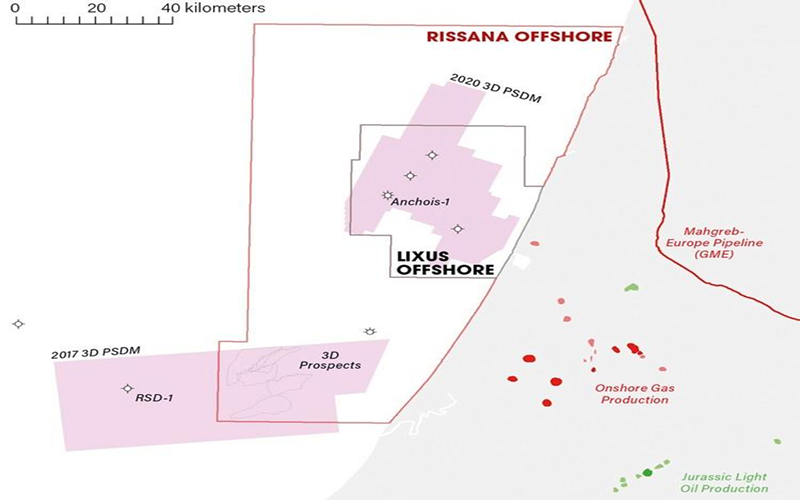

Chariot has announced the results of Independent Assessments on its gas resources offshore Morocco, incorporating the results of the recent successfully drilled Anchois-2 appraisal and exploration well. The Independent Assessments have been made by Netherland Sewell & Associates Inc. (‘NSAI’) on the Anchois Gas Field and further selected exploration prospects in the Lixus Offshore licence and the adjacent Rissana Offshore licence with material resource upgrades reported across the portfolio.

These resource upgrades underpin:

- the Company’s decision to fast-track its field development plans;

- the associated exploration programmes to deliver further growth from the portfolio; and

- Chariot’s focus on developing a significant energy resource, prioritising the growing demand within Morocco’s domestic market, and potentially supplying surplus gas to Europe.

Anchois Gas Field:

- 82% increase in 1C contingent resources from 201 Bcf to 365 Bcf

- 76% increase in 2C contingent resources from 361 Bcf to 637 Bcf

- 49% increase in 2U prospective resources to 754 Bcf in three undrilled targets with an improvement in the probability of geological success, now ranging from 49 to 61%

- Total remaining recoverable resource at Anchois (2C plus 2U) now stands at 1.4 Tcf

Additional Lixus Prospects:

- Updated assessments on two key undrilled prospects (Maquereau, and Anchois West) with improvements in both prospective resource potential and probability of geological success and the newly identified Anguille prospect, which are all part of the same tertiary gas play as the Anchois gas field

- Combined, 2U prospective resources of 838 Bcf with an estimated probability of geological success ranging from 30-52%, with closely related additional targets in the areas surrounding the prospects

- The total remaining recoverable resources (2C plus 2U, comprising audited and internal Chariot estimates) in the entire Lixus portfolio stands at approximately 4.6 Tcf

Rissana Offshore:

- Early assessment of the areas covered by 3D seismic, provides a total 2U prospective resource of over 7 Tcf, combining a high-graded prospect ‘Emissole’ within the lower risk Anchois tertiary gas play and multi Tcf prospects in a higher-risk Mesozoic play, inherited from Chariot’s legacy Mohammedia Offshore licence area.

‘This independent assessment report confirms that following the drilling of Anchois-2, we have a growing resource base from which we can fast track our gas development towards material cashflows and provide gas to meet Morocco’s growing energy demand.

These resource upgrades across our Moroccan portfolio are a significant step forward. As well as confirming the increased scale of our discovery at Anchois, this independent assessment has also corroborated the multi Tcf opportunity that sits within the basin in our Moroccan licences and served to de-risk a number of high potential future targets in Lixus.

We remain fully focused on bringing Anchois into production as quickly as possible and are working hard across all aspects of the development plan required to reach FID. We are committed to realising the value of this gas field as well as continuing to prove up the significant scope of our wider resource base from the Moroccan portfolio.’ Duncan Wallace, Technical Director of Chariot Limited, said.