BW Energy, operator of the Dussafu Marin licence in Gabon and the Golfinho cluster offshore Brazil, reported EBITDA for the first quarter of 2024 of USD 109.7 million, down from USD 133.4 million in the fourth quarter of 2023, mainly due to lower oil sales in the quarter.

Net production from the operated assets was ~27,300 barrels of oil per day in the quarter, slightly up from the previous quarter. This includes production from the Tortue, Hibiscus and Hibiscus South fields in the Dussafu licence (73.5% working interest) and the Golfinho field (100% working interest) after assuming ownership in late August 2023.

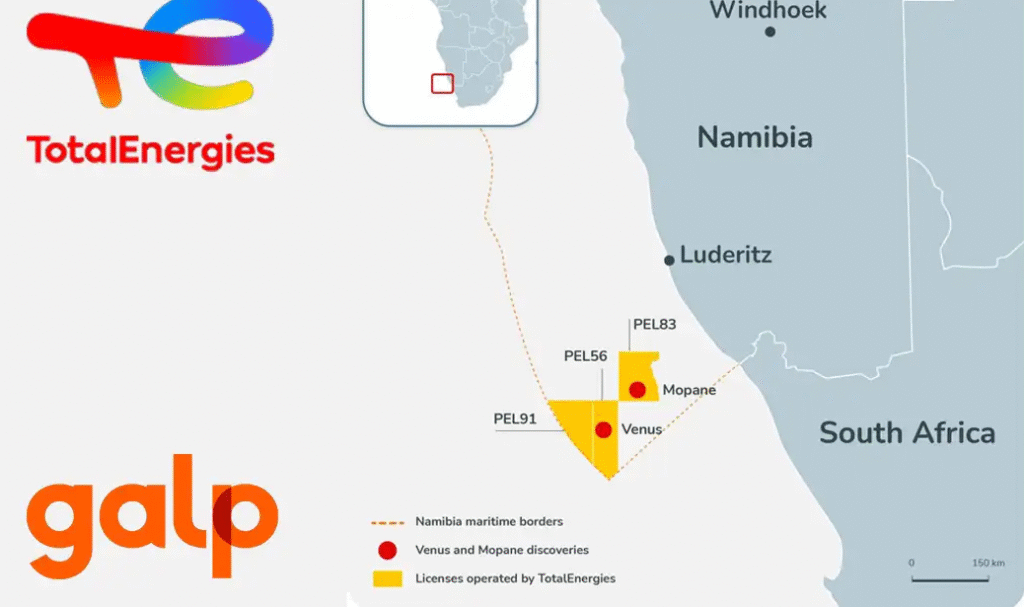

“BW Energy continues to progress the Hibiscus / Ruche drilling program, optimising available rig time to increase production and reserves through low-cost, low-risk development activity and efficient ESP replacements once equipment becomes available,” said Carl K. Arnet, the CEO of BW Energy. “In Brazil, the Golfinho field is producing in line with expectations as we prepare for the planned infill drilling campaign, and in Namibia, the potential of the Orange Basin and our Kudu asset is reaffirmed by another major new oil discovery.”

DUSSAFU

BW Energy completed two liftings in the first quarter at an average realised price of USD 83 per barrel. BW Energy’s share of gross production was approximately 1.66 million barrels of oil. The net sold volume, which is the basis for revenue recognition in the financial statements, was approximately 1.7 million barrels including 97,500 barrels of DMO deliveries and 203,800 barrels of state profit oil with an over-lift position of 167,800 barrels at the end of the period. Proceeds in the amount of approximately USD 50 million from the second lifting in March were received in April 2024.

Net production from the Dussafu licence averaged 18,260 barrels of oil per day in the quarter. Production was impacted by the previously communicated electrical issues affecting the ESPs (electrical submersible pumps) on the Hibiscus field. First quarter production cost (excluding royalties) was 17% lower than the prior quarter at approximately USD 23 per barrel. The decrease reflected improved operational efficiency and production.

In March, production started from the DHBSM-1H well in the Hibiscus South field five months after the initial discovery in November 2023.

The Company continues the work on resolving the electrical integrity issues affecting the ESPs. Currently, the DHIBM-6H well is producing on natural flow. The DHIBM-3H, DHIBM-4H and DHBSM-1H wells are producing on ESP. The programme of diagnosis, repair and replacement of the ESPs is well underway.

In May and June, the FPSO BW Adolo will undergo annual scheduled maintenance, resulting in a planned shutdown for approximately three weeks.

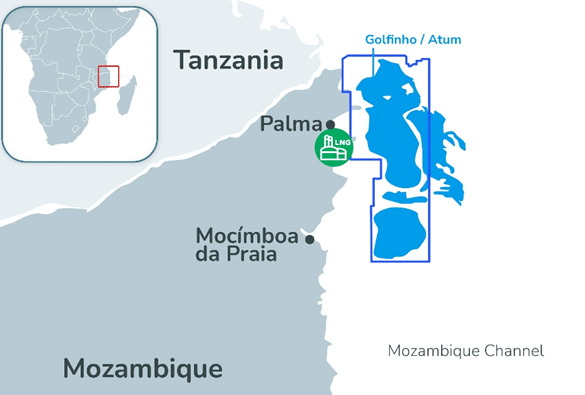

GOLFINHO

Net production from the Golfinho field averaged 9,030 barrels of oil per day in the first quarter, amounting to a total production of 822,500 barrels in the period. One lifting was carried out in February of 490,000 barrels at a realised price of USD 82 per barrel. Remaining inventory was approximately 657,900 barrels at the end of the period. Production cost (excluding royalties) averaged USD 48 per barrel. This compares with Q4 production costs of USD 44 per barrel, mainly reflecting lower production.

OTHER ITEMS

During the quarter, the Company extended and increased the Golfinho prepayment facility to USD 120 million from originally USD 80 million. The facility was fully drawn at the end of the period.

In April, the Company executed a USD 150 million sale and leaseback agreement with a Minsheng Financial Leasing Co entity for the MaBoMo production facility with a ten-year term with an option to repurchase the unit from the end of year seven. The transaction has freed up net USD 110 million of liquidity to BW Energy and is not reflected in the end of period cash position.

BW Energy had a cash balance of approximately USD 150 million on 31 March 2024, compared to USD 194 million on 31 December 2023. The decrease reflects the net impact from oil sold in the period, drawdown on the expanded prepayment facility and investments, primarily related the ongoing Hibiscus Ruche field development. The Company had a total drawn debt balance of USD 412.8 million as of 31 March 2024 including the Golfinho prepayment facility.

Total production net to BW Energy from Gabon and Brazil for 2024 is projected to be between 10 and 12 million barrels, based on the current Hibiscus / Ruche development plan and ESP work-over schedule. Full-year production cost (excluding royalties) is expected to be USD 30 to 35 per barrel. Net capital expenditures are expected in the range USD 280 to 330 million. The increase is directly related to the successful exploration activities and added reserves in Dussafu.

DEVELOPMENT PLANS

The ongoing Hibiscus / Ruche drilling campaign has the potential to bring total oil production on the Dussafu licence up to the FPSO capacity of approximately 40,000 barrels per day gross when all wells are on-stream.

Drilling of the DRM-3H well in the Ruche field has been completed with production start pending delivery of a new conventional ESP (electrical submersible pump). This is expected during the second quarter. Following completion, the Borr Norve jackup drilled the DHBSM-2P pilot well, which confirmed that the Hibiscus South deposit extends into the northern part of the field with good reservoir quality, increasing reserve estimates. Preliminary evaluation indicates gross recoverable reserves of 5 to 6 million barrels of oil and approximately 14 million barrels of oil in place.

In May, the Company made a substantial oil discovery with good reservoir quality in the DHIBM-7P pilot, appraising the northern flank of the Hibiscus field. Evaluation of well data confirm approximately 24 metres of pay in an overall hydrocarbon column of 37 metres and the first example of a common Gamba-Dentale hydrocarbon accumulation in Hibiscus field. Preliminary evaluation indicates a notable increase in both the volume of oil in place and gross recoverable reserves.

The Hibiscus / Ruche Phase 1 drilling campaign has been expanded to nine wells. In addition to the four Hibiscus wells, one Hibiscus South well and one Ruche well, drilled to date, the updated plan includes the second Hibiscus South well, a fifth Hibiscus well and a Bourdon prospect test well.

In Brazil, BW Energy continued preparations for the two planned Golfinho infill wells (GLF-51 oil well and GLF-50 gas well) which are expected to double production in 2027. This included filing of permitting documents with the environmental regulator IBAMA. Final Investment Decision (FID) is planned later this year.

Also in Brazil, the Maromba development plan progressed with completion of the revised concept expected in the second quarter of 2024. Total oil production from Maromba at peak annual average is expected between 30-40,000 barrels of oil per day. In April, BW Energy paid the second and last instalment of USD 20 million for FPSO Polvo, renamed BW Maromba. The FPSO is at the COSCO yard in China where it is being prepared for upgrades. The final investment decision for the Maromba development is subject to completion of the project financing.

In Namibia, BW Energy is progressing the revised development plan for the gas-to-power project and analysing data from the 3D seismic survey completed in May 2023. Interpretation of the initial data has enhanced the depositional model and de-risked potential targets with additional prospects identified, and the Company continued the work on securing long-lead items for a future exploration program.