Eco (Atlantic) Oil & Gas has confirmed that the company and Azinam Group Holdings have completed all conditions required to be completed in order to close Eco’s acquisition of Azinam save and accept for receipt of the final approval of the TSX Venture Exchange.February 8, 2022Eco (Atlantic) Oil and Gas Ltd Announced that the Share Purchase Agreement with Azinam has been signed

As disclosed in the Company’s announcement of February 8, 2022, the Acquisition will result in the issuance to Azinam of 40,170,474 common shares in the capital of Eco, providing Azinam with 16.5% of Eco’s share capital as enlarged by such issue, providing for a cashless acquisition to become the sole owner of Azinam’s entire African portfolio.

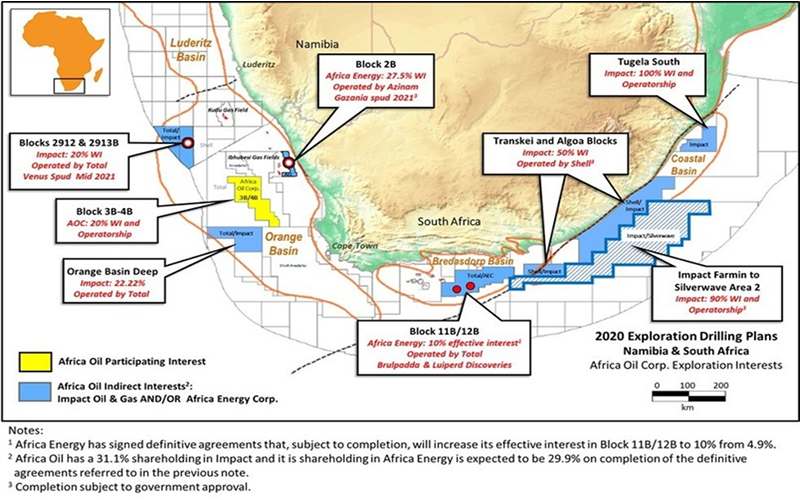

In addition to the New Issue, Azinam will be issued warrants to acquire additional Common Shares, exercisable only in the case of a producible commercial discovery on Block 2B or Block 3B/4B, as follows: 20,000,000 warrants exercisable at a price of CAD$1.00 per Common Shares during the twenty-four month period immediately following the date of receipt of the Approval, and 20,000,000 warrants exercisable at a price of CAD$1.50 per Common Share during the thirty-six month period immediately following the Approval, such exercise dates to be extended in the event a well is not drilled on Block 2B or Block 3B4B, until such time as a well is drilled on either block and a producible commercial discovery declared.

At no time will Azinam be entitled to subscribe for and purchase such amount of Common Shares which, when aggregated with its already exiting ownership of Common Shares, would result in Azinam being the registered or beneficial holder of more than 19.9% of the then issued and outstanding Common Shares, without the prior written consent of the Exchange and Eco and in accordance with the policies of the Exchange. Eco has agreed that, for as long as Azinam holds at least a 12.5% interest in Eco’s share capital, it shall be entitled to nominate one director for election to Eco’s board of directors.

In connection with the Acquisition, a fee of 350,000 Common Shares and US$50,000 will be payable to an arms length third party in connection with their advisory services to Eco.

Gil Holzman Co-Founder and CEO of Eco Atlantic commented:

“We are pleased to have completed this acquisition, subject to final Approval to issue the shares. we now own and operate a number of highly prospective licences in three of the most exciting regions for exploration in the world: Guyana, Namibia and South Africa. We continue to make strong progress towards the upcoming drilling of the Gazania-1 well, offshore South Africa, and following the signing of the rig contract earlier in the month we anticipate drilling to commence in late Q3 2022. We look forward to making further updates on our strategic acreage in due course.”