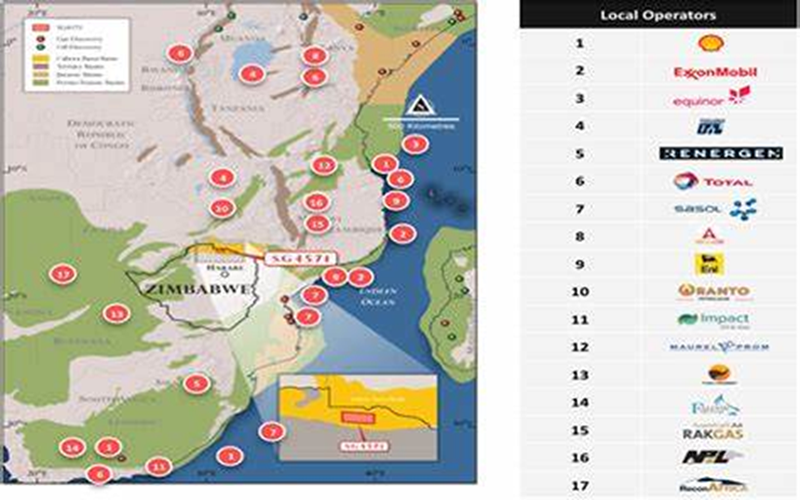

Cluff Energy Africa (CEA) has snatched 25% shareholding in Invictus Energy, the firm that is exploring for oil and gas in Zimbabwe’s Muzarabani District.The transaction entails CEA bankrolling 33,33% of the drilling of Invictus’ first test well, early next year, and ultimately taking over 25% shareholding. The country’s local media reported

Invictus has announced that it has executed a farm in option agreement with Cluff Energy Africa Limited (“CEA”) for a 2 well exploration drilling campaign in the CaboraBassa Project. CEA will fund 33.33% of the costs for a 25% interest in the CaboraBassa Project and Invictus will remain as operator.

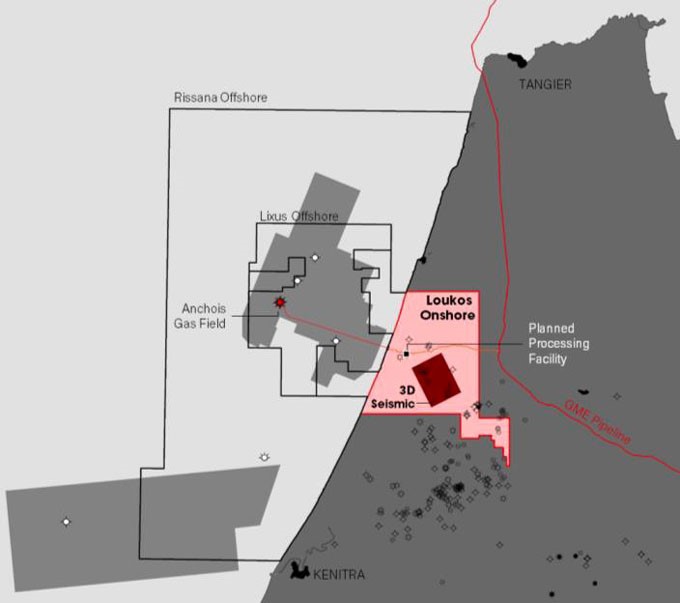

Invictus, which has been exploring an area covering over 100 000 hectares, requires about US$20 million to sink the test well, a crucial step towards finding out whether oil or gas lie beneath.TheMuzarabani prospect is potentially the largest, undrilled seismically defined onshore asset in Africa, according to Invictus. It will remain as an operator, it said in a recent statement.

“Cluff Energy Africa is currently assembling a portfolio of African oil and gas exploration assets with the intent of raising further capital during early 2022 to fund their exploration programmes,” Invictus said.

CEA has previously raised and invested over US$0,5 billion in natural resources projects.

“Under the terms of the non-binding agreement, CEA must exercise the option by March 31, 2022 to enter a binding farm in agreement and a joint operating agreement and obtain the necessary funding to meet the farm in commitment for two wells.

“Invictus and CEA will also investigate the options for mitigating carbon emissions from the project including carbon capture and storage (CCS) or similar solutions to align with Zimbabwe’s strategic objectives.”

Invictus chief executive officer Scott Macmillan said: “Invictus is pleased to enter into the option agreement with Cluff Energy Africa and work towards formalising our relationship in the CahoraBassa joint venture over the coming months. CEA is a like-minded partner and a close cultural fit, and their team has an outstanding track record of making and monetising discoveries in Africa.”

CEA chairman AlgyCluff said the company viewed the Muzarabani project as a rare high quality but low-cost opportunity that has world-class scale.

“We believe it will form a key pillar in the portfolio of assets that we are currently assembling. I am also excited to be bringing the Cluff Group back to Zimbabwe having enjoyed previous success in the resources sector in the country with the discovery and development of the largest gold mine in the country at Freda Rebecca,” he said.

The firm — CEA — is an African-focused oil and gas exploration company headquartered in London and is currently building a portfolio of exploration assets in sub-Saharan Africa.It is also a pioneer in the natural resource sector, having successfully acquired, explored, financed, operated, and sold assets in eight different countries in Africa.

Cluff was the founder of CEA Oil, which was an early entrant into the UK North Sea and led the consortium that discovered the Buchan Oil Field and followed this with oil discoveries in Australia, Canada, and the United States before founding Cluff Resources plc which focused on mineral exploration in Africa.

CEA Natural Resources returned to offshore oil and gas activity in the UK North Sea in 2009 entering a number of licences and negotiating a joint venture with Royal Dutch Shell in April 2019.Cluff’s previous experience in Zimbabwe commenced immediately after Independence in 1980, with CEA being the first foreign investor at that point.

CEA also discovered and brought in production three gold deposits including the Freda Rebecca Mine in Bindura, the largest mine measured both by ounces produced (100 000 per annum) and tonnage throughput in the country together with the Royal Family Mine near Bulawayo, the first open cast mine to utilise the heap leach process in southern Africa.

CEA listed the company’s local subsidiary on the Zimbabwe Stock Exchange vesting 10% of the equity in a workers’ trust and appointed the first African chief executive of a mining company, a Zimbabwean, Godfrey Gomwe.CEA exited Zimbabwe in 1996 after being acquired by Ashanti Goldfields.