LEKOIL, the oil and gas exploration and production company with a focus on Nigeria and West Africa has announced that Savannah Energy Investments, has entered into a convertible facility agreement (the ‘CFA’) and option agreement with the Company in order to support the Company’s restructuring.

Savannah Investments is a wholly owned investment vehicle of Savannah Energy, the British independent energy company focused around the delivery of Projects that Matter in Africa.

The Company has entered into the CFA with Savannah Investments whereby Savannah Investments will support LEKOIL’s proposed restructuring (as described below) by providing a GBP 0.9 million loan to LEKOIL.

The CFA is repayable on Wednesday 2 March 2022 and bears interest at 5% per annum. In the event of non-payment by LEKOIL, Savannah Investments may elect to convert the outstanding amount into 177.1 million new ordinary shares of Lekoil Limited (“Ordinary Shares”) at a price of 0.5 pence per share. The terms of the CFA are set out more fully at the end of this announcement.

Savannah Investments has also entered into arrangements with LEKOIL and certain of its service providers who have agreed to their unpaid fees being settled by way of the issue of 22.9 million new Ordinary Shares at 0.5 pence per share (the “Tripartite Agreements”). Savannah Investments has the right to acquire these shares pursuant to the Tripartite Agreements and a further announcement will be made once these shares have been issued.

In the event that Savannah Investments exercises its rights to purchase the abovementioned 22.9 million Ordinary Shares and converts the CFA into 177.1 million new Ordinary Shares, Savannah Investments’ holding is expected to represent approximately 25.2% of the fully diluted share capital of LEKOIL.

The Company has also signed an Option Agreement with Savannah Investments granting it, subject to approval of the Company’s shareholders at an extraordinary general meeting (the “EGM”) to be called in March 2022, an option to be assigned the intercompany debt owed to the Company by Mayfair Assets & Trusts Limited (the “Mayfair Loan”), its associated security related to OPL 310 and all rights and benefits of the Company with respect to the same. A US$1 million payment is payable by Savannah Investments to LEKOIL upon such assignment. A summary of the Option Agreement, the expected date for the EGM and full details of the OPL 310 asset are provided below.

Pursuant to the Option Agreement, it is intended that the Company would be paid deferred consideration in the event that Savannah Investments obtains a working interest in OPL 310 and the same is developed. Such deferred consideration is structured as a royalty (capped at US$50 million) of 0.5% on crude oil sales attributable to Savannah Investment’s actual participating interest in OPL 310 (the royalty capped at a 17.14% participating interest).

Savannah Investment’s CFA and strategic involvement in the restructuring has received the support of the Company’s major institutional shareholders in LEKOIL, representing approximately 42% of the Company’s current issued share capital. This support when combined with Savannah Investment’s potential shareholding of 25.2%, would represent approximately 59% of the Company’s fully diluted share capital.

Following the drawdown under the CFA, the Company expects to be well funded for its currently anticipated working capital needs in 2022.

LEKOIL owns a 40% legal interest and 90% economic interest in Lekoil Nigeria Limited (“Lekoil Nigeria”), the Nigerian holding company for the LEKOIL Group assets. Via its subsidiaries, Lekoil Nigeria has, among other interests, a 40% participating interest in the Otakikpo producing oil field and a 17.14% participating interest in OPL 310 which contains the potentially world-class Ogo oil, gas and condensate discovery with estimated gross contingent resources of 774 MMboe.

Since 2013, and in line with the original Group corporate structure, LEKOIL has raised equity capital in excess of US$260 million from international investors which has then been provided, by way of intercompany loans, to fund Lekoil Nigeria’s operations.

The investment made by Savannah Investments is integral to LEKOIL’s planned restructuring. Through this investment, the LEKOIL Board (the “Board”) and management team expect to prevent Lekoil Nigeria and its CEO, Mr. OlalekanAkinyanmi, from taking control of its parent company by purchasing LEKOIL Ordinary Shares effectively with its own cash, thereby seeking to deprive long-standing LEKOIL investors of their investment.

Following the restructuring, LEKOIL now plans to engage with Lekoil Nigeria, its board and Mr. OlalekanAkinyanmi as an individual to pursue all of its rights to loan repayments, its right to appoint directors to the board of Lekoil Nigeria and remedy of all other matters of dispute. It is the Board’s firm intention to pursue and hold accountable all three parties for their actions.

The Board strongly believes that the proposed investment by Savannah Investments and associated planned restructuring of the LEKOIL Group will provide the necessary capital to unlock the material inherit value of the LEKOIL portfolio, far in excess of the 1.9p per share available to shareholders through the Lekoil Nigeria offer.

Details of the proposed extraordinary general meeting will be published shortly.

Tony Hawkins, Interim Executive Chairman of LEKOIL, said:

“We are extremely pleased to announce that, following an extensive consultation with LEKOIL’s existing major institutional shareholders, we have entered into the CFA and the Option Agreement with Savannah Investments. The CFA will provide LEKOIL with much needed working capital and value realisation assistance from a successful, well-respected and well-financed African-focused investor with substantial Nigerian corporate restructuring and turnaround experience. I would encourage shareholders to vote in favour of the Option Agreement at the upcoming Extraordinary General Meeting.

The investment by Savannah Investments is expected to provide the Company with the working capital to commence a significant restructuring of the LEKOIL Group with the intention of unlocking the underlying value in the Group’s asset base. While the Board and our major institutional shareholders are cognisant of the potential dilution associated with the CFA, both groups believe this cost is a more than fair price to enable this substantial value to be potentially unlocked. The initial steps in the planned restructuring are expected to see LEKOIL enforce our legal rights in relation to our 40% legal and 90% economic equity ownership, the recovery of the intercompany debt investments in Lekoil Nigeria group and the US$1.6 million loan owed by MrAkinyanmi to LEKOIL, and engage directly with these parties in relation to this.

I think it is important to recognise that LEKOIL has been unable to unlock the Group’s underlying value over the course of the past nine months due to the actions of Lekoil Nigeria and its board whereby they decided to stop funding the Company and effectively blocked the appointment of the three nominated Directors of LEKOIL to the Lekoil Nigeria board. Further, Mr. Akinyanmi has failed to repay the CEO loan on its scheduled payment dates (as early back as March 2021) which could have provided the Group with the working capital it requires to fund itself. It is our view that these actions constituted a clear attempt to starve our Company of working capital to force a sale of the Company to Lekoil Nigeria at a valuation unreflective of the underlying value of the Group’s future prospects had these actions not been taken. Their actions have clearly caused significant harm to the Group which we will now seek to remedy.

Lastly, I would like to thank our major institutional shareholders and Savannah Investments for their support for the planned restructuring.”

Rory Kutisker-Jacobson, Portfolio Manager at Allan Gray Investment Management, one of LEKOIL’s institutional shareholders, said:

“Shareholders have to date invested some US$260 million in LEKOIL in good faith. The events that have transpired over the past year are entirely unsatisfactory. We view Lekoil Nigeria’s attempts to acquire its parent, LEKOIL, using the cashflows of Lekoil Nigeria, in a dim light. This is a particularly unsatisfactory move as LEKOIL’s shareholders are arguably already entitled to this cashflow. We welcome the supportive investment of Savannah Investments and would urge the management of Lekoil Nigeria to obey their fiduciary duties and contractual commitments to all shareholders.”

Oge Peters, Director Savannah Energy Investments Limited, said

“‘We are proud to have been asked by LEKOIL to work with them as they seek to restructure their Group over the course of the coming months. Savannah is a supportive long-term investor with significant corporate restructuring and turnaround experience. While LEKOIL’s recent history has been disappointing for its stakeholders, we hope that LEKOIL can be restructured to enable the potential of the Company’s asset base to be realised.”

FunmilolaOgunmekan, Head of Finance, Savannah Energy Nigeria, said:

“We believe that Savannah Energy’s experience restructuring the Seven Energy group from the brink of bankruptcy to becoming Nigeria’s most reliable gas supplier leaves us well placed to provide LEKOIL with the required support to enable a potentially successful outcome for its planned group restructuring. Savannah employs over 170 people in Nigeria and from 2017 to the end of 2021 has organically increased the former Seven Energy group’s Total Revenues by 65% and cash collections by 92%. We are an award-winning employer of choice in country, with our subsidiary company having won the prestigious Nigeria Employers’ Consultative Association (“NECA”) Employer of the Year Award for the Oil and Gas (Upstream) sector last year at the Annual Employers’ Excellence Awards. NECA is the biggest umbrella organisation of private-sector employers in Nigeria. We look forward to working with LEKOIL and its employees over the course of the coming months to hopefully enable a successful restructuring.”

Asset Review

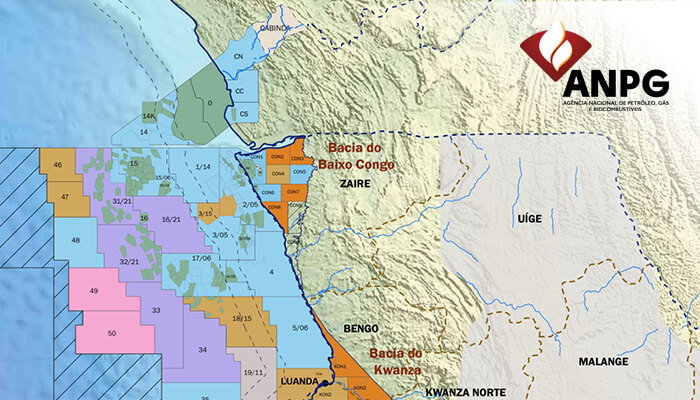

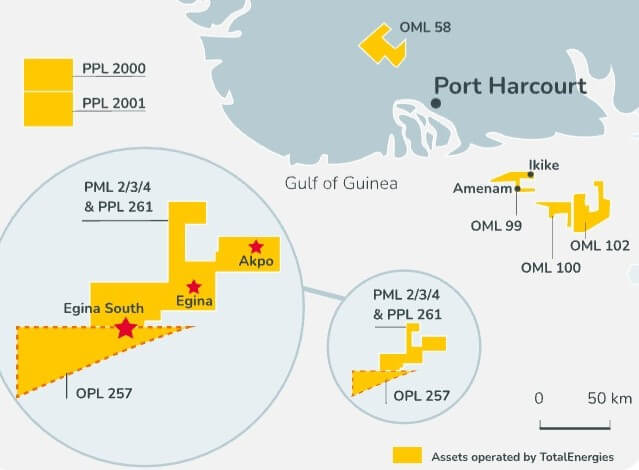

The LEKOIL Group has interests in four core assets in Nigeria, spanning the Niger Delta and Dahomey basins.

Otakikpo

The Otakikpo marginal field is located on the shoreline in the Niger Delta and previously formed part of surrounding licence OML11. Lekoil Nigeria holds a 40% working interest in Otakikpo alongside local partner and operator Green Energy. The field is currently onstream from two wells (Otalikpo-002 & 003) at gross rates of 4.5 kbopd (1.8 kbopd net) during December 2021, with production processed in field and then shipped offshore to a third party-owned FPSO via a dedicated subsea pipeline. Gross 2P reserves are estimated at 48.6 mmbbls by McDaniel Associates & Consultants Ltd. (June 2019).

Subject to funding, the next phase of field development envisages ramping up gross production to 15-20 kbopd (6-8 kbopd net) with the drilling of up to seven new wells and facilities upgrades. Development capex is estimated at US$110m gross (US$44m net). A further 331.6 mmbbls of gross unrisked OIP is estimated in near field exploration targets.

OPL 310

Lekoil Nigeria holds a 17.14% participating interest in OPL 310, offshore from the Dahomey basin, in partnership with the operator Optimum Petroleum Development Limited. The licence includes the 2013 Ogo oil & gas discovery which straddles water depths of 200-3,000 feet. The find is estimated to contain P50 gross recoverable resources of 774 MMboe, split between a four-way dip closure and deeper syn-rift stratigraphic trap. Further appraisal work is required to de-risk these volumes, ahead of any field development. In addition, following the acquisition of 3D seismic in 2014, the licence partners have identified surrounding prospects and leads which offer significant upside potential.

OPL 325

Further outboard of OPL 310, Lekoil Nigeria owns a 62% indirect interest in deep water exploration licence OPL 325, through its 88.57% holding of Ashbert Oil & Gas Limited, the licence operator. The block covers an area of 1,200 sq km and contains several large prospects with 3D seismic coverage. Gross unrisked OIP is estimated at 5.7bn bbls.

OPL 276

Lekoil Nigeria has entered into an agreement to purchase a 45% participating interest in development licence OPL276 in the Niger Delta, alongside Newcross Petroleum Limited (“Newcross”) and Albright Waves Petroleum Development Limited. Based on preliminary analysis by Newcross the licence contains gross recoverable volumes of 29 mmbbls of oil and 333 Bcf of gas across four discoveries.

Financial Review

On 27 October 2021, the LEKOIL Group reported its results for the six months ended 30 June 2021. These interim results have been presented on a Group consolidated basis, in line with the previous practice of the Company.

As previously disclosed, the Company has received no funding from Lekoil Nigeria since mid-2021 and, as a result, has considered a number of alternatives to conserve its cash position and to access capital. It has needed to do this to supplement its rights under the Lekoil Nigeria shareholders agreement, which entitles the Company to 90% of any distributions from Lekoil Nigeria, and the intercompany loan agreements between the Company and Lekoil Nigeria (and its subsidiaries). Without full drawdown under the CFA with Savannah Investments, the Company does not expect to be fully funded for its working capital in 2022.

As at 30 June 2021, the Company’s review of the intercompany and related party debt position between LEKOIL Group and Lekoil Nigeria (and its subsidiaries) showed that the par value of amounts (including accrued interest) which were owing to LEKOIL as at 30 June 2021 exceeded US$350 million (as set out below).

- US$41.6 million across two loans due from Lekoil Nigeria by January 2026 and February 2029, respectively;

- US$19.8 million due from Lekoil Oil & Gas Investments (i.e. Otakikpo) by February 2024;

- US$253.0 million due from Mayfair Assets & Trust Limited (i.e., OPL 310) by May 2023 (the “Mayfair Loan”), the loan to which the Option Agreement relates; and

- US$35.5 million due from Ashbert Oil & Gas Limited (i.e., OPL 325) by September 2022.

These loan amounts are in addition to the c. US$1.6 million (which includes default interest) owing from MrAkinyanmi as at 31 December 2021.

The Company has, in parallel with entry into the CFA, impaired the value of the Mayfair Loan to US$1 million. This does not affect the amount of the loan owing from Mayfair to the Company but is a recognition by the Company that an impairment of the intercompany debt is appropriate given: (i) in the Company’s accounts for the year ended 31 December 2020, the Company reduced the carrying value of its equity investment in Mayfair by US$107 million to US$10 million; and (ii) the factors that justified the impairment of the equity value are still relevant and existing and equally apply to the ability of Mayfair to repay the Mayfair Loan (i.e., the lack of bids during the OPL 310 farm out process, the inability to raise financing for OPL 310 to date, the proximity to the end of the term of the OPL 310 license and the ongoing legal dispute with Optimum).

The Company will, as part of the Company’s annual reporting procedures, undertake an assessment of impairment indicators on the other inter-company loans. The Company does not expect that the other inter-company loans will be subject to the same level of impairment as the Mayfair Loan given that the loans to Lekoil Nigeria and Lekoil Oil & Gas Investments, in particular, are underpinned by the cash generating Otakikpo asset.

Background to Recent Disputes with Lekoil Nigeria and OlalekanAkinyanmi

As a result of a number of events which have occurred since early 2020, the Company is now in a number of disputes with its founder and former CEO, MrOlalekan Akinyanmi, and Lekoil Nigeria. These events and disputes include:

- The US$600,000 loan fraud from entities purposing to represent the Qatar Investment Authority;

- The discovery by the Board that in December 2020, MrOlalekanAkinyanmi had entered into a parallel contract with Lekoil Nigeria to be their CEO;

- Non repayment of the US$1.6 million loan from the Company to former CEO, MrOlalekanAkinyanmi (the “CEO Loan”), per the agreed terms;

- Mr. Akinyanmi’s civil action in New Jersey alleging breach of contract in termination his employment contract; seeking declaratory relief for the award of bonuses for past services; seeking to employ set off of any termination payments due under the employment contract or the bonuses against the sum due under the CEO loan; and alleging defamation for issuing the RNS’s related to the termination of his contract.

- Failure by Lekoil Nigeria to adhere to its obligations to the Company under the Lekoil Nigeria shareholder agreement and intercompany loan documentation, including the appointment of the Company’s director nominees to the Lekoil Nigeria board and the provision of corporate records, together with financial and operational information to LEKOIL; and

- On 6 January 2022, the Company announced that it had been served with a writ of summons in the Grand Court of the Cayman Islands by MrOlalekanAkinyanmi (the “Claim”) challenging the validity of certain resolutions duly passed at the Company’s Annual General Meeting held on 21 December 2021 (the “AGM”). By Notice of Motion dated 14 February 2022, Mr. Akinyanmi has applied to restrain the Company from acting on Resolutions 8 and 9. The Notice of Motion is expected to be heard in mid to late-March 2022. For completeness, a summary of the potential allotment of Ordinary Shares is set out below.

Takeover Offer by Lekoil Nigeria

On 15 December 2021, an offer was made to shareholders of the Company by Lekoil Nigeria to purchase ordinary shares in the Company (“Shares”) at a cash price of 1.9 pence per share or an exchange for Class B ordinary shares in Lekoil Nigeria (“Offer”).

On 23 December 2021, the Board unanimously recommended that shareholders DO NOT accept the Offer for the following reasons:

- The Offer materially undervalues the Company;

- The Offer does not have certainty of funding;

- There is a significant risk to shareholders associated with transferring Shares prior to receiving payment for the Shares;

- Lekoil Nigeria wants to use cash already belonging to the Group and its shareholders to purchase the Shares; and

- The Offer does not take into account the value obtained by Lekoil Nigeria if it cancels the circa US$350 million of intercompany debt owing to the Company.

Proposed Restructuring

LEKOIL is now seeking to commence a restructuring process with the ultimate goal of realising the underlying value of its asset base to be unlocked for the benefit of shareholders.

As part of the proposed restructuring, the Company will be making efforts to restore trading in its Ordinary Shares although there is no certainty that this will be achieved. It is important to note that the Company is planning so that it will not be reliant on the support of Lekoil Nigeria for any unsuspension to occur.

The restructuring is also expected to see LEKOIL engage with Mr. OlalekanAkinyanmi and Lekoil Nigeria to pursue all its right to loan repayments, its right to appoint directors to the board of Lekoil Nigeria and to remedy of all other matters. It is the Board’s intention to pursue and hold accountable both Lekoil Nigeria and Mr. OlalekanAkinyanmi for their actions.

Savannah Investments and the Company’s major institutional investors have indicated that they are willing to provide additional financial support to the Company to support the resolution of such matters and provide the necessary capital to unlock the material inherit value of the LEKOIL Group’s portfolio if required.