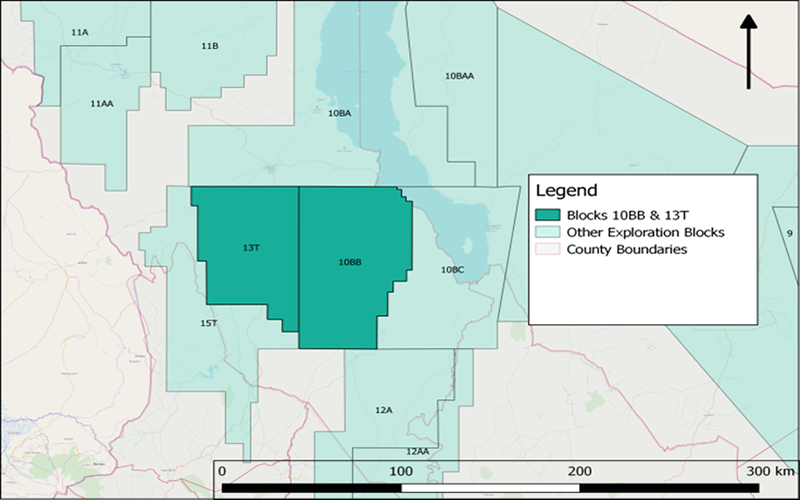

Africa Oil Corp. has made a recent provisional update on its operations in Kenya oilfield development project incorporating Blocks 10BB and 13T.

Over the past year, Africa Oil and its JV Partners (Tullow Oil and Total Energies) have completed the redesign of the Project Oil Kenya to ensure it is technically, commercially and environmentally robust. A higher oil production plateau of 120,000 barrels of oil per day is now planned with expected gross oil recovery of 585 million barrels of oil over the life of the field1.

This resource position has been audited by external independent auditor, Gaffney, Cline & Associates (“GaffneyCline”). Africa Oil’s best (2C) development pending contingent resource on a net working interest basis, derived from GaffneyCline’s report is 93 MMbbl2. The estimated unrisked3 post-tax net present value, using a 10% discount rate, of $577 million is attributable to Africa Oil’s net 2C development pending contingent resource base.

The company and its JV Partners have presented a draft Field Development Plan (FDP) to the Government of Kenya (GoK) ahead of the plan to submit a finalised FDP by the end of 2021, in line with licence extension requirements provided by the GoK in December 2020. Africa Oil and its JV Partners have created a continuity network to work in collaboration with the GoK on land and water access and on the necessary commercial agreement and are waiting on the final approval of the Environmental and Social Impact Assessment (ESIA) from the regulatory authorities.

At the same time Africa Oil and its JV Partners are actively seeking strategic partners for the project. Based on the revised plan, Africa Oil believes that this project is an attractive commercial prospect for investors looking to access the East Africa oil and gas sector in both the upstream and midstream. It is intended that a strategic partner will be secured ahead of a Final Investment Decision (FID).

“Together with our JV partners we have made significant progress in redesigning and optimizing Project Oil Kenya. Compared to the previous field development plan, we have a more economically robust project, which I am confident is more attractive to potential new partners. We will continue to work with our JV partners and the government of Kenya towards the final investment decision and I am pleased that our interests are fully aligned on what is a strategically significant project for Kenya.” Africa Oil President and CEO, Keith Hill, commented.