Chevron Corporation announced that it has completed its acquisition of Hess Corporation following the satisfaction of all necessary closing conditions, including a favorable arbitration outcome regarding Hess’ offshore Guyana asset. The combined company has one of the most advantaged and differentiated portfolios in the industry, with leading positions in critical energy markets around the world and a high cash margin production profile. In addition, on July 17, 2025, the Federal Trade Commission (FTC) lifted its earlier restriction, clearing the way for John Hess to join Chevron’s Board of Directors, subject to Board approval.

“This merger of two great American companies brings together the best in the industry,” said Chevron Chairman and CEO Mike Wirth. “The combination enhances and extends our growth profile well into the next decade, which we believe will drive greater long-term value to shareholders. Additionally, I’m pleased with the FTC’s unanimous decision. John is a respected industry leader, and our Board would benefit from his experience, relationships and expertise.”

“We are proud of everyone at Hess for building one of the industry’s best growth portfolios including Guyana, the world’s largest oil discovery in the last 10 years, and the Bakken shale, where we are a leading oil and gas producer,” former Hess Corporation CEO John Hess said. “The strategic combination of Chevron and Hess creates a premier energy company positioned for the future.”

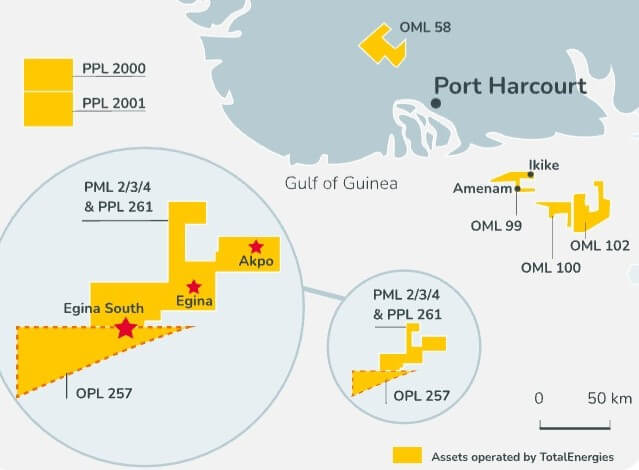

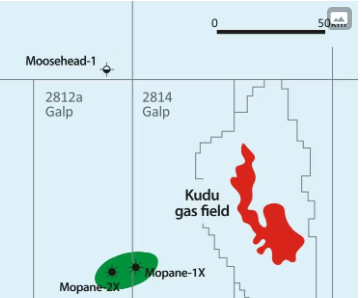

The acquisition adds world class assets, including Guyana and U.S. Bakken, to Chevron’s diversified global portfolio where it is a leader in the Permian Basin, Gulf of America, DJ Basin, Kazakhstan, Eastern Mediterranean and Australia. Chevron now owns a 30% position in the Guyana Stabroek Block, which has more than 11 billion barrels of oil equivalent discovered recoverable resource; 463 thousand net acres of high-quality inventory in the Bakken; complementary assets in the Gulf of America with 31 thousand barrels of oil equivalent per day; and natural gas assets in Southeast Asia with 57 thousand barrels of oil equivalent per day.

“This accretive transaction is expected to drive significant free cash flow and production growth into the 2030s,” added Chief Financial Officer Eimear Bonner. “We are quickly integrating our two companies and expect to achieve $1 billion in annual run-rate cost synergies by the end of 2025. All of this should enable even higher returns to shareholders over the long-term.”

Under the terms of the merger agreement, Hess shareholders will receive 1.0250 shares of Chevron for each Hess share. As a result, Chevron intends to issue approximately 301 million shares of common stock out of treasury to Hess stockholders in connection with the transaction. The 15.38 million shares of Hess common stock (which were acquired in open market transactions) beneficially owned by Chevron immediately prior to the closing were cancelled for no consideration.

Chevron expects to achieve the following transaction benefits:

Accretive to cash flow per share and extends growth into 2030s

Expected to be accretive to cash flow per share in 2025 after achieving synergies and start-up of the fourth floating production storage and offloading vessel in Guyana.

Increases Chevron’s estimated five-year production and free cash flow growth rates and expected to extend such growth into the next decade.

Capital and cost efficient

The combined company’s capital expenditures budget is expected to be between $19 and $22 billion.

After closing, Chevron will target to sustain a double-digit Return on Capital Employed (ROCE) at mid-cycle prices.

The transaction is expected to achieve run-rate cost synergies of $1 billion by the end of 2025.

Chevron will provide updated long-term financial and operational information and guidance to reflect the acquisition of Hess at its Investor Day in New York City on November 12.