The Ghana energy minister Matthew Prempeh recently in a 10-page power-point presentation and a rambling thesis on ‘global energy transition’ presented to the country’s parliament seeks for parliamentary approval to borrow the sum of $1.6bn to buy back stakes in two offshore oil licences not yet in development.

The minister expressed his initiative for Ghana to borrow $1.6bn for onward lending – on commercial terms – to its national oil company, the Ghana National Petroleum Corporation (GNPC) so that it can buy higher stakes in two oil blocks operated by two Norwegian companies – Aker Energy and AGM.

In recent times, the Ghanaian government has shown intent to borrow $1.3bn to buy back stakes in the blocks, and another $350m to cover its share of development costs.

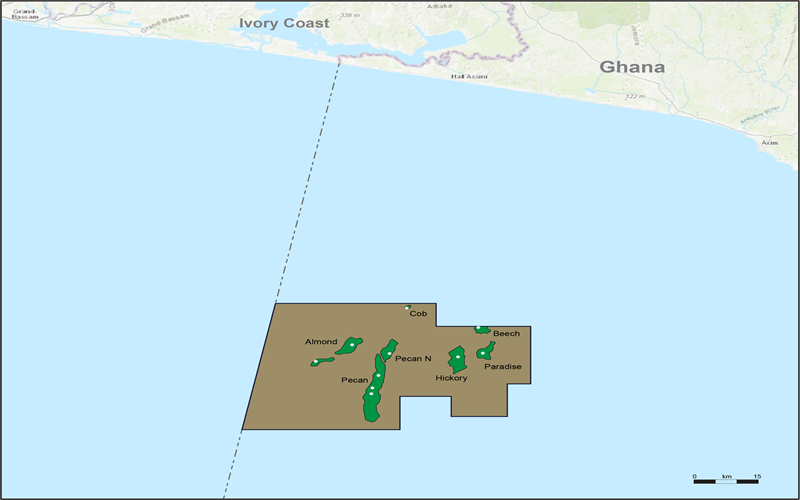

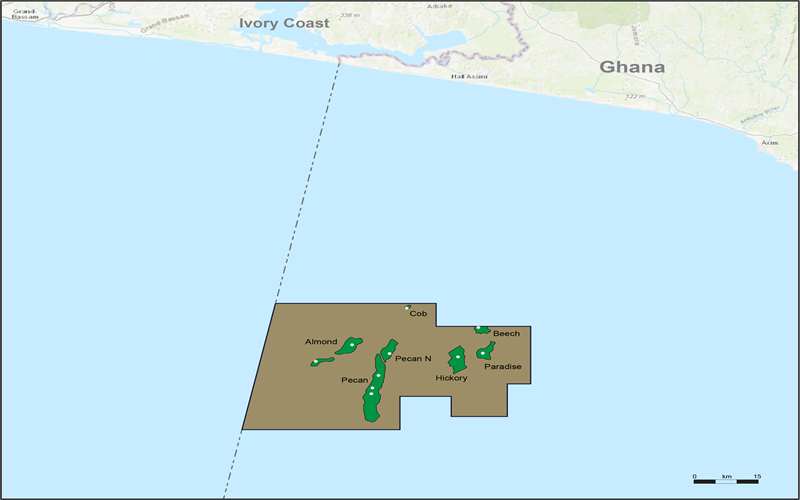

Prempeh said the government planned to acquire a 37% direct and indirect interest in the Deepwater Tano/Cape Three Points (DWT/CTP) block from Aker Energy; and a 70% interest in the adjacent South Deepwater Tano (SDWT) block from AGM Petroleum.

Aker and AGM are both controlled by Norwegian shipping billionaire Kjell Inge Røkke, who initially tried to acquire the acreage just before the 2008 elections in Ghana. To justify why Ghana should take such a financial risk, a strategy paper was circulated at cabinet in Accra excoriating attempts by rich countries to persuade developing economies to leave their hydrocarbon assets ‘stranded’.

Prempeh said discoveries already made in the two blocks could add 200,000 barrels per day to Ghana’s capacity within four to five years, more than doubling output. He said “five agencies” had valued the two licences at between $2bn and $2.55bn.

Two agencies are parties to the proposed deal (Aker and GNPC); two are consultancies in Norway; and the fifth, Lambert Energy, established a reputation from brokering deals in Russia.

If the government is acting to protect the national interest, why then does Aker want to sell such an apparently lucrative asset? Aker Energy is a 50:50 joint venture between Aker, a $7.5bn Norwegian oil company, and a family asset holding company, TRG.

Two-thirds of Aker is in fact owned by the same TRG, which in turn is owned by Rokke and his wife. In short, the Rokke family owns more than 80% of Aker Energy.

AGM Petroleum is a somewhat simpler affair. In 2018, through Petrica Holdings, TRG acquired all the shares of AGM from Gibraltar-based investors.

Prempeh’s memorandum was written on 30 July. It reached the speaker of parliament on 2 August and he referred it to a joint committee on finance and energy. The committee met the following day, read essays on the energy transition, and after two hours of deliberations, decided that the most important change to be made was to reduce the spending ceiling for the GNPC from $1.3bn to $1.1bn.

The minister’s view – on how the energy transition has dampened investor sentiment in the fossil fuel industry thereby forcing national oil companies (NOCs) to become operators themselves – was fully adopted. The $350m investment contribution to the development of the Pecan field – until it produces oil, hopefully in 2024 – was left untouched.

On 5 August, a thin 7-point report was signed off by the committee to enable the government to borrow $1.45bn for its new adventures in the country’s fraught oil story. Parliamentarians then took off for their seasonal break until 19 October.

And that is how a struggling West African country signed off a windfall in hundreds of millions of dollars to one of the richest men, from one of the richest countries in the world.