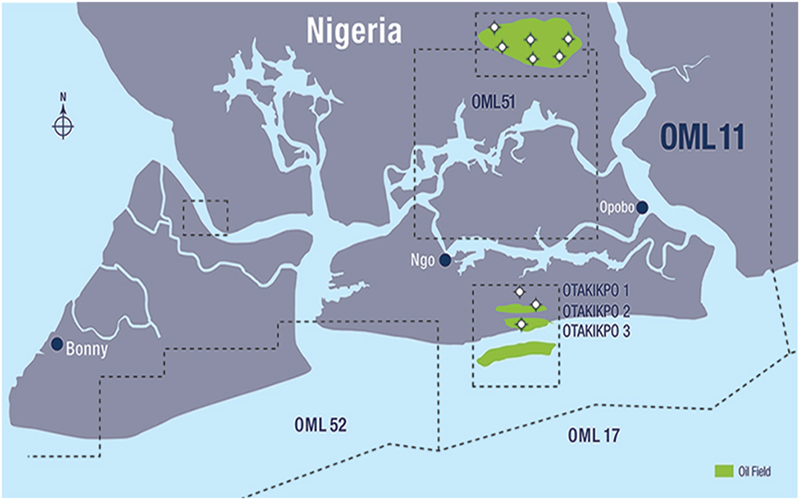

Barely a year after The Shell Petroleum Development Company of Nigeria Limited (SPDC), has completed the sale of its 30% interest in Oil Mining Lease (OML) 17 in the Eastern Niger Delta, and associated infrastructure, to TNOG Oil and Gas Limited, a related company of Heirs Holdings Limited and Transnational Corporation of Nigeria Plc (Transcorp), the company has launched a tender for work on the Elelenwa multi-phase pump gathering station, on OML 17 in Nigeria.

Heirs Holdings Oil & Gas said it was seeking interested and pre-qualified contractors for the work. The contractor will carry out the work under an engineering, procurement, installation and commissioning (EPIC) contract. The deadline to apply is January 21.

The scope covers work through to start up of a pump gathering station for well fluids from the Elelenwa West manifold and flow to Agbada-1 flow station for processing. The Agbada field is in the middle of the licence, while Elelenwa is in the south, close to Port Harcourt.

Scope includes a mini front-end engineering and design (FEED), followed by a detailed engineering design. Work will also include the provision of a schedule, site surveys and power generation. The supplier will also provide two years of operational spares, deliver the pump and other facilities to site, carry out performance testing and finally handover.

The company requires interested bidders to be pre-qualified in the NipeX joint qualification system database. They must also submit details on how they will comply with local content requirements. Bids must include commercial and technical tenders at the same time.

Heirs Holdings’ purchase from the three IOCS in early 2021 included Schlumberger as a technical partner, while Shell’s trading arm is an offtaker. Financing involved United Capital, Afreximbank, ABSA, Africa Finance Corp. (AFC), Union Bank of Nigeria, Hybrid Capital and Amundi. Standard Chartered acted as global co-ordinater.

OML 17 can currently produce 30,000 barrels of oil equivalent per day. It has 2P reserves of 1.2 billion boe, with another 1bn boe of exploration potential. The company has said infrastructure in the area could allow production of 200,000 bpd of oil and 300 million cubic feet per day of gas. Heirs Holdings has plans to cut flaring and increase power generation. The company has said OML 17 will “drive an integrated energy strategy to deliver the benefits of meeting energy demands, while improving labour productivity in the country”.