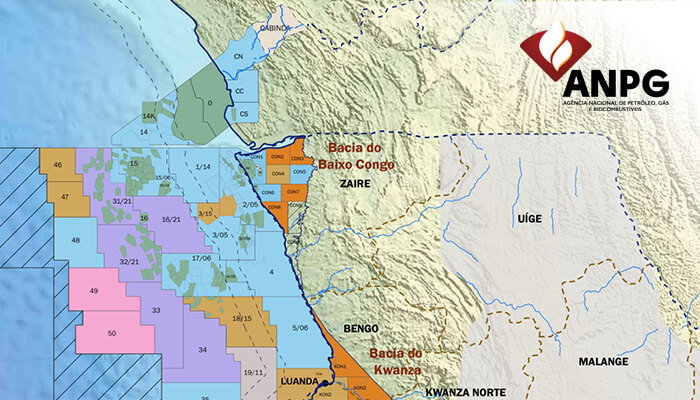

BW Energy has, in a consortium with Maurel & Prom signed an agreement to acquire a combined 20% non-operated interest in Block 14 and 10% in Block 14K offshore Angola from Azule Energy. Within this transaction, BW Energy’s net share will be 10% in Block 14 and 5% in Block 14K, providing a strategic foothold in Angola aligned with the Company’s long-term regional growth strategy.

“The entry to Angola is a key step in BW Energy’s West Africa growth strategy and provides further diversification of our resource base. Firstly, we see clear upsides beyond the current production in Block 14. And, more importantly, we build a position for potential future operated development opportunities in the country,” said Carl K. Arnet, the CEO of BW Energy. “Angola is a mature hydrocarbon basin with an active M&A market and strong political support for the energy sector. We see attractive opportunities for BW Energy to apply our strategy of developing proven reserves and stranded assets through the re-use of existing energy infrastructure to unlock significant value over time.”

Block 14 is a mature deepwater asset comprising nine producing fields, while Block 14K is a tie-back to the main block. The asset is operated by Chevron, and the licence currently runs to 2038. Gross production is approximately 40 kbopd, with net to BW Energy at 4 kbopd. Current producing reserves are estimated at 9.3 mmbbls net to BW Energy, with several identified opportunities to further increase recoverable volumes. Abandonment and decommissioning costs are covered by existing provisions.

The acquisitions are part of a joint transaction with Maurel & Prom, which will acquire equal ownership interests as BW Energy in the two licences. BW Energy values Maurel & Prom as a strong and experienced partner in this process. Completion of the transaction remains subject to regulatory approvals and customary closing conditions, with closing expected by mid-2026.

The transaction carries a base cash consideration of USD 97.5 million net to BW Energy. A deposit of USD 6 million is payable immediately, with the balance to be settled at completion. The final amount will be subject to customary adjustments reflecting cash flows between the effective date of 1 January 2025 and the closing date.

In addition, contingent payments of up to USD 57.5 million net to BW Energy may become payable upon the occurrence of specific events, including Brent prices exceeding certain thresholds over the 2026–2028 period and Achievement of defined production milestones associated with the PKBB development