Kosmos Energy announced today its financial and operating results for the first quarter of 2025. For the quarter, the Company generated a net loss of $111 million, or $0.23 per diluted share. When adjusted for certain items that impact the comparability of results, the Company generated an adjusted net loss(1) of $105 million, or $0.22 per diluted share for the first quarter of 2025.

“While the macro backdrop continues to be volatile, Kosmos’ priorities announced with our full year 2024 results in February remain unchanged – the delivery of free cash flow from increasing production and a rigorous focus on costs. We are seeing evidence of this with a material reduction in year-on-year capex in the first quarter and production starting to rise in the second quarter after heavy scheduled 1Q maintenance.

Operationally, the GTA partnership achieved a major milestone in April exporting the first cargo from the project, with a second currently loading. Production is ramping up to the contracted sales volume, with potential to push higher towards, or beyond, the nameplate capacity of the floating LNG (FLNG) vessel of 2.7 mtpa. In Ghana, the partnership completed the 4D seismic survey. This new seismic data, combined with the latest processing techniques, will support the high grading of the future infill drilling program.

Financially, the actions taken in 2024 to improve the resilience of the company enable Kosmos to better withstand the current market volatility. We concluded the spring RBL redetermination with a strong reserve base supporting the $1.35 billion facility capacity, with ample liquidity. In addition, we continue to focus on reducing the company’s capex and overhead costs and are delivering the targeted reductions.

The long-term outlook for our portfolio of high-quality assets remains positive. A 2P reserves-to-production ratio of over 20 years supports the long-term potential of Kosmos as we focus in the near term on cash generation, cost control and debt paydown,” Chairman and Chief Executive Officer Andrew G. Inglis said.

Financial update

Net capital expenditure for the first quarter of 2025 was $86 million, below guidance primarily due to the Ghana 4D seismic campaign coming in under budget and a one-month delay in drilling Winterfell-4. We are working to reduce full year 2025 capex below the $400 million guidance given with the full year 2024 results. In addition, we have made significant progress on the $25 million overhead reduction target.

Operating costs per barrel of oil equivalent were in line with guidance, but higher year on year, reflecting the lower production and higher maintenance in the first quarter of 2025, including a construction support vessel at Jubilee prior to and during the scheduled shutdown and the Winterfell-3 workover.

In March, Kosmos successfully concluded the RBL redetermination, maintaining a facility size of $1.35 billion which is supported by a borrowing base that is materially higher, at a long-term price deck below the current forward curve.

The Company generated net cash provided by operating activities of approximately $(1) million and free cash flow(1) of approximately $(91) million. As previously signaled, the first quarter free cash flow was impacted by the timing of liftings, heavy scheduled maintenance across the portfolio, and no cash flow contribution from GTA sales in the first quarter.

Kosmos exited the first quarter of 2025 with approximately $2.85 billion of net debt(1) and available liquidity of approximately $400 million. Post quarter end, Kosmos continued its rolling hedging program adding an additional two million barrels of oil. The company now has approximately 40% of remaining 2025 oil production hedged with a floor of approximately $65/boe and a ceiling of approximately $80/boe.

Operational update

Production

Total net production(2) in the first quarter of 2025 averaged approximately 60,500 boepd, impacted by planned shutdowns at Jubilee in Ghana and at the Kodiak host facility in the Gulf of America. Both shutdowns have been completed, with no major scheduled shutdowns for the remainder of the year. Production was slightly below guidance primarily due to the delayed ramp-up at GTA. Full year 2025 production guidance for GTA remains at 20-25 gross cargos as production ramps up towards the annual contracted level. Full year 2025 company production guidance is unchanged at 70,000 – 80,000 boepd.

The Company exited the quarter in a net underlift position of approximately 1.2 mmboe.

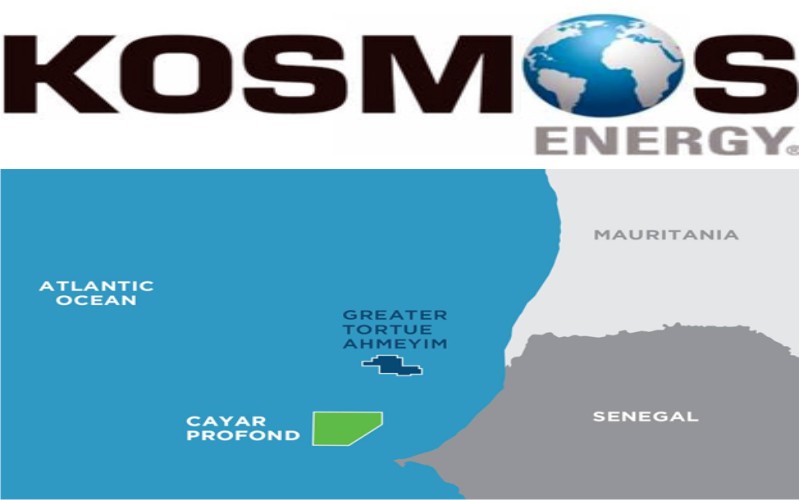

Mauritania and Senegal

The GTA project successfully exported its first LNG cargo in early April, a major milestone for the project. Production has continued to ramp-up with a second cargo currently lifting. Production in the first quarter averaged approximately 1,300 boepd net (7.8 mmcfd). All four FLNG trains are now operational and are being tested at ~10% above the nameplate capacity. Additionally, the subsurface is performing ahead of expectations, with higher connected volumes potentially reducing the number of future wells required.

Near-term, the partnership is continuing to work to reduce operating costs on GTA phase 1, eliminating duplicate costs related to the handover from commissioning to operations. We are also actively progressing the FPSO refinancing which is expected to be completed in the second half of the year. The operator is also investigating alternative operating models that could further materially reduce costs.

The partnership has commenced work on Phase 1+, a low-cost brownfield expansion of the development that is expected to double gas sales through increased LNG production and domestic gas. The expansion would leverage existing infrastructure put in place for the initial phase of GTA with low-cost upgrades to existing facilities that should drive materially lower unit costs and enhance overall project returns.

Ghana

Production in Ghana averaged approximately 33,000 boepd net in the first quarter of 2025. Kosmos lifted two cargos from Ghana during the quarter, in line with guidance.

At Jubilee (38.6% working interest), oil production in the first quarter averaged approximately 66,600 bopd gross, reflecting the scheduled FPSO shutdown that ran from March 25, 2025 to April 8, 2025. The shutdown was completed safely and on budget.

The Noble Venturer rig is due to arrive later this month to drill two Jubilee wells in 2025. The rig is scheduled to undertake a four-well drilling campaign on Jubilee in 2026, which will benefit from the 4D seismic data that is currently being processed with state-of-the-art algorithms.

In the first quarter of 2025, gas production net to Kosmos was approximately 5,300 boepd in line with expectations.

At TEN (20.4% working interest), oil production averaged approximately 16,900 bopd gross for the first quarter.

Gulf of America

Production in the Gulf of America averaged approximately 17,200 boepd net (~85% oil) during the first quarter reflecting the scheduled Kodiak shutdown. Remediation of the Winterfell-3 well was unsuccessful and the partnership is currently evaluating a future sidetrack to produce those reserves. Drilling of the Winterfell-4 well is currently underway and is expected online in the third quarter of 2025.

On Tiberius, Kosmos (operator, 50% working interest) continues to progress the development with our partner Oxy (50% working interest), evaluating opportunities to further enhance the project. This has resulted in a lower cost development, which will be supported by new ocean bottom node (OBN) seismic data being acquired this year.

Equatorial Guinea

Production in Equatorial Guinea averaged approximately 25,700 bopd gross and 9,000 bopd net in the first quarter. Kosmos lifted 0.5 cargos from Equatorial Guinea during the quarter, in line with guidance.

For the remainder of the year, production should be supported through a cost effective well work program.

(1) A Non-GAAP measure.

(2) Production means net entitlement volumes. In Ghana, Equatorial Guinea, and Mauritania and Senegal this means those volumes net to Kosmos’ working interest or participating interest and net of royalty or production sharing contract effect. In the Gulf of America, this means those volumes net to Kosmos’ working interest and net of royalty.