The back-to-back downturns that exploration and production companies (E&Ps) have faced during the past decade have accelerated the energy transition, adding to growing social and regulatory demands for greener energy solutions. This is putting the resilience of global upstream portfolios under pressure. Energy transition experts on Rystad Energy’s upstream team have now quantified the long-term risk of this change to oil prices and to the net present value (NPV) of global oil and gas portfolios.

In an analysis marathon that has generated a series of three commentaries and a report to its clients, Rystad Energy has assessed the way E&Ps are navigating the energy transition, based on energy diversification, portfolio resilience and decarbonization. While the full in-depth findings are not going to be made public outside our client portal, in this press release we are offering a glimpse of our portfolio resilience findings.

The downside risk that the energy transition can bring to oil prices is calculated to as much as $10 per barrel in the long term, meaning oil prices could end up $10 lower in the future than they otherwise would if the transition to cleaner energy speeds up.

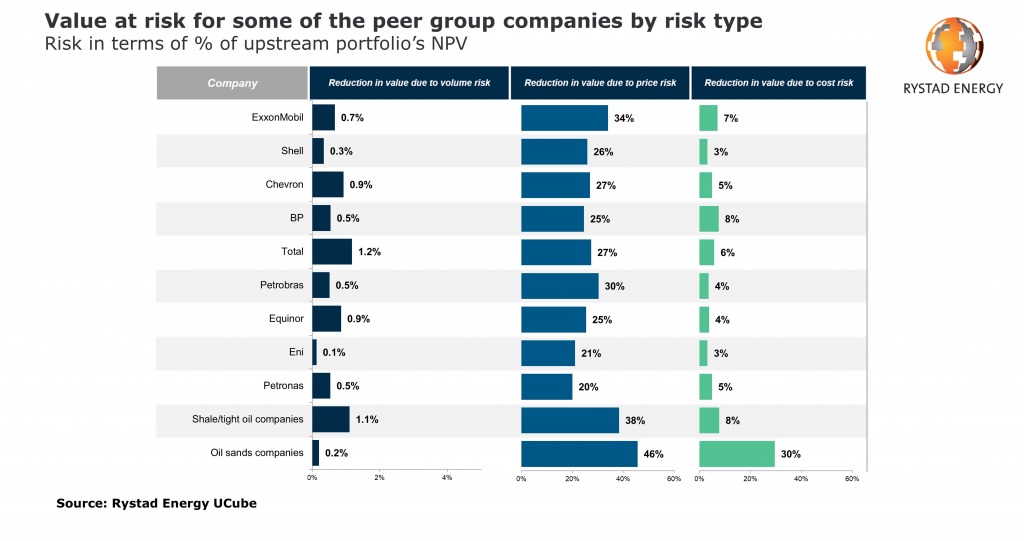

This oil price downside risk is by far the biggest factor in determining the resilience of global E&P upstream portfolios, along with the potential for rising costs for emitting carbon dioxide. Rystad Energy has studied the portfolio resilience of the top 25 non-national oil and gas companies and found big differences in how robust they are to the risks of lower commodity prices and increased CO2 taxes.

While the average portfolio value at risk due to volume (stranded assets) is normally very low, on average contributing less than 1% to the reduction in valuation, the value at risk due to price has the largest impact, contributing to an average reduction of 30%. The value at risk due to cost (CO2 tax) is low for most companies, mostly below 10%. As a result, up to 30-40% of the net present value of an average portfolio is at risk as a result of the energy transition.

“The energy transition risks vary depending on each individual E&P company. Equinor, for example, whose risk is relatively smaller compared to other peers, could see the value of its upstream portfolio reduced by $21.8 billion, almost 30%, with an oil price decrease of $10 per barrel and a CO2 tax,“ says Espen Erlingsen, head of upstream research at Rystad Energy.

There is a large span for the price risk among the different companies. For some companies the value is reduced by around 50% when the long-term oil price falls by $10 per barrel. Companies with a large price risk are typically oil sands companies or shale/tight oil companies.

The reason these companies are most affected is that their portfolios normally include assets with high breakeven prices. On the opposite side of the scale, most majors have a reduction in value due to price risk in the range of 20-25%. Mature assets and high gas content help reduce the risk for these companies.

When it comes CO2-related costs, some companies stand out with a high value. Oil sands companies have the highest cost risk, causing the value of their portfolio to decrease by around 30% in an example of a CO2 tax of $100 per tonne.

Eni, Shell, Equinor and Total all have very similar scores with modest value at risk. ExxonMobil has a higher revenue risk than its peers, primarily because its portfolio includes several large, capital-intensive projects such as Permian tight oil and its Guyana assets.

Producers with less profitable projects, like oil sands and shale/tight oil, are typically punished both along the revenue and cost dimensions. The key reason for this is that the profitability of these projects is very sensitive to price and cost changes. In addition, oil sands projects normally have a high CO2 emission, which increases their cost risk.

For more analysis, insights and reports, clients and non-clients can apply for access to Rystad Energy’s Free Solutions and get a taste of our data and analytics universe.