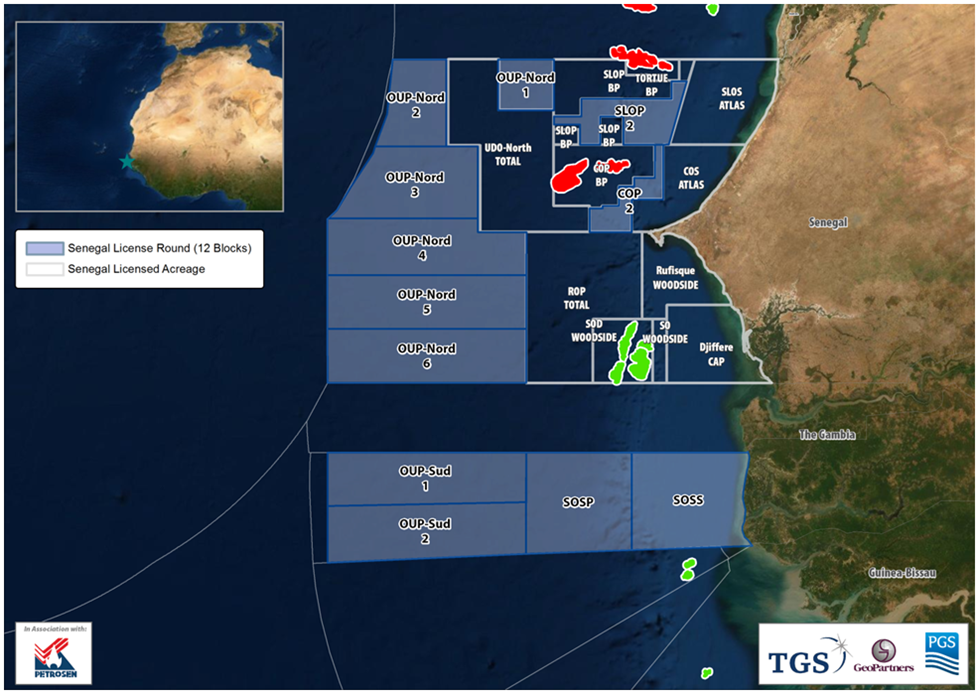

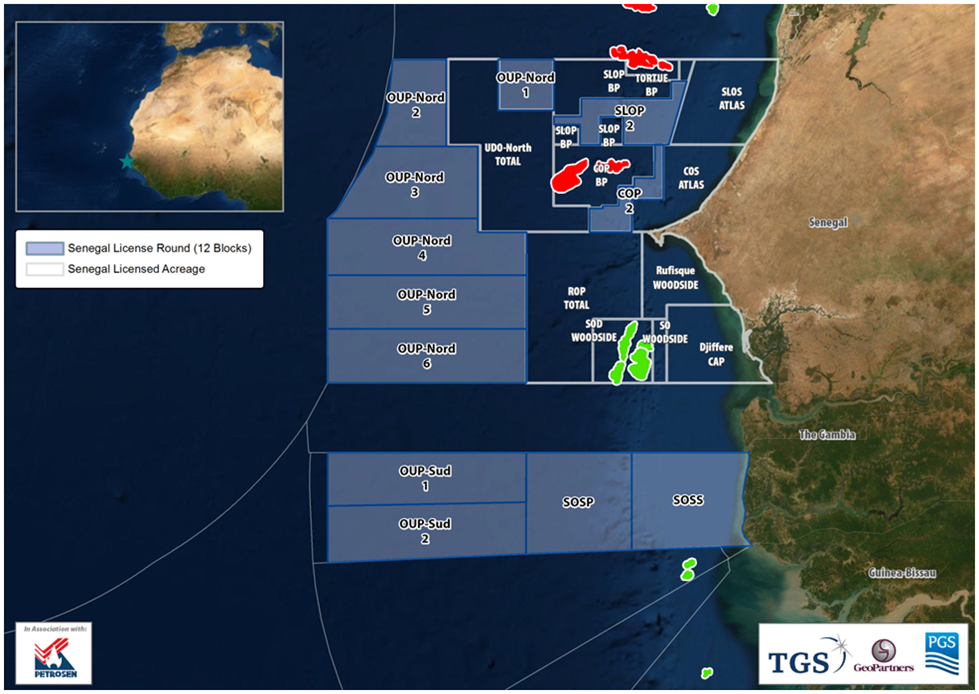

FAR Limited has announced update on The Remus conditional non-binding indicative proposal of a potential offer from Remus Horizons PCC Limited to acquire 100% of the shares in FAR at 2.1c cash per share. The company said that the proposed sale by FAR of its interest in the RSSD project to Woodside Energy (Senegal) BV is subjected to FAR shareholder approval and certain other conditions.

FAR further cautioned that the Remus Proposal is not a legally binding offer, and there is no certainty that the Remus Proposal will necessarily eventuate pointing that the Remus Proposal terms are uncertain at this stage. The company stated that care needs to be used in assessing the Remus Proposal at this time.

FAR has obtained further information from Remus in relation to the Remus Proposal as follows:

· Remus is presently finalising the funding arrangements in advance of making the proposed offer.

· The only internal and regulatory approval required to proceed with the offer is the final approval of the Remus Board and final review and confirmation of documentation.

· Remus is presently satisfied that it will not need to undertake any further due diligence on FAR

.· FIRB approval is not required and any offer made will not be conditional on FIRB approval.

· Any proposed offer is expected to be subject to a requirement that Remus achieves a controlling interest in FAR together with other customary conditions.

FAR has determined to further postpone the shareholder meeting to consider approving the Woodside Sale believing that this will enable further time for FAR shareholders to see if the Remus Proposal eventuates.

FAR is continuing to advance negotiations with Woodside in relation to the form of the Woodside Sale proposed contractual documentation, following Woodside’s pre-emptive rights exercise. FAR advises that it is in the process of paying the RSSD project November 2020 cash call (US$8.96 million plus interest) and the December 2020 cash call (US$6.48 million plus interest). Following these payments, FAR’s cash position is approximately US$10.3 million.