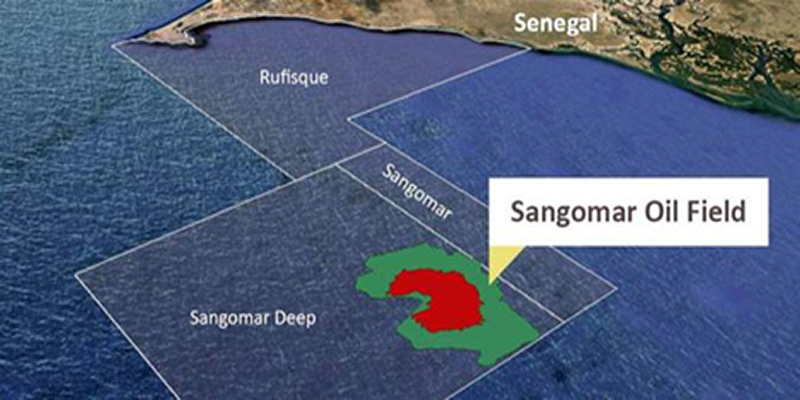

FAR Ltd has provided an update on the Woodside Contingent Payment associated with the sale of FAR’s entire interest in the Senegal RSSD Project (the ‘Sangomar Field’) to Woodside Energy in 2021.

Highlights

The Woodside Contingent Payment entitlements are associated with the sale of FAR’s entire interest in the Senegal RSSD Project to Woodside.

Woodside, as operator of the Sangomar Field, recently updated the market as to the project’s progress. In a release to the market dated 30 August 2022 Woodside noted that the Sangomar Field Development Phase 1 will be comprised of a stand-alone Floating Production Storage and Offtake (FPSO), 23 wells and supporting sub-sea infrastructure. Woodside indicated that the Sangomar Field Development was 63% complete as at 30 June 2022 and first production was anticipated in 2H 2023.

Based on the recent statements by the operator and current oil prices, the Board of FAR expects that the full $55 million will be received prior to the transaction long stop date in 2027 with annual payments anticipated to commence in 2024.

The Contingent Payment comprises 45% of entitlement barrels (being the share of oil relating to the Group’s previously held 13.67% of the Sangomar Field) sold over the previous calendar year, multiplied by the excess (if any) of the crude oil price per barrel and US$58 per barrel (capped at US$70 per barrel).

“With the Sangomar Field progressing towards first production in the second half of 2023 the net present value of the Woodside Contingent Payment continues to increase delivering shareholder value for FAR. The Board will consider opportunities for the monetisation of this asset nearer the commencement of production from the field, in line with our strategy to explore every opportunity to seek to reflect the underlying asset value in the FAR share price. FAR continues to evaluate broader opportunities across the energy sector and intends to balance any initiatives against the underlying value of our capital position,” Commenting on the update, FAR Chairman Patrick O’Connor, said.

Oilfieldafricareview offers you reviews and news about the oil industry.

Get updates lastest happening in your industry.

©2025 Copyright - Oilfieldafricareview.com

Please wait....

Thank you for subscribing...