of delivery against our disciplined financial frame

- For the fourth quarter bp has announced a dividend of 5.46 cents per ordinary share payable in March 2022.

- Net debt fell to $30.6 billion at the end of the fourth quarter – a reduction of $8.3 billion compared to fourth quarter 2020.

- Capital expenditure in the fourth quarter and full year was $3.6 billion and $12.8 billion respectively. bp now expects capital expenditure of $14-15 billion in 2022 and continues to expect a range of $14-16 billion per annum through 2025.

- During 2021 bp generated surplus cash flow of $6.3 billion.

- Share buybacks of $1.725 billion were executed during the fourth quarter including $1.25 billion announced with third quarter results and $475 million to complete the buybacks announced with second quarter results.

- bp intends to execute a further $1.5 billion share buyback from 2021 surplus cash flow prior to announcing its first quarter 2022 results.

- For 2022, and subject to maintaining a strong investment grade credit rating, bp is committed to using 60% of surplus cash flow for share buybacks and intends to allocate the remaining 40% to strengthen the balance sheet.

- On average, based on bp’s current forecasts, at around $60 per barrel Brent and subject to the board’s discretion each quarter, bp expects to be able to deliver share buybacks of around $4.0 billion per annum and have capacity for an annual increase in the dividend per ordinary share of around 4% through 2025.

- In addition, to date in 2022, bp has executed a share buyback of $500 million to offset the expected full year dilution from the vesting of awards under employee share schemes in 2022.

- The board will take into account factors including the cumulative level of and outlook for surplus cash flow, the cash balance point and the maintenance of a strong investment grade credit rating in setting the dividend per ordinary share and the buyback each quarter.

Investing for the future – transforming to an Integrated Energy Company

In a separate announcement,bp has today provided an update on the significant progress made in executing its transformation to an IEC since outlining its new strategy. Since announcing third quarter results:

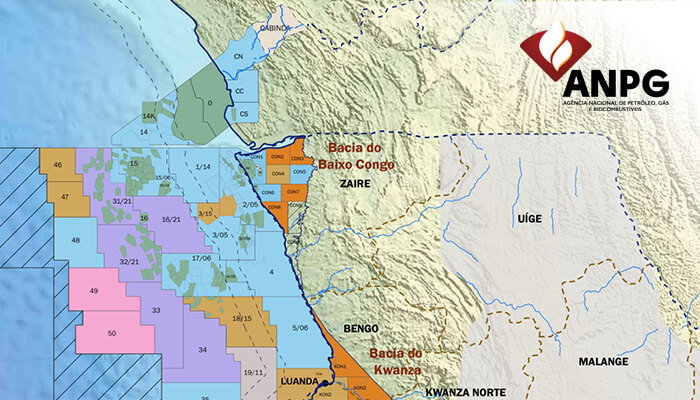

- In resilient and focused hydrocarbons bp announced the start-up of Platina, offshore Angola – the seventh major project start-up during the year. In addition, bp has taken further steps to drive portfolio competitiveness supporting the proposed acquisition of Lundin Energy’s oil and gas business by Aker BP.

- In convenience and mobility, bp acquired EV fleet charging provider AMPLY Power in the US, and in the UK, bp and Marks & Spencer agreed to extend their convenience partnership until at least 2030.

- In low carbon bp has continued to advance its offshore wind strategy with the award of a lease option with 2.9GW gross potential in the Scotwind auction and finalizing offtake terms for the Empire Wind 2 and Beacon Wind 1 projects offshore New York. In addition, bp has announced plans for a new large-scale green hydrogen production facility in the UK – HyGreen Teeside – and formed a strategic partnership with Oman to progress an integrated project to deliver world-class scale renewable energy and green hydrogen.

Murray Auchincloss, Chief financial officer, commented:

“During 2021 we established a track-record of delivery against our financial frame with four quarters of strong underlying financial performance. We raised our dividend, substantially reduced net debt, invested with discipline, announced $4.15 billion of share buybacks and drove returns to 13.3%. Looking ahead, our priorities for capital allocation are unchanged and we remain committed to the continued execution of this plan.”

Production Reported production for the quarter and full year were 974mboe/d and 912mboe/d respectively, higher than the same periods in 2020 mainly due to major project start-ups, partially offset by base decline and the partial divestment in Oman. Underlying production was also higher, by 26.5% and 9.0% for the quarter and full year respectively, mainly due to major project* start-ups, partially offset by base decline.