Chariot, the Africa focused transitional energy company, has announced its unaudited interim results for the six-month period ended 30 June 2023.

Adonis Pouroulis, CEO of Chariot commented:

“We continued to progress all workstreams across the business throughout the period and further enhanced our portfolio with the award of the Loukos licence onshore Morocco and the acquisition of our water desalination business. In each pillar of transitional gas, renewable power and green hydrogen, we have the opportunity to deliver a range of tangible benefits and drive real value. Long term scalability is a shared theme across all of our projects, but we are fully focused on executing our core objectives to de-risk the business, enable further growth and deliver near term production.”

Highlights during and post period

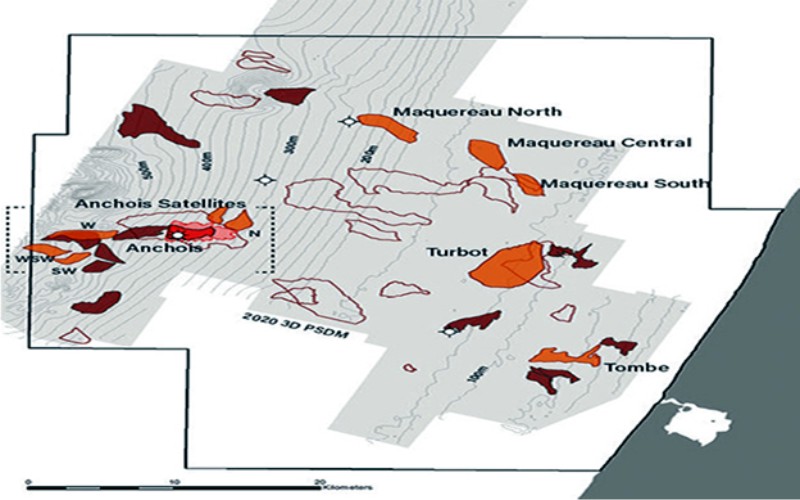

Transitional Gas: Developing a New Gas Province in Morocco

Transitional Power: Building a Substantial Renewable Energy pipeline across Africa

Green Hydrogen – Focused on early stage production and future scale up

Corporate and Financial

Financial Review

The Group remains debt free and had a cash balance of US$2.7 million at 30 June 2023 (US$12.1 million at 31 December 2022) which was further increased in the post-period following the equity fundraising completed in August 2023 which raised gross proceeds of US$19.1 million.

Hydrogen and other business development costs of $0.9 million (30 June 2022: $1.5 million) comprise non-administrative expenses incurred in the Group’s business development activities within the Green Hydrogen pillar.

Other administrative expenses of US$3.5 million (30 June 2022: US$5.0 million) are lower than the prior period reflecting the Group’s focus on maintaining a lean cost foundation, without impacting operational capability.

Finance income of US$0.2 million (30 June 2022: US$ nil) is higher than the prior period due to bank interest received on cash balances, as well as foreign exchange gains on non-US$ cash.

Finance expenses of US$0.02 million (30 June 2022: US$0.4 million) are lower than the prior period reflecting the stabilising of foreign exchange rates on the holding of cash balances in Sterling as well as the reduced unwinding of the discount on the lease liability under IFRS 16.

Share-based payments charges of US$3.4 million (30 June 2022: US$0.9 million) are higher than the prior period due to the granting of share awards to employees across the group over the past 12 months.

Please wait....

Thank you for subscribing...