Chariot Limited has presented its interim results outlining the workstreams and progress across its business pillars through June and post-period to date. Within each of these verticals, the company is looking to develop domestic energy resources that can provide accessible, sustainable solutions and help alleviate power poverty across the African continent.

This is the ethos that underpins the Chariot strategy and business model and recent events have had a material impact on its share price in maintaining the importance and positioning of the company’s portfolio within the energy transition.

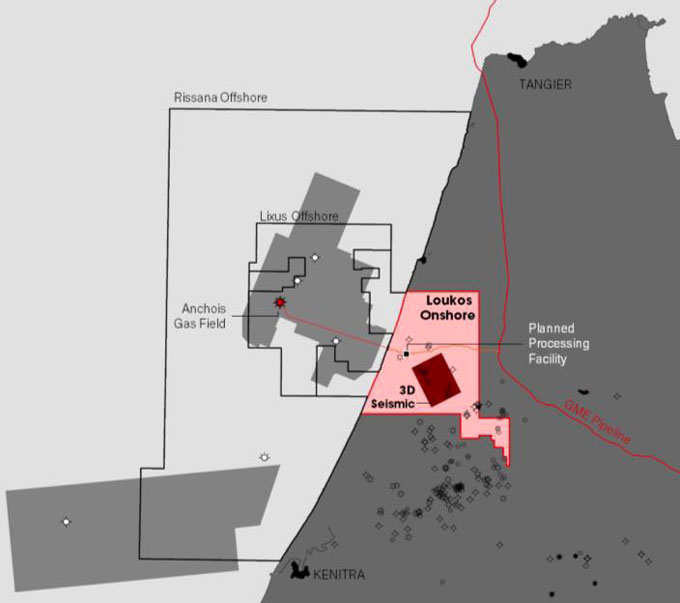

Lixus and Rissana Offshore licences (Energean, Operator, holding 45% in Lixus and 37.5% in Rissana, Chariot 30% and 37.5% respectively, ONHYM 25% in both licences)

As announced on 16 September, the Anchois East drilling campaign conducted at the Anchois gas project in the Lixus Offshore licence along with our partners Energean and ONHYM was safely and efficiently drilled to target depth in both the Pilot and Main Holes. This evaluated all of the pre-drill reservoir targets however the results did not deliver as anticipated or in line with the excellent results of the previously drilled Anchois-2 well.

As stated in our press release, multiple good quality gas-bearing reservoirs were found in the B sand appraisal interval in the Main Hole, but the associated gas pays were interpreted to be lower than the pre-drill geological model, and other target reservoirs beneath the B sands were also encountered but were water wet. The appraisal target reservoirs of the C and M sand were drilled deeper than the gas-bearing sands in the Anchois2 well and into the water-leg at this down-dip location.

The Anchois North Flank exploration prospect was found to have well-developed O sand reservoirs, with associated gas shows, but also water wet. Both holes were plugged and abandoned, without flow testing the Main Hole, and the drill ship was demobilised.

The primary exploration objectives were unsuccessful however, the company did demonstrate the extension of gas-bearing reservoirs in the B sand interval, and the data acquired from the other reservoirs will be useful for our understanding of the field as well as establishing the impact on pre-drill estimates.

Chariot team have worked very hard over the past few years on this asset, from drilling the Anchois-2 discovery, completing the FEED, securing Energean as a partner, and taking it through this drilling campaign. Whilst there is always risk in drilling, the successful farm-out process provided validation of the pre-drill prospectivity and potential of the targets and Chariot is looking to deliver an expanded development following this campaign.

Clearly, the results were below expectations but Chariot still believes the Anchois field and the surrounding licence areas have a lot of potential. Post well analysis is underway and The company is working with its joint venture partners to determine the next steps for the project.

Loukos Onshore Licence (Chariot, Operator, 75%, ONYHM, 25%)

The company successfully drilled two wells in the onshore Loukos licence in May with a discovery at the OBA-1 well which reported an approximate 70m gross interval of primary interest, with elevated resistivities coincident with elevated mud gas readings and interpreted gas pays.

The team has also been interpreting reprocessed seismic across the acreage and have identified a number of additional exploration targets not evident in previous data. The uplift in quality of this dataset has helped define new amplitude-supported target structures as well as potential commercial opportunities within and around the historic discoveries situated on the block.

Chariot partnership agreement with Vivo Energy announced in June has the potential to play a key part in commercialising future onshore production as it will enable the company to build out and distribute gas via a virtual compressed natural gas (CNG) pipeline.

CNG is a low-cost, flexible development solution, and gas would initially be delivered to the high-demand local Kenitra industrial market which is just 40km from Loukos. The partnership would also be able to trade third-party gas which could drive further expansion and growth into regional hubs and generate an additional future value stream for both parties.

In light of the results from the Anchois-3 drilling campaign, Chariot is reviewing its work programme for the Loukos licence as they look to preserve capital and utilise funds in the most optimal way.

Adonis Pouroulis, CEO of Chariot commented: “We are providing an update on our Interim results today, but the main news recently has been around the drilling campaign offshore Morocco. As reported, the preliminary results of the Anchois-3 well did not deliver as expected.

Post-well analysis is now underway and we will collaborate with our joint venture partners to determine the forward plan for the project. We still see a lot of potential within the Anchois field and the wider licence area, across Lixus and Rissana, and these drilling results need to be further analysed and incorporated into our understanding of the area.