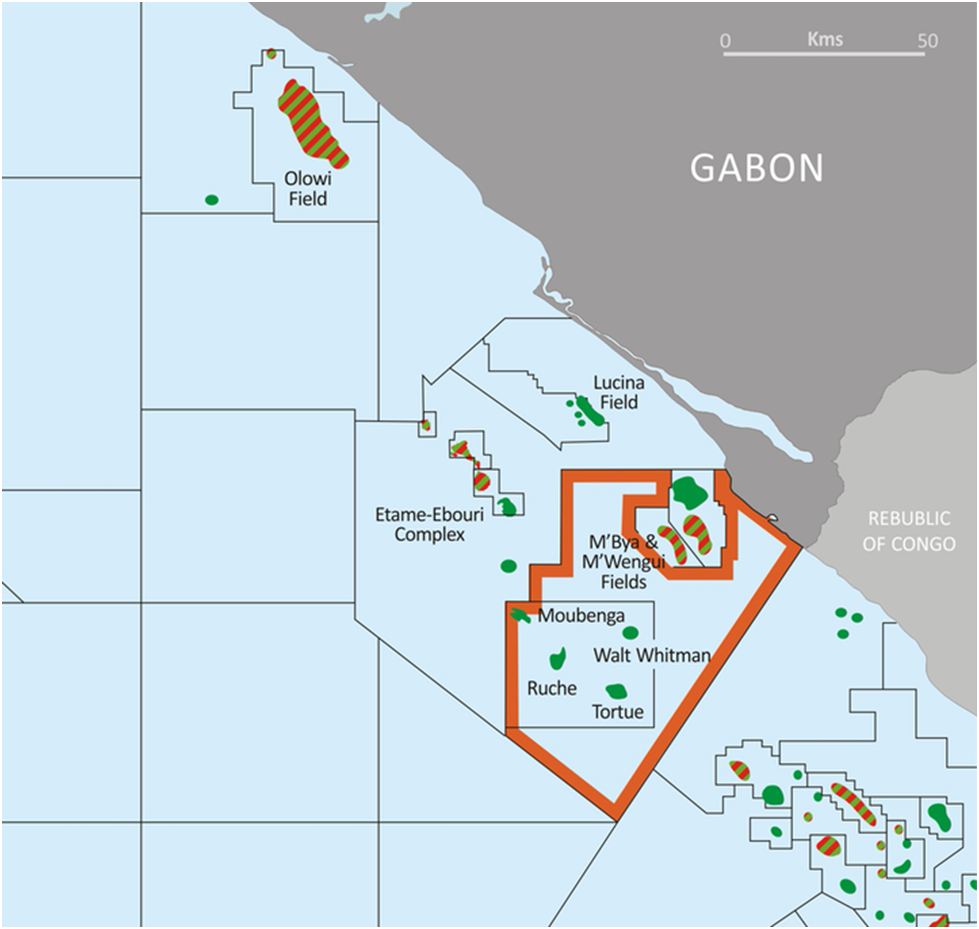

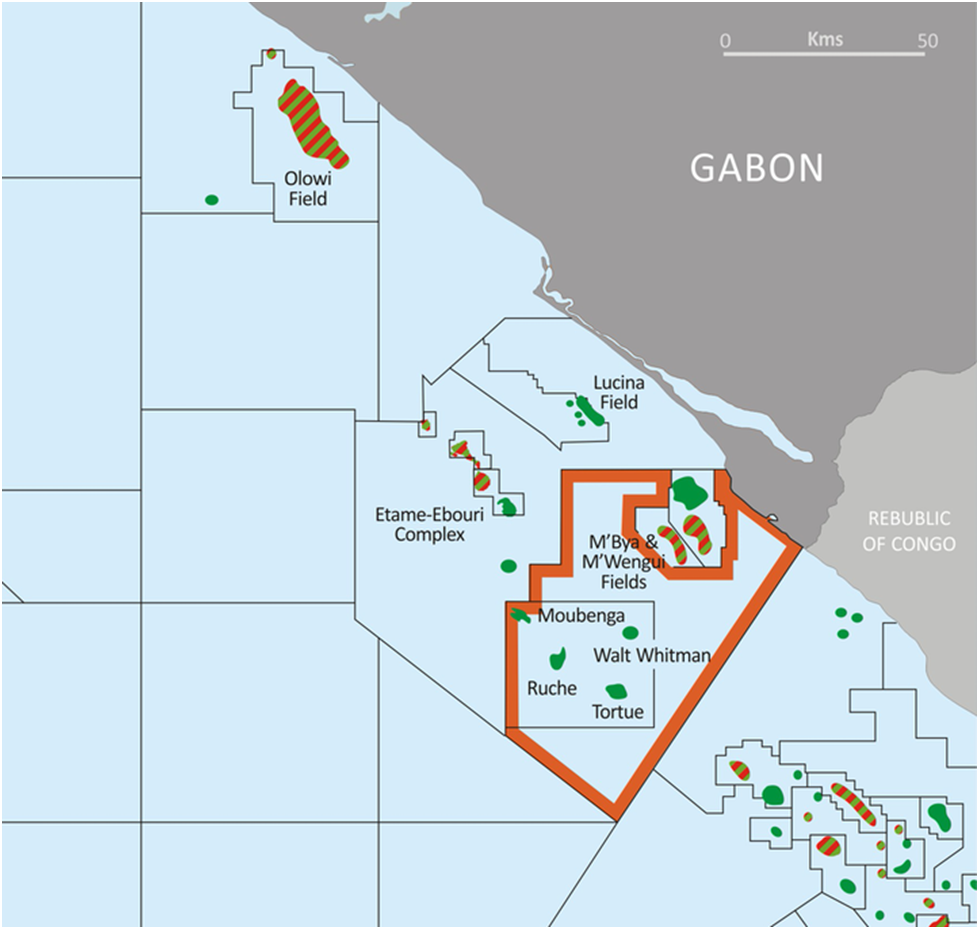

BW Energy has announced that the EBITDA for the fourth quarter of 2020 was USD 28.3 million, up from USD 22.2 million in the third quarter. Dussafu production averaged approximately 13,500 barrels of oil per day from four wells, amounting to a total gross production of 1.24 million barrels of oil in the quarter. Two liftings were completed to BW Energy in the quarter, realising an average price of approximately USD 46.15 per barrel. The latter lifting was paid to the Company in January 2021. The Company sold 1.26 million barrels of oil net in the quarter including approximately 162,.000 barrels of fourth quarter DMO deliveries and an over-lift position of around 41,000 barrels at period-end.

“We have resumed value-enhancing development activities on the Dussafu license with preparations underway for an initial exploration well in the Hibiscus Extension in the second quarter followed by completion of the remaining Tortue Phase 2 wells,” says Carl K. Arnet, CEO of BW Energy. “At the same time, we are progressing the Hibiscus/Ruche project and jack-up conversion which will reduce investments, time to first oil and environmental footprint.”

Fourth quarter production cost (excluding royalties) was USD 22.7 per barrel, including approximately USD 2.2 million of additional COVID-19 related costs. BW Adolo had scheduled downtime of 11 days for annual maintenance and to comply with Gabonese production allocations under OPEC quotas.

Total Dussafu production for 2021 is projected to be approximately 14,800 to 15,900 barrels per day gross, or between 5.2 to 5.8 million barrels in total for the year, based on first oil from the remaining Tortue phase 2 at end of the third or early in the fourth quarter. Full year production cost (excluding royalties) is expected between USD 19 to 22 per barrel.

Full-year 2020 production averaged approximately 14,100 barrels of oil per day, equalling a gross production of approximately 5.2 million barrels of oil. Full-year EBITDA was USD 87 million.

Cash balance was USD 120.6 million at 31 December 2020, compared to USD 145 million at 30 September 2020. On 20 January 2021, BW Energy completed a private placement raising gross proceeds of approximately USD 75 million, ensuring that BW Energy has capital to deploy towards accretive projects and capture significant value creation going forward. Free float after completion of the private placement is approximately 71%. Following the private placement, BW Offshore holds 35.2% and BW Group Limited 35.1% of BW Energy, respectively.

DEVELOPMENT PLANS

Execution of the Dussafu development plan is progressing with the recent award of a drilling contract for one exploration well and one development well (DTM-7H). Additionally, BW Energy holds an option for another exploration well subject to the results of the drilling campaign. In November 2020, BW Energy concluded on an alternative development plan for the Hibiscus/Ruche satellite field reducing the capital investments by around USD 100 million by utilising a converted jack-up as the offshore installation. The conversion project is progressing with focus on structural engineering and yard selection.

The Maromba project continues to progress towards the environmental approval and optimisation of the field development plan with respect to investment, operational costs, and schedule. A final investment decision is planned by the first quarter of 2022.

In January 2021, BW Energy announced a Farm-In and Carry Agreement with NAMCOR to increase its working interest in the Kudu gas field to 95% line with previously disclose intentions. BW Energy is continuing its efforts to develop this resource commercially.

OUTLOOK

Key macro drivers have developed positively through the course of 2020 and into 2021 as societies have started vaccination programs and gain increased control of the COVID-19 pandemic. Disciplined OPEC production cuts have supported the oil price in the short-term, while oil demand is recovering with improvements in the global economy. The exact degree of demand growth will rely on the pace of global vaccine rollouts, easing of lockdowns and government economic stimuli through 2021.

BW Energy expects to generate significant positive cash flow at current oil price levels. With no debt, a solid capital base following the 2020 IPO and the January 2021 capital raise, and access to a number of accretive investment projects, the Company expects to create significant value for its stakeholders going forward.

BW Energy remains focused on realising long-term value creation via its phased development strategy targeting investments in high-return assets. The flexible investment strategy has proven robust for a range of market scenarios and positions the Company to address both short- and long-term opportunities to drive cash flow and earnings.

BW Energy today published its annual report, comprising the sustainability report, for the financial year ended 31 December 2020. BW Energy has also today published the Board approved report on payments to governments and the annual statement of reserves for the financial year 2020. Please find all reports and the fourth-quarter earnings presentation attached. The reports are also available