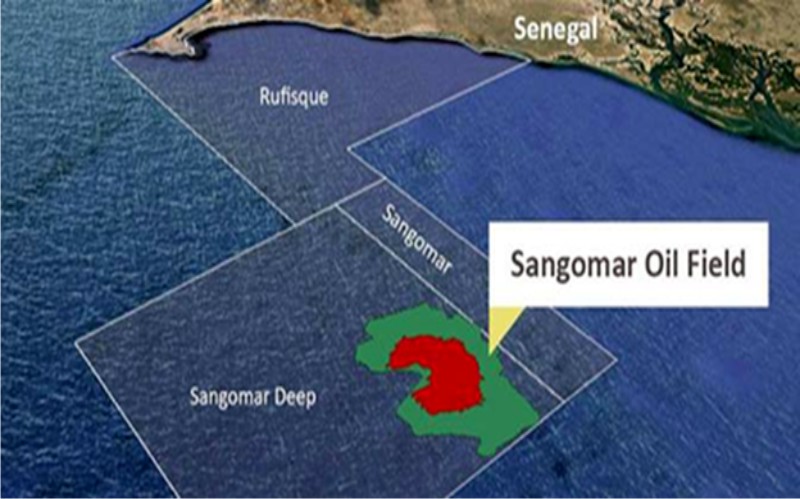

Capricorn has noted the Woodside Petroleum’s announcement regarding the departure from Singapore of the FPSO for Woodside’s Sangomar Field development offshore Senegal. And as defined in the sale and purchase agreement, Capricorn may become entitled to a contingent payment of either $25m or $50m if the average Brent oil price during the first six months of production exceeds the $55 per barrel or $60 per barrel thresholds and first oil is achieved in the first half of 2024.

If first oil is achieved prior to 30 June 2024, the contingent payment is anticipated in early 2025 once the average oil price has been determined and there has been 30 days of continuous production. First oil is defined as the first continuous 72-hour period of production from the Sangomar Field during which at least a total of 30,000 barrels is produced for sale.

In either case, no additional payment will be due from Woodside if the average Brent price is less than or equal to $55 per barrel or if first oil is achieved later than H1/2024.

Capricorn remains committed to returning any proceeds of this contingent payment to its shareholders.