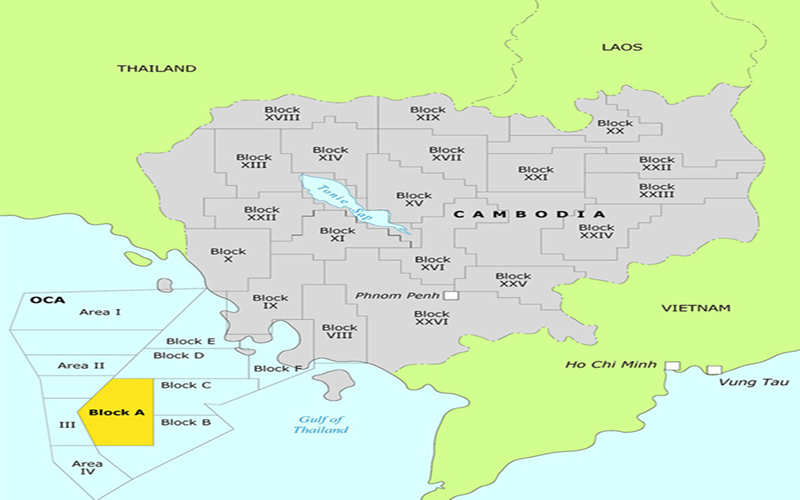

KrisEnergy Ltd together with its subsidiaries, an independent upstream oil and gas company, refers to its announcement dated 31 March 2021 in relation to the production performance of the KrisEnergy-operated Apsara oil development. The Company has received the update on the independent review of the Apsara field’s performance by third-party petroleum engineering consultant, Netherland, Sewell & Associates, Inc.

Based on performance data of the five wells since they were brought online on 23 February 2021, NSAI concluded that:

• Estimated ultimate recovery from the five development wells is likely to be a small fraction of the pre-development estimates primarily due to significantly lower volume of hydrocarbon-in-place connected to the wells and the geological complexity resulting in smaller oil accumulations;

• Additional contributing factors for the underperformance include:

While the Company is evaluating whether there are any reasonable remedial actions to undertake in order to try and improve production rates, such remedial action has limited potential to increase well productivity (if at all) and is not expected to materially improve total oil recovery due to the fixed configuration of the subsurface reservoirs.

Apsara productivity versus oil price

Lower production from the Apsara wells will have a substantial adverse impact on revenue generated from the Apsara Mini Phase 1A development despite the recovery in benchmark oil prices since the lows of 2020 when the COVID-19 pandemic began to emerge.

The average price of benchmark Brent crude oil in 2020 was approximately US$43.00 per barrel (“bbl”), the lowest average since KrisEnergy was established in 2009. As of 27 April 2021, the Brent price in 2021 to date has averaged US$62.12/bbl. The benchmark price is an indicator of oil price direction and not the realised price achieved for Apsara crude oil. Actual realised price will fluctuate and could be lower or higher than the benchmark price depending on the specific crude quality and overall market conditions at the time of entering into crude sales contracts.

Despite the recovery in oil prices, the disappointing recovery expected from Apsara production will significantly reduce revenues generated from the development and therefore further deteriorate the Company’s financial condition and its ability to service the Cambodia Block A project financing loan from Kepinvest Singapore Pte. Ltd. and other obligations and expenditure.

Oilfieldafricareview offers you reviews and news about the oil industry.

Get updates lastest happening in your industry.

©2025 Copyright - Oilfieldafricareview.com

Please wait....

Thank you for subscribing...