2020 was a year that hurt demand for all fuels, and natural gas was no exception. As the year concluded, Rystad Energy has analyzed all of the year’s gas-related activity and produced a thorough report, offering some easily digestible key figures and some long-term outlook on the future of the industry. Here is a selection of our high-level key findings:

2020 estimates

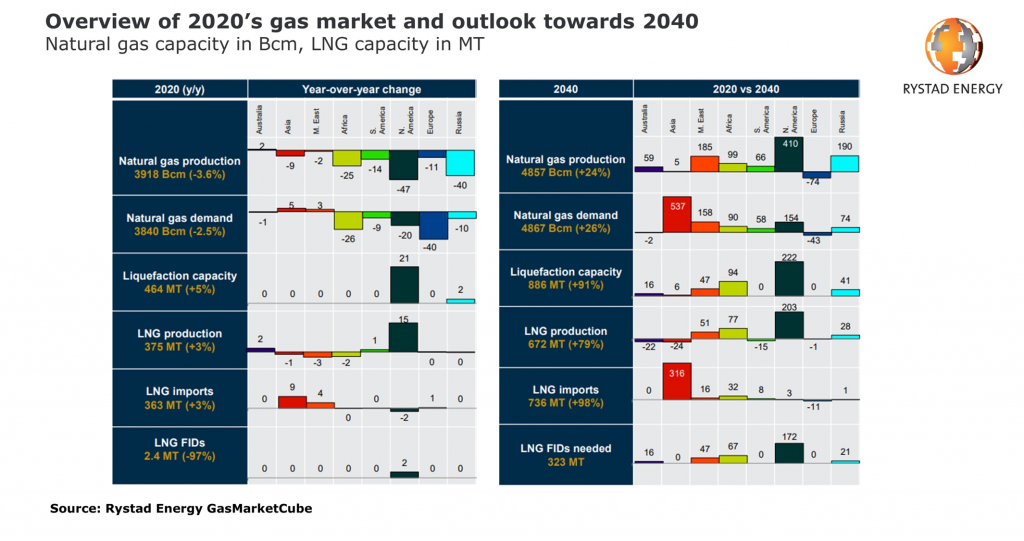

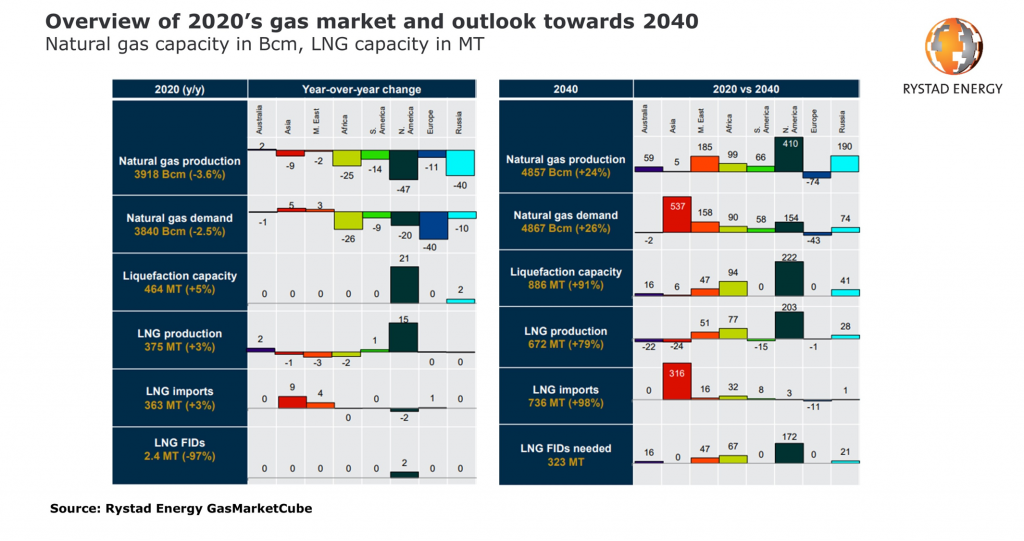

- Global natural gas production is estimated to have dropped by 3.6% in 2020 as low oil and gas prices led to lower exploration and production. Rystad Energy estimates the total produced figure at around 3,918 billion cubic meters (Bcm) for the year.

- North America is the gas-producing region that the pandemic impacted the most, with production estimated to have dropped by 47 Bcm from 2019 to 1,103 Bcm in 2020.

- Despite the lockdowns, gas demand was shielded by low prices which made gas competitive in the power sector, preventing a larger drop. Demand for gas therefore did not fall as much as for oil, recording only a 2.5% decline to an estimated 3,840 Bcm.

- While demand in Asia remained relatively strong, European consumption was more severely affected, dropping around 7% year-on-year, or by around 40 Bcm, followed by Africa with 26 Bcm.

- Liquefaction capacity grew 5% in 2020, reaching 464 million tonnes per annum (tpa), as new plants started operations, mainly in the US. US capacity is estimated to have reached 71 million tpa (+42%) with the commissioning of trains at Cameron, Corpus Christi, Elba Island and Freeport. Russian capacity reached 29 million tpa.

- Despite lockdowns, global LNG imports grew 3% to 363 million tonnes (Mt) in 2020. Asian LNG demand grew 4% year-on-year, mainly driven by China. Other buyers in the region also took advantage of low prices to substitute coal in power. European imports remained strong during the first half of the year as buyers nominated less Russian piped gas.

Outlook towards 2040

- Global natural gas production is expected to grow by 24% to 4,857 Bcm in 2040, with most additions coming from North America (+410 Bcm versus 2020 production), followed by Russia (+190 Bcm) and the Middle East (+185 Bcm).

- US natural gas production could reach 1,194 Bcm in 2040, driven by output from Marcellus and the Permian. Shale production is however at risk due to the new government. Russia, Iran and Qatar can contribute with substantial output. Europe will be the only region to decline (-74 Bcm) due to lower production from Norway and the Netherlands.

- Global natural gas demand is set to increase through 2040 by 26% to a monstrous 4,867 Bcm, with Asian demand being by far the largest addition (+537 Bcm versus 2020), as gas is needed to power the region despite growth in renewables.

- Environmental policies in Europe and growth in renewables will lead to a decline in demand from 2024, with the total demand losses on the continent to reach 43 Bcm in 2040, compared to 2020 demand. US demand is also at risk due to new environmental policies expected to be announced by the Biden administration.

- Global liquefaction capacity is expected to nearly double by 2040, reaching a total of 886 million tpa, a 91% increase from 2020. With gas production growing the most in the US, its liquefaction capacity can continue to increase to 220 million tpa in 2040. The US is expected to be followed by Qatar with 124 million tpa, Australia with 96 million tpa and Russia with 70 million tpa.

- The world’s LNG production is expected to reach 672 Mt in 2040, a 79% growth from 2020 numbers. A spectacular rise in LNG production in the US is expected (+203 Mt for the whole of North America) as gas production grows but domestic demand growth is limited. Qatar will continue to be a key LNG player driving Middle Eastern exports, while Mozambique will help put Africa back on the LNG map. However, more LNG production is needed to keep up with demand.

- Far exceeding production, the need for LNG imports is expected to grow to 736 Mt in 2040. Due to limited domestic production, Asia will absorb most of the growing LNG supplies to fuel the increasing power demand. China, India, Pakistan, Thailand and Bangladesh will also drive the growth. European imports will drop as pipeline imports are accessible.