Eni’s Board of Directors, chaired by Lucia Calvosa, has approved the unaudited consolidated results for the second quarter and first half 2022.

“Amid uncertainty and volatility in markets we moved fast to secure new energy supplies. After new gas agreements with our partners in Algeria, Congo and Egypt earlier in the year, in June Eni entered the North Field East venture in Qatar, part of the world’s largest LNG project. In East Africa, gas production started from the Eni’s operated Coral South FLNG, the first development of Mozambique’s large potential. In Italy, we have invested to rebuild gas storage ahead of winter and our refineries raised their processing rates significantly to ensure oil products are available for the market.

While maximizing our efforts on energy security, we continue to execute our decarbonisation strategy. In Plenitude the build-up of our renewable generation capacity progresses towards over 2 GW by year end; given market condition, the IPO has been postponed but remains our intention. Our Sustainable Mobility business will enhance the value of our biorefineries, vertically integrating with our innovative agri-business and portfolio of decarbonized solutions. Development of breakthrough technology is at our core and the construction of the magnetic fusion demonstration plant is well underway, aiming at producing net energy by 2025.

Financial delivery is underpinned by our continued efforts on efficiency and cost control. The Group adjusted EBIT for the quarter was €5.8 billion driven by E&P and R&M and adjusted net income was €3.8 billion. With an adjusted cash flow of €10.8 billion we are able to cover our organic capex of €3.4 billion, and our distribution policy for the full year. Based on these robust results and our updated market outlook, we are enhancing shareholders’ distribution by raising the 2022 share buyback to €2.4 billion,” Eni CEO Claudio Descalzi said.

Financial highlights of the second quarter of 2022

- Group adjusted EBIT in the second quarter 2022 was €5.84 billion, up 13% q-o-q and more than doubling y-o-y driven by the favorable commodity price environment, strong refining margins and the focus on cost management and business operating performance.

- E&P delivered €4.87 billion of adjusted EBIT in the second quarter 2022, up by 11% q-o-q and more than doubling y-o-y, fully capturing the improved scenario. Production in the quarter was 1.58 million boe/d down 1% y-o-y and slightly decreasing from the previous quarter due to primarily force majeure events in Libya, Nigeria and Kazakhstan.

- After a strong first quarter thanks to the LNG business and portfolio flexibility, GGP was at break-even in the second quarter, reflecting normal seasonal patterns in profitability.

- R&M performed very well, achieving adjusted EBIT of €979 million driven by strong refining margins but outperforming thanks to higher utilization, output optimization, efficiency measures to address utilities costs, and despite the higher expenses required to replace Russian crudes in our refinery slate.

- Despite the rising prices of oil-based feedstock and higher utilities costs driven by natural gas prices, the chemicals business managed by Versalis reported a positive result of €125 million in the second quarter, reversing the €115 million loss of the first quarter 2022, thanks to efficiency initiatives and the optimization of production volumes.

- Plenitude (including the retail, renewables & electric mobility businesses) reported second quarter adjusted EBIT of €112 million (+58% y-o-y) driven by a ramp-up in produced volumes of renewable electricity, higher wholesale prices and effective customer base management, confirming the resilience of our integrated business model.

The legacy business of natural gas-fired power and steam production reported a lower adjusted EBIT compared to the second quarter 2021 (down 24%) due to a less favorable scenario, partly offset by higher revenues on services (capacity market and dispatching). At the end of July, the divestment of a 49% stake of the business to a minority shareholder was closed with net proceeds to Eni of €0.55 billion. - Group adjusted net profit in the second quarter was €3.81 billion (€7.08 billion in the first half 2022), an improvement of €2.9 billion y-o-y (€5.9 billion increase in the first half) reflecting this strong EBIT result and further helped by the performance of our equity-accounted entities and a lower tax rate (quarter on quarter tax rate was essentially in line). The year over year reduction in the tax rate mainly relates to an improvement in the geographical mix of pre-tax profits and scenario-related effects in E&P, as well as in Italy better profitability in the lower taxed downstream, and also for the first half midstream.

- In the second quarter 2022, the Group adjusted cash flow before working capital at replacement cost was €5.19 billion. In the first half of 2022, it reached €10.80 billion, more than doubling y-o-y. After funding first half organic capex of €3.44 billion, +18% y-o-y due to a stronger US dollar and planned post lockdown activity, and working capital needs, the Group realised an organic FCF of about €5 billion.

- Dividend distribution: in May Eni paid its final 2021 dividend of €0.43 per share, amounting to €1.52 billion. The first quarterly instalment of 2022 dividend of €0.22 per share will be paid in September 2022.

- Buy-back program: based on the authorization granted by the Shareholders Meeting on May 11, 2022, the Board of Directors approved a new share purchase program to be executed through April 2023, providing for a minimum outlay of €1.1 billion and a possible upside up to €2.5 billion depending on trends in the scenario.

- The 2022 buy-back program commenced at the end of May and through July 22, 2022, 29.4 million shares have been purchased for a cash outlay of €355 million. Following the Board’s revised outlook for the Brent crude oil prices, now expected at 105 $/bbl average for the full year 2022 and reflecting the effects of the stronger US dollar plus broader strength in the Group’s cash flows the buy-back commitment has been raised by €1.3 billion to €2.4 billion.

- Net borrowing ex IFRS 16 as of June 30, 2022, was €7.9 billion down by €1.1 billion compared to December 31, 2021, and the Group leverage stood at 0.15 versus 0.20 as of December 31, 2021.

Strengthening the natural gas portfolio

- Secured alternative sources of gas supply to Italy and Europe by leveraging Eni’s strong strategic alliances, accelerating a key component of Eni’s long-term strategy, where equity gas will progressively play a major role.

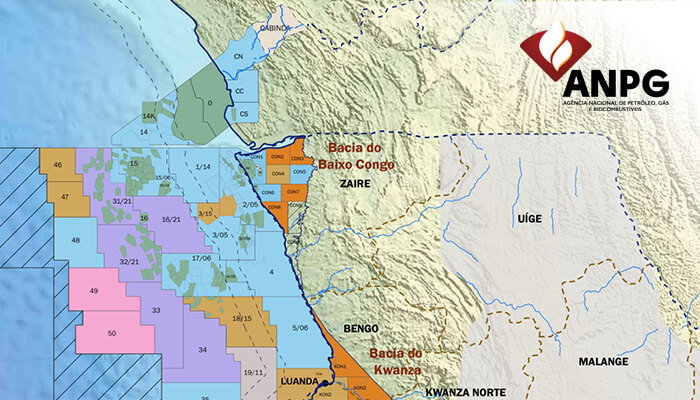

- New supply agreements with Algeria, Egypt and Congo were signed and additional opportunities may also arise in other countries in our global gas portfolio: including Libya, Angola, Mozambique, Indonesia and Italy.

- The initiatives are designed to deliver up to an equivalent of 100% of Russia’s 20 billion cubic meters of annual gas import to the Italian market secured by 2025.

- In June, Eni entered in the Qatar’s North Field East project, the world’s largest LNG project, expanding its presence in the Middle East and gaining access to a leading LNG producer country.

Exploration & Production

- In the first half of 2022 added about 300 million boe of new resources to reserve base. Main discoveries were made close to existing assets and facilities as part of our fast-track development model: in Algeria, near to the Bir Rebaa North field complex and in the Berkine North basin, in Angola Block 15/06 in particular with the incremental result of the appraisal well Ndungu-2, and in Abu Dhabi with the well XF-002. In addition, findings in the Meleiha concessions, in Egypt’s Western Desert, have already been tied to existing production facilities.

- Appraisal of the Baleine discovery with the well Baleine East-1X in Block CI-802, increasing the potential mineral resources of the area to around 2.5 bbbl and 3.3 Tcf of associated gas in place. The well has been successfully tested, allowing the optimization of ongoing and future development plans.

- Start-up in Angola: the Ndungu field started production by hooking it up to the Ngoma Floating Production Storage and Offloading (FPSO) located in the operated Block 15/06.

- In July, reached the final investment decision (FID) by New Gas Consortium (Eni 25.6%, operator) for the development of the Quiluma and Maboqueiro fields in Angola. The project, the first non-associated gas development in the country, is planned to start-up in 2026 with an expected production plateau at 330 mmcf/d.

- In July, signed with Sonatrach, Oxy and TotalEnergies a new Production Sharing Contract (PSC) for blocks 404 and 208 located in the Berkine basin in Algeria. This will allow to boost investments, increasing the fields’ reserves while enabling future valorization of associated gas, available for export, further contributing to the diversification of gas supplies to Europe.

- In July, completed the construction of an oilseed collection and pressing plant (agri-hub) in Makueni, Kenya and started the production of the first vegetable oil for bio-refineries. The first agri-hub will have an installed capacity of 15,000 tons with an expected production of 2,500 tons in 2022.

- In June, started the commissioning of the Coral Sul Floating Liquefied Natural Gas (FLNG) vessel, offshore Mozambique, by safely achieving the introduction of natural gas from the Coral South reservoir into the treatment plant. First LNG cargo is scheduled for the second half of 2022.

- In May, Solenova, a venture equally owned by Eni and the Angolan national oil company Sonangol, commenced construction of the Country’s first photovoltaic project in Caraculo, with a targeted generation capacity of 50 MW, being the first phase of 25 MW.

- In May, signed with Sonatrach a MoU to evaluate viability of a green hydrogen project at the Bir Rebaa North concession, to enable decarbonizing the operations of the gas complex.

Refining & Marketing and Chemicals

- In July, Versalis, Eni’s chemical company, agreed terms with Forever Plast to acquire a license to build a mechanical recycling unit for post-consumer plastics from waste, capable of manufacturing 50 ktonnes/year of recycled polymer compounds. The expected start-up is in 2024 and the plant will be located in Porto Marghera contributing to the progressive transformation of industrial hub.

- In June, Versalis started recycling plastics from used industrial packaging. The project has successfully tested sacks made at 50% with recycled materials for the packaging and shipping of polyethylene products. The new product will be deployed at all Versalis industrial hubs.

- In June, the first Eni-branded hydrogen refuelling station was inaugurated in Venice Mestre. The station is equipped with two dispensing points with a capacity of over 100 kg/day, where vehicles or buses could be filled in about 5 minutes.

- In May, Enjoy, Eni’s car sharing service, introduced in the City of Turin the first 100 new XEV YOYO city cars among its fleet. The XEV YOYO is a fully electric city car designed for battery swapping, which can be done in just a few minutes.

- In April, signed a cooperation agreement with Iveco to develop a sustainable mobility platform for commercial fleets by offering innovative vehicles powered by biofuels and other sustainable energy vectors, as well as the related supply infrastructure.

- In April, signed an agreement with the Chinese Shandong Eco Chemical Co. Ltd. to license Versalis proprietary continuous mass technology to manufacture styrenic polymers with a low-carbon footprint.

Plenitude and Power

- In July, Plenitude and HitecVision reached a deal to boost the joint venture Vårgrønn in Norway to become a material full cycle offshore wind player. Plenitude will contribute to the venture a 20% interest in the Dogger Bank offshore wind project in the UK, with HitecVision increasing its ownership share from 30.4% to 35% through a cash injection.

- In May, signed an agreement with Ansaldo Energia to evaluate technologies for storing electricity, as an alternative to electrochemical batteries. Those technologies will be implemented in synergy at Eni’s industrial hubs in Italy, leveraging existing power generation and consumption systems.

- In April, Plenitude announced an investment in EnerOcean S.L., a Spanish developer of the W2Power technology for floating wind power. The agreement is structured as a long-term partnership focused on the deployment of the W2Power technology as a lead solution for floating wind power developments worldwide. Plenitude will contribute with capital and expertise to the EnerOcean development program and initially retain a 25% equity share in EnerOcean S.L., which will continue to operate independently.

- In April, GreenIT, a joint venture between Plenitude and the Italian agency CDP Equity, signed an agreement with the equity fund Copenhagen Infrastructure Partners (CIP) to build and operate two floating offshore wind farms in Sicily and Sardinia, with an expected total capacity of approximately 750 MW.

Decarbonization & Sustainability

- In July, signed a new €6 billion five-year Sustainability-Linked revolving credit line, linked to two targets of Eni “Sustainability-Linked Financing Framework” updated in May 2022. The new facility will increase the Group financial flexibility, further strengthening its solid liquidity position, and is consistent with Eni’s goal of fully integrating its financing with its decarbonization strategy.

- In July, Eni was awarded the Energy Intelligence’s Energy Innovation Award, in recognition of its preparedness for the energy transition and acceleration in low-carbon investments. Eni was ranked strongly in terms of emissions reduction targets, portfolio resilience and transformation of its business model.

- In June, Eni strengthened the collaboration with the United Nations Industrial Development Organization (UNIDO) to pursue joint initiatives in the fields of green hydrogen, renewables, energy efficiency, technical education, youth employment and the agricultural value chain, particularly in Africa, as part of Eni’s commitment to develop the UN’s SDG.

- In June, an Eni-led sustainable initiative was launched in the Ivory Coast involving distribution of improved cookstoves to vulnerable households. It is estimated that more than three hundred thousand people from the Region of Gbêkê, will benefit from the projects, which aims at delivering one hundred thousand cookstoves over a period of 6 years.

The Company is issuing the following updated operational and financial guidance for the FY ’22 based on information available to date, management’s judgement of potential risks and uncertainties and assuming no additional material disruptions to Russian gas flow:

- E&P: Hydrocarbon production is expected at 1.67 million boe/d, in line with previous guidance of 1.7 million boe/d adjusted for force majeure effects and at the Company’s updated price deck of 105 $/bbl.

- E&P: Around 700 million boe of new exploration resources are expected to be discovered in 2022, up from 600 million boe previously guided.

- GGP: Reaffirmed guidance of adjusted EBIT of at least €1.2 billion. Second half EBIT is expected to be concentrated in the fourth quarter.

- Plenitude & Power: Reaffirmed Plenitude’s EBITDA guidance, expected to be higher than €0.6 billion. We also confirm our guidance of more than 2 GW of installed renewable generation capacity by year-end.

- Downstream: Adjusted EBIT (R&M with ADNOC pro-forma and Versalis) is raised to the range of €1.8- 2 billion vs previous guidance of just positive territory, assuming a SERM of 6 $/bbl in the second half of 2022.

- Our main price sensitivities foresee a variation of €130 million in free cash flow for each one-dollar change in the price of Brent crude oil and around €700 million for a 5 USD/cent movement in the USD/EUR cross rate vs our new assumption of 1.08 USD/EUR for 2022 and considering 105 $/bbl Brent price.

- Adjusted cash flow before working capital at replacement cost is now expected to be €20 billion at 105 $/bbl, vs our previous guidance of €16 billion at 90 $/bbl.

- Organic capex is seen at €8.3 billion, in line with previous guidance of €7.7 billion adjusting for EUR/USD exchange rate updated assumption.

- Cash neutrality on a normalized basis is expected at a Brent price of around 40 $/bbl, reflecting current strong underlying performance and cost management across our businesses.

- 2022 leverage ante IFRS 16 is seen at 0.13 at our price assumption.