Energean has updated the company’s proposed sale of its portfolio in Egypt to an entity controlled by Carlyle International Energy Partners. The portfolio in Egypt include NEA and NI concessions both 100% owned by Energean and whilst operated through separate 50/50 JV companies they both fall under the overall management of Abu Qir Petroleum.

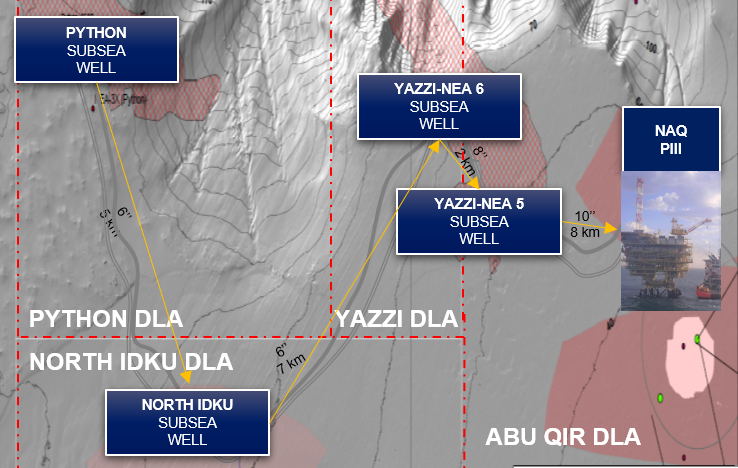

NEA contains two discovered and appraised gas fields (Yazzi and Python). NI – which is split into northern 21 and southern areas – contains four discovered gas fields, one of which is readied for development. Both areas contain additional mapped but undrilled prospects.

The Abu Qir concession is the oldest gas production area in the Mediterranean Sea, located in the shallow waters of Abu Qir Bay in the West Nile Delta of Egypt. It remains one of the largest gas producing hubs in Egypt, and comprises three fields (Abu Qir, North Abu Qir and West Abu Qir) and a network of six production platforms interconnected by pipelines. Energean holds 100% W.I. in the concession

Completion of the Transaction is conditional upon customary regulatory approval in Egypt together with antitrust approvals in Italy, Egypt and Common Market for Eastern and Southern Africa. The Transaction is subject to such conditions being satisfied by a longstop date of 20 March 2025 (or such other date as may be agreed by Energean and Carlyle).

As of the date of this announcement, certain regulatory approvals in Italy and Egypt have not yet been obtained by Carlyle (or waived) and the Company has no assurance that such conditions will be satisfied on or before 20 March 2025 in accordance with the terms of the binding Sale and Purchase Agreement (“SPA”) signed on 19 June 2024.

Additionally, as of the date of this announcement, the Company has not been able to reach agreement with Carlyle to extend the longstop date beyond 20 March 2025. Accordingly, there is a significant risk that the outstanding conditions precedent will not be satisfied (or waived) by the relevant long stop date and that, therefore, (absent an extension being agreed) the Transaction may be terminated in accordance with the provisions of the SPA.

Energean remains committed to closing the Transaction under the terms of the SPA and to maximising return for shareholders including via its ongoing dividend programme – with or without the disposal. Energean continues to focus on achieving its key business drivers: paying a reliable dividend, deleveraging, growth and our commitment to Net Zero.

“Although the necessary regulatory approvals have not yet been obtained by Carlyle, we remain committed to closing the Transaction. These are high-quality, diversified assets with significant growth potential and, if the Transaction does not close, we will assess all strategic options, focusing, as always, on the best interests of our shareholders keeping in mind the need for diversification, scale, dividend accretion and growth,” Mathios Rigas, Chief Executive of Energean, commented.