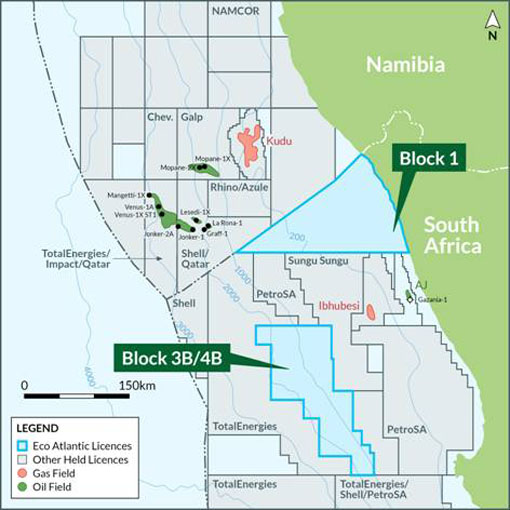

Eco (Atlantic) Oil & Gas, an Atlantic Margin-focused oil and gas exploration company, provides an update on activities in its entry into Block 1 offshore South Africa, located in the proven and highly prospective Orange Basin.

Eco, through its wholly owned subsidiary Azinam South Africa, has entered into a Farm-In Agreement with Tosaco Energy to acquire a 75% Working Interest and Operatorship in Block 1 offshore South Africa. The Company is now in the final stages of securing the requisite Section 11 regulatory approval to complete the transfer of the interest and formalize operatorship, which is expected in the near term.

Data Acquisition and Subsurface Intelligence

Eco has now completed the acquisition of Block 1’s substantial volume of 3D and 2D legacy data from the Petroleum Agency South Africa (“PASA”) This purchase includes:

- Two 3D seismic surveys totalling 3,500 km² (2,000 km² and 1,500 km²)

- 20,000+ line kilometres of 2D seismic

- Three key exploration well logs: AF-1, AO-1, and AE-1 (All drilled on the block)

All data is of high-resolution quality and is processing-ready, with no reprocessing or reconditioning required. The seismic surveys offer full coverage across key structural and stratigraphic targets, from inboard gas-prone zones to outboard oil-charged systems.

Historical Well Data and Hydrocarbon Shows

The block benefits from three legacy exploration wells drilled in the late 1980s by Soekor, South Africa’s former state oil company. These include:

- AF-1: Confirmed gas discovery with tested flow rates of 32.4 MMscfd

- AE-1: Encountered gas shows and oil indications

- AO-1: Provided key stratigraphic data and reservoir markers

All three wells were part of Soekor’s regional Orange Basin program and offer critical calibration for seismic interpretation and future prospect de-risking.

Strategic Asset Overview

Block 1 spans 19,929 km² offshore South Africa, directly abutting the Namibian border. The block extends from the shore to the continental shelf, some 175km offshore then to ~263 km out into deep water, encompassing a full margin transect from the shelf to deep water channel and fan complexes.

Water depths range from shallow shelf (~200 m) to deepwater (~1,000 m), enabling a full spectrum of play types. The acreage is considered geologically analogous to the Kudu gas field to the north and sits immediately south of recent discoveries made by Galp Energia (Mopane), Shell (Graff, La Rona), TotalEnergies (Venus), and Rhino Resources (Capricornus 1-X light oil discovery).

Operational Readiness

Eco will assume operatorship of the block upon final regulatory approval. As the current Exploration Right Budget and Work Plan does not involve field operations, the program proceeds without the need for additional environmental permitting for immediate interpretation and technical work to progress.

Colin Kinley, Co-Founder and COO of Eco Atlantic, commented:

“The Orange Basin has rapidly emerged as one of the most compelling hydrocarbon fairways globally, with recent multi-billion-barrel discoveries adjacent in Namibia extending directly into the geological runway of Block 1. This asset provides Eco with material exposure across a full-margin basin play-ranging from proven, gas-rich inboard sections to oil-prone targets in the deepwater and ultra-deepwater domain.”

“This strategic acquisition of high-quality 2D and 3D seismic, along with historic well logs deliver massive value to the company. This acquisition is currently conservatively estimated to replace US$50-60 million in acquisition costs required for new exploration. The data quality enables us to aggressively pursue subsurface interpretation and prospect ranking immediately. This dataset provides a robust foundation for accelerated prospect maturation and the opportunity to consider potential farm-out and partnership conversations.”

“In parallel with our South African work program, we are actively negotiating farm-out and drilling participation opportunities on our Orinduik Block in Guyana. We will update the market as those discussions progress. Our Walvis Basin acreage in Namibia, particularly the ultra-deepwater blocks, is also receiving strong interest as Orange Basin real estate becomes increasingly competitive. We continue to engage with industry and government stakeholders to advance partnerships across these core positions. Finally, our interest in Blocks 3B/4B in South Africa-now operated by TotalEnergies-offers unique upside potential, both on completion payment of farm down costs to Eco and importantly drilling the significant resource opportunity assessed on the block.”