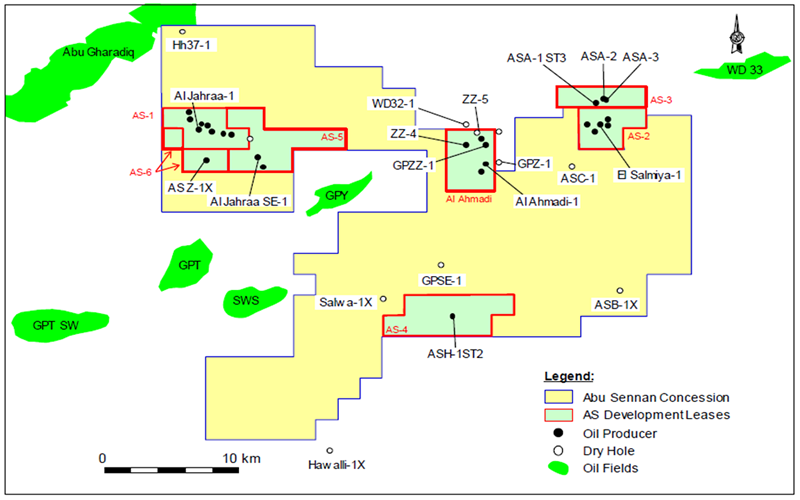

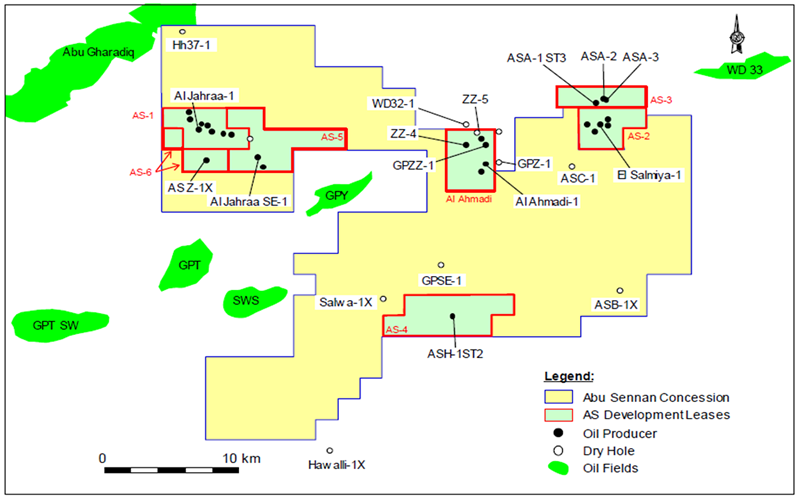

United Oil & Gas plc’s (UOG) an exploration and production company with operations in Egypt has been granted approval for a development lease to cover the ASD-1X discovery, part of the Abu Sennan Licence, which allows production operations to get underway.

Production starts from the ASD-1X well at an initial gross rate of 1,295 bopd, which is 285 bopd net to United. Meanwhile, a separate programme to workover the ASH-1ST2 well has also boosted production numbers, adding just over 1,000 bopd gross or 220 net to United. The well adds 285 bopd net to United, meanwhile, a workover of another Egyptian well has added a further 220 bopd.

United highlighted the rapid pace of progress at Abu Sennan where the ASD-1X well was drilled as recently as April.

“The speed at which the joint venture is developing Abu Sennan is demonstrative of the excitement we share for the long-term potential of the licence, which continues to deliver for the company,” said chief executive Brian Larkin. “We would also expect this result to add to the proven reserves on the licence.”

“In tandem with exploration success in Abu Sennan, the encouraging result from the ASH-1ST2 workover will provide a further boost to production, and will also help increase our understanding of the ASH Field.”

Larkin also highlighted that drilling is presently underway on the Al Jahraa-8 development well with results pending in due course.

……Cenkos lifts United Oil & Gas valuation as Egypt success discovery continues

Cenkos has again nudged up its valuation for United Oil & Gas plc’s (UOG) as it marked an increase in production at the 22% owned Abu Sennan licence in Egypt, with analyst James Mccormack describing the update as “the latest in a continual flow of success” for the company.

This is followed the previous positive announcement made out of Egypt Recently as concerned United’s partner Kuwait Energy submission of a notice of commercial discovery to the authorities as testing of the ASD-1X exploration well confirmed positive results.

The well encountered the lower Bahariya and Abu Roash C (ARC) reservoirs, and, performed positively in short term testing. In the Lower Bahariya reservoir, the well flowed at a maximum rate of 2,187 barrels oil equivalent per day (boepd)

“The continued drilling success at both the ASD-1X and ASH-1 ST2 wells further underline the potential of the licence, both through the drilling of new wells and through workovers / recompletions,” Mccormack said in a note.

Mccormack highlighted that drilling continues at Abu Sennan, with the AJ-8 development well, and increased his core valuation (Net Asset Value) to 5.9p and the analyst’s risked exploration NAV moves up to 29.6p. Compared to a market price of 4.48p, the valuation sees significant upside.

This morning United reported that a development lease had bee issued for the ASD-1X discovery which means that production can now begin, with the initial gross rate seen at 1,295 bopd, which equates to 285 bopd net to United.

A separate programme to workover the ASH-1ST2 well has also boosted production numbers, adding just over 1,000 bopd gross or 220 net to United.

United highlighted the rapid pace of progress at Abu Sennan where the ASD-1X well was drilled as recently as April and is now producing.

“The speed at which the joint venture is developing Abu Sennan is demonstrative of the excitement we share for the long-term potential of the licence, which continues to deliver for the company,” said chief executive Brian Larkin. “We would also expect this result to add to the proven reserves on the licence.”

“In tandem with exploration success in Abu Sennan, the encouraging result from the ASH-1ST2 workover will provide a further boost to production, and will also help increase our understanding of the ASH Field.”