According to RenewableUK the total pipeline of floating offshore wind projects has grown significantly in the last 12 months in terms of capacity from 185 gigawatts a year ago to 244GW now – a 32% increase.

The number of projects has increased globally during that time from 230 to 285. The pipeline includes projects at any stage: fully operational, under construction, approved, in the planning system awaiting a decision or at an early stage of development.

The EnergyPulse Insights report was compiled by RenewableUK’s data analysts to coincide with the opening of our 2-day Floating Offshore Wind 2023 conference and exhibition in Aberdeen.

So far, 227 megawatts of floating wind are fully operational across 14 projects in 7 countries. Norway has the most with 94MW across 3 projects. The UK is second with 80MW (2 projects), Portugal has 25MW (1 project) and China is fourth with 19MW across 3 projects. Japan has 5MW (2 projects), Spain 2.225MW (2 projects) and France 2MW (1 project).

Globally, 46MW are under construction (3 projects), 576MW are consented or in the pre-construction phase (11 projects), 68GW are in the planning system or have a lease agreement (80 projects), and 175GW are in early development or applying for a lease (177 projects).

Nearly two-thirds of floating wind capacity announced so far worldwide are being developed in European waters (160GW), 14% is in the UK (35GW – of which 29GW is in Scottish waters). Outside Europe, projects are being developed mainly off the west coast of the USA, the southeast coast of Australia and South Korea.

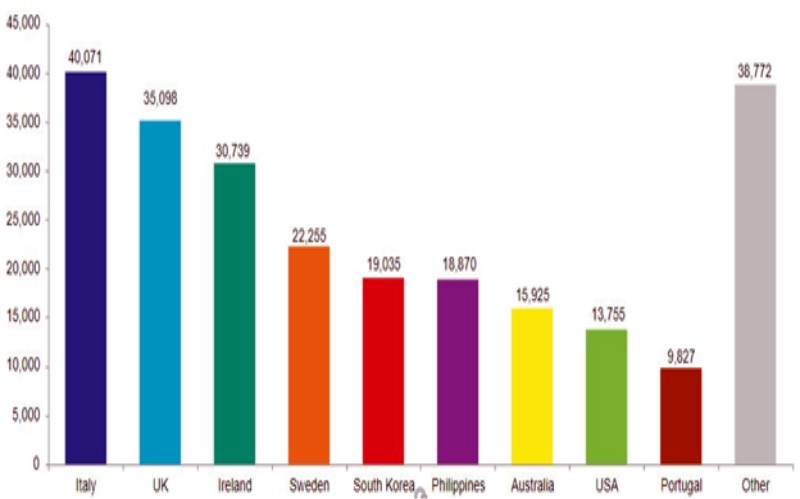

Although Italy has the largest project pipeline (40,071MW), nearly all its 47 projects are at an early stage of development, with only one (90MW) submitted into the planning system so far.

Floating Offshore Wind Total Portfolio By Country (MW)

The report also shows that demand for floating foundations is expected to ramp up fast, with the potential for 472 in the UK by the end of 2032. There could be 1,369 floating foundations in Europe and 1,924 for projects globally by the end of 2032.

RenewableUK predicts that floating wind will represent well over half of the UK’s offshore wind generation by 2050, generating around £43.6bn in economic value and more than 29,000 jobs. It will also play a critical role in regenerating our coastal communities; with £4bn required to transform up to eleven ports across the UK into industrial hubs for mass roll-out of floating wind by the turn of the decade. There is up to £3.6bn in development funds ready to be released across 24GW of floating capacity with leasing secured in UK waters.

RenewableUK believes that the Government’s target of reaching 5GW of floating wind in UK waters by 2030 remains achievable, but the next CfD auction and future rounds must be underpinned by sustainable parameters in order to maximise deployment, drive down costs and incentivise investment in domestic supply chains. This year’s Contracts for Difference (CfD) auction failed to secure any new floating wind capacity, despite 250MW of floating wind capacity being shovel-ready.

RenewableUK’s Chief Executive Dan McGrail, Co-Chair the Floating Wind Taskforce said:

“This report shows that although the UK is a world leader in floating wind, other countries are eyeing the massive economic opportunity offered by this innovative technology and are determined to get a slice of the action. The international competition for investment is intensifying rapidly.

“We urgently need a step-change from our partners in Government to ensure that this cutting-edge industry can attract billions in investment to boost deployment and build up new supply chains, rather than focussing solely on a race to the bottom on prices.

“To ensure that the UK seizes the industrial benefits of developing state-of-the-art technology and revitalising ports around the country, we need to see sustainable prices to enable stepping-stone projects to go ahead in a successful auction next year, and every year going forward. Leveraging these projects will enable us to replicate the cost reductions we’ve seen in fixed-foundation offshore wind, as well as catalysing supply chain development. We’re determined to make the 2020s a decade of acceleration for floating wind”.